Although it yields 60%, it is not at risk of going bankrupt and even has the potential to hand investors a whopping 100% or more total return in 2016. Those are numbers that are hard to ignore, and investors would be wise to look into this investment opportunity.

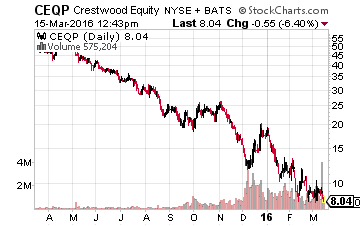

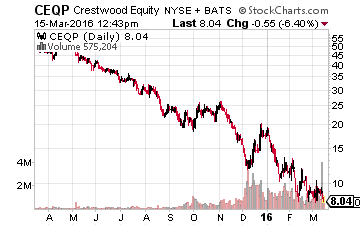

The energy sector crash has resulted in some interesting/intriguing/perplexing/scary yield and valuation stories in the midstream energy infrastructure businesses dominated by publicly traded master limited partnerships (MLPs). Currently, there are a handful of MLPs where management has stated the company can and will maintain current distribution rates while the market is pricing them as if the distributions will be dramatically reduced or eliminated. The result is yields ranging from 25% up to an astounding 60%. That last number belongs to Crestwood Equity Partners LP (NYSE: CEQP) a diversified midstream energy services provider.

When you dig deeper into the Crestwood Equity Partners story, it is not an obvious conclusion that the company will stop paying distributions or even go out of business, which the current pricing and yield may indicate. Here is the story behind CEQP, the current positives and negatives faced by the company, and why it may be worth consideration in your portfolio.

In the two to three years leading up to the start of the energy sector crash in the latter months of 2014, Crestwood consisted of two companies: Crestwood Midstream Partners (CMLP) was the traditional midstream MLP and Crestwood Equity Partners was positioned as the publicly traded general partner.

With this arrangement, distribution growth at the midstream partners would generate a mathematical multiple of the growth rate for the general partner. However, in its short life before the crash, Crestwood Midstream Partners was not able to generate very much free cash flow growth, so distribution growth was stagnant at both companies.

The Crestwood assets consist of a combination of storage and distribution pipelines and terminals primarily serving the Northeast and gathering and transport facilities in the North Dakota Bakken and the Delaware-Permian Basin in Texas and New Mexico. The Northeast natural gas storage system is a group of high-value assets providing essential natural gas supply into New York and the region. The production basin located assets are more at risk from a slowdown in crude oil and natural gas production.

Leave A Comment