Thick Skin Bootcamp

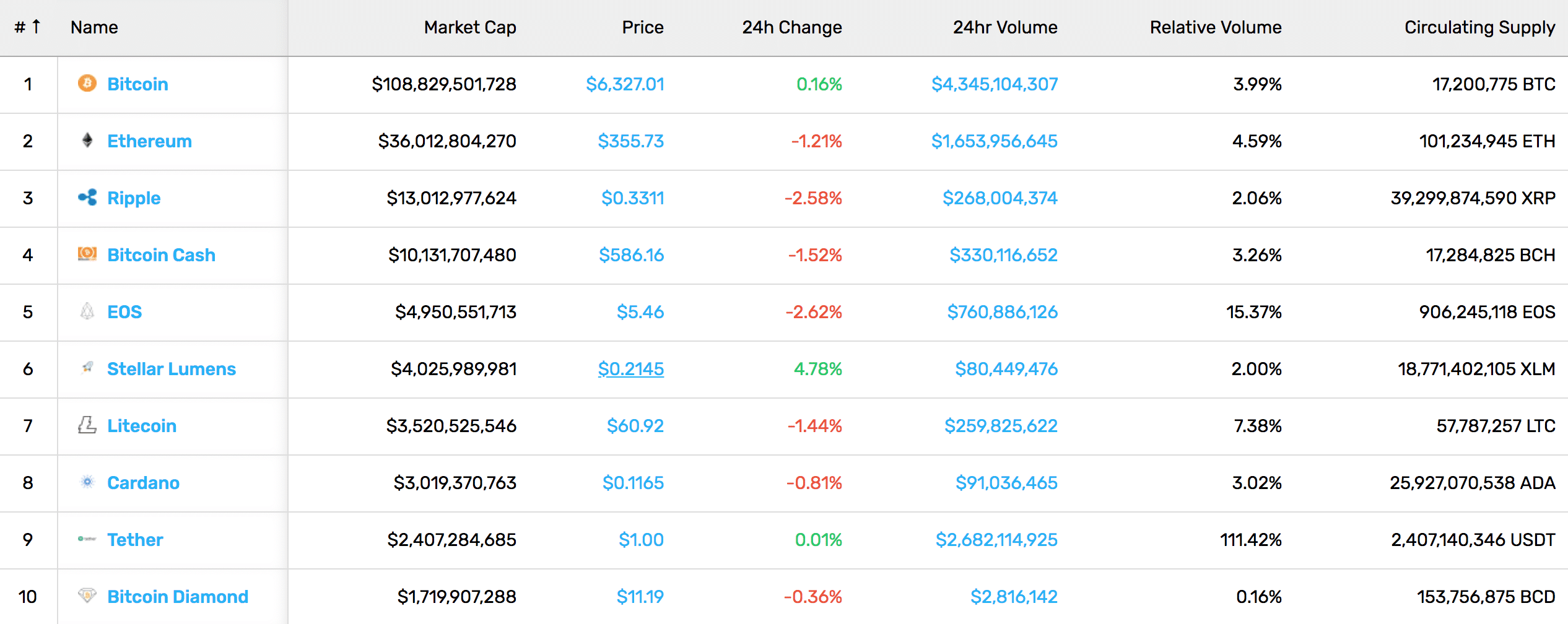

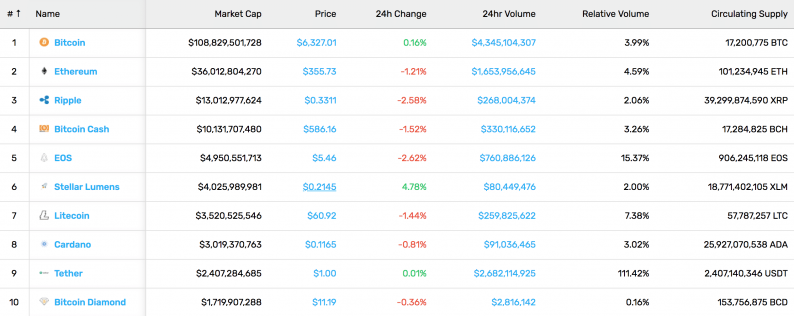

Last week, the total cryptocurrency market took an 8% hit from the SEC’s rejection of the Winklevoss ETF filing.

This week, the total cryptocurrency market cap fell 14.33%, largely catalyzed by the SEC postponing their decision on a Bitcoin-ETF proposed by CBOE, VanEck, and SolidX.

Bitcoin fell from $7,400 to $6,388.59, a drop of 13.67%. Bitcoin’s lowest price this year was around $6,194on February 6th, 2018. To put things into perspective, Bitcoin is still 88.67% higher than it was this day last year.

Ethereum fell from $413 to $357.18, a drop of 15.6%.

Saving the bigger fireworks for last, XRP fell from $0.43 to $0.33, a drop of 23%.

These market conditions bring us to plead, JAMES – where are you!? We beg of you James, the market needs the advice only someone in a lab coat holding about $27 dollars can provide! If only we had all subscribed to his “secrets to making a fortune from this red-hot market!”

Unfortunately, not even the all-knowing James or his scammy Facebook ads could have prepared us for this!

Jokes aside, this ad is a snippet of the sentiment that played a substantial role in today’s market conditions. Massive speculation launched the total cryptocurrency market cap into the stratosphere, but then gravity set in.

That’s why news of the SEC even so much as *delaying* a judgment leads to a sharp market movement of speculators panicking and converting their BTC to Tether or USD.

Many people’s first introduction into cryptocurrency in 2017 was throwing money into a random coin they knew very little about, and magically seeing it go up 50% – 100% a day. With lambo and moon memes aplenty, the insanity of the cryptocurrency market somehow became normalized in our psychology.

It’s this live by the lambo, die by the lambo mentality that likely has many people feeling bleak after checking out the cryptocurrency prices (on our sick homepage *plug*).

However, that doesn’t mean that any of the developments have zero impact on the cryptocurrency world. To the contrary, a handful of them are super critical and can set precedents for years to come.

That’s why it’s important to stay level-headed, absorb information, and search for the long-term value and return on your attention.

Leave A Comment