And, the best news is that it has even more room to run higher. The major averages are down, but this stock is showing no signs of stopping its rally.

Retail sales haven’t been great. It was a so-so holiday shopping season, with Amazon.com (NASDAQ: AMZN) being the only real winner.

The industry-wide retail sales in the US were down 0.1% in December (versus November). For all of 2015, retail sales were up 2.1%, which is the slowest growth we’ve seen since 2009.

There’s plenty of pain and blame to go around.

However, one particular sore spot has been the department retailers. Let’s look at some of the performances over the last year: Bon-Ton Stores (Nasdaq: BONT), which made our 2014 bankruptcy watch list, is down 65%, Sears (Nasdaq: SHLD) has fallen 50%, Dillard’s (NYSE: DDS) is down 41% and Kohl’s (NYSE: KSS) has fallen 17%.

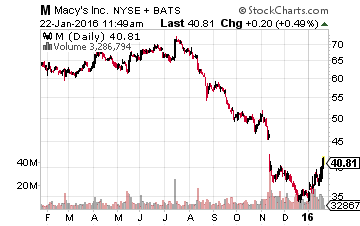

Even the world’s largest employer, Wal-Mart (NYSE: WMT) is off 26% for the last year. In that same vein, there is the largest department store operator, Macy’s (NYSE: M), which has fallen 35% over the last twelve months.

If you’re going to invest in retail you have to have a plan, a dividend, and some downside protection. There’s a few stocks offering a 3% plus dividend in the retail space – but how safe are those dividends is the real question.

But, not many (if any) of those retailers have true catalysts to push the stock higher in the interim. For these names, it is really just a wait-and-see game and should best be avoided.

The Best Retail Play Today

Right now, what if I told you there was a retailer offering a dividend yield of 3.5%, with five straight years of dividend growth, and has a payout ratio of less than 40% of its earnings via dividends.

And, it gets better. This same retail stock is trading at close to 10 times earnings and 6.5 times free cash flow while generating double-digit returns on invested capital.

Leave A Comment