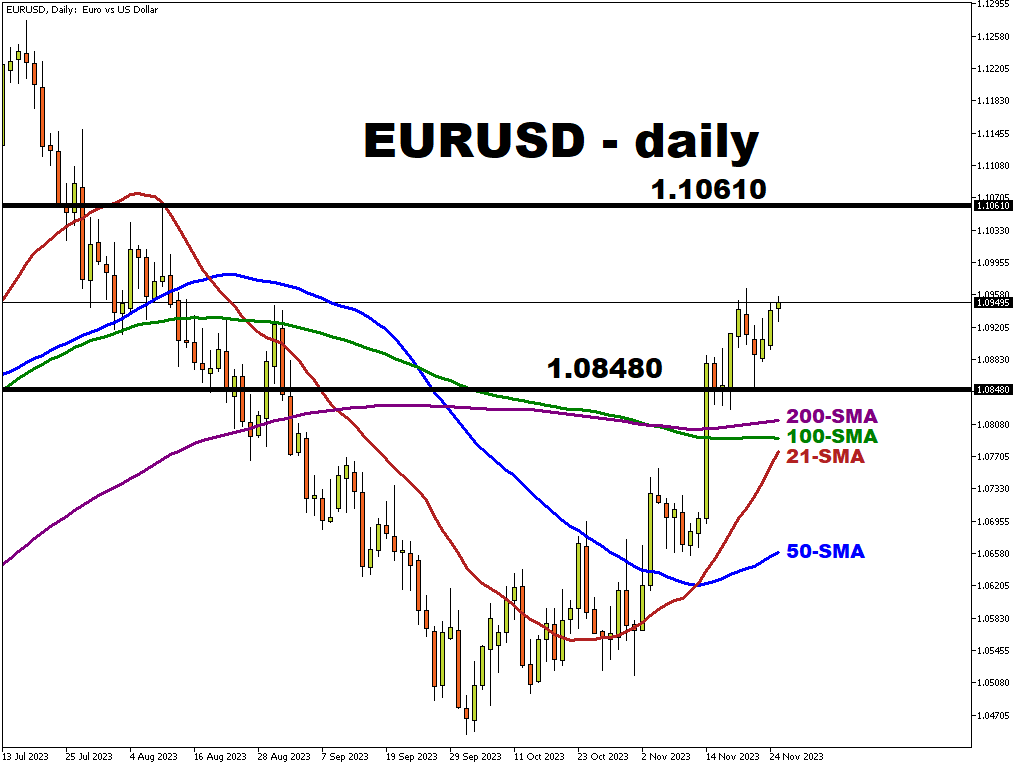

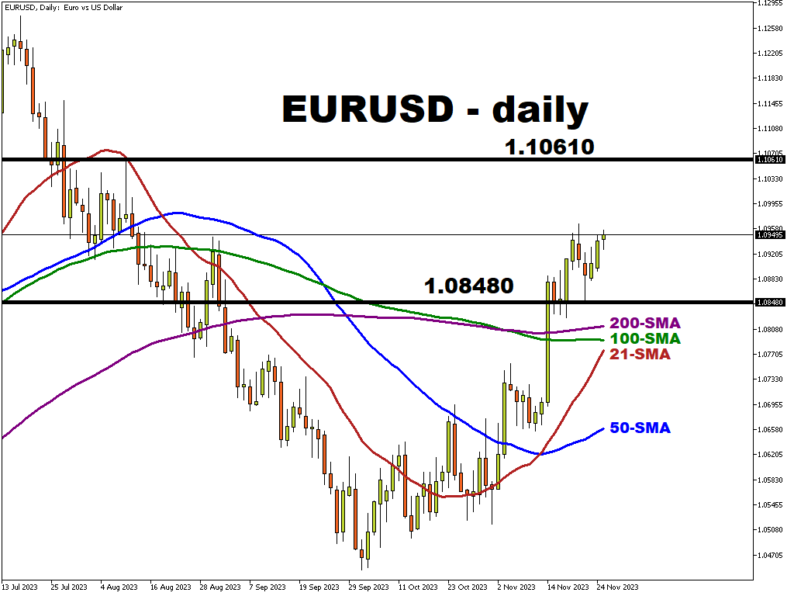

The world’s most-traded FX pair has rebounded since the start of October, now back above its 200-day simple moving average.Bloomberg’s FX forecast model predicts a 75% chance that EURUSD will trade between 1.0848 and 1.1061, with bulls surely eyeing the psychological 1.10 handle once more.

Although the implied one-week volatility for this currency pair is expected to remain subdued, the scheduled data releases and events in the days ahead could yet jolt FX markets.

EURUSD is ready to react if any of the economic data from either side of the Atlantic offer fresh signals about what either the ECB or the Fed will do with their respective policy settings in 2024.

Events Watchlist

Wednesday, November 29: Germany November CPI

The month-on-month CPI is expected to post a negative 0.1% print, while the year-on-year CPI is forecasted to come in at 3.5%, both lower than October’s figures. Yet, a surprise uptick in inflation may reinvigorate ECB hawks, perhaps offering a limited boost to the euro, despite Germany’s ongoing economic woes.

Thursday, November 30: Eurozone November CPI

The larger EURUSD reaction will likely be reserved for Germany’s CPI that’s released the day prior. Still, the broader Eurozone’s inflation data bears watching. Though these CPI prints are forecasted to moderate lower year-on-year to 2.7% for headline CPI and 3.9% for core, policymakers will be wary of a resurgence in inflation.

Friday, December 1: Speech by Fed Chair Jerome Powell

This week is littered with US economic data, including consumer confidence, GDP, and jobless claims; each could offer fresh signals about the Fed’s 2024 policy outlook. Still, it’s better to hear from the horse’s mouth.If Chair Powell can push back on market bets over US rate cuts next year, that may support the US dollar while potentially delaying the quest by euro bulls to reclaim the psychologically important 1.10 level.

Here’s a comprehensive list of other key economic data and events due this week:Monday, November 27

Tuesday, November 28

Wednesday, November 29

Thursday, November 30

Friday, December 1

More By This Author:BRN Struggles Below 200-Day SMA Amid OPEC+ Uncertainty

USDJPY To Hit 150.055 Resistance Level?

Bitcoin Tracks Sideways Amid Binance Volatility

Leave A Comment