Photo Credit: Mike Mozart

The TJX Companies (TJX) Consumer Discretionary – Specialty Retail | Reports May 17, Before Market Opens

Key Takeaways

The leading off-price retailer, The TJX Companies, is scheduled to report first quarter earnings Tuesday, before the opening bell. TJX is probably best known as the parent company of TJ Maxx, Marshalls, and HomeGoods. The company is coming off a spectacular fiscal 2016 where it beat in each of the fourth quarters. Given the shifting sentiment towards discounters, expectations are high that TJX will start 2017 off strong.

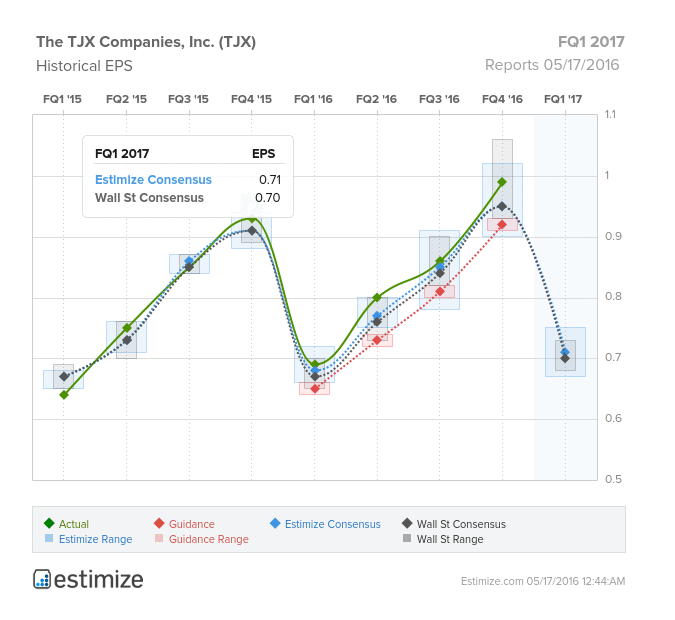

The Estimize consensus is calling for earnings per share of 71 cents on $7.3 billion in revenue, 1 cent higher than Wall Street on the bottom line and $20 million on the top. Compared to a year earlier earnings are predicted to climb 3% with sales up as much as 6%. On average, the stock is a positive mover durings earnings season, seeing its biggest movements 30 days prior and after earnings. This should be a nice boost for shares which are already up 11% from a year earlier.

TJX’s diverse holdings of off price retailers have resonated well with consumers. Overall comparable store sales were up 6% last quarter driven by a 6% increase from Marshalls and TJ Maxx and double digit gains in TJX Canada. On the year, TJX reported an increase in comparable store sales across its 4 major reporting segments. During fiscal 2016, the company benefited from ramped up efforts with marketing and promotional activities coupled with its emergence in the ecommerce space. The company also took over Australia based Sierra Trade Post stores which will provide a much need global presence. Store traffic has also been steadily improving.

Leave A Comment