Small-capitalization equities in the US have been on a tear this year, but investors are wondering if the headwinds in recent weeks are a sign that the strong upside momentum has run its course.

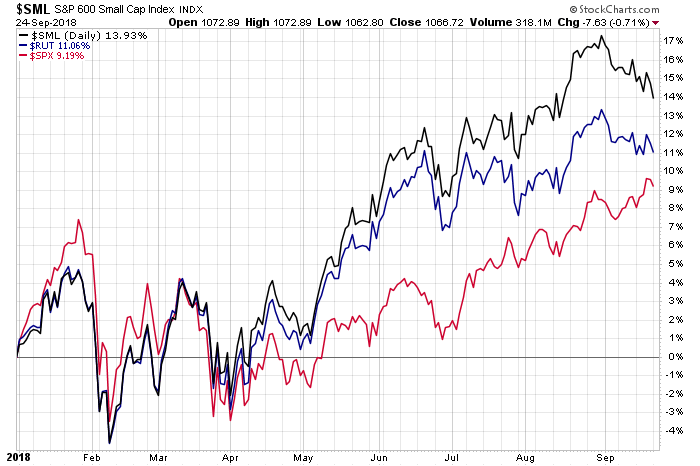

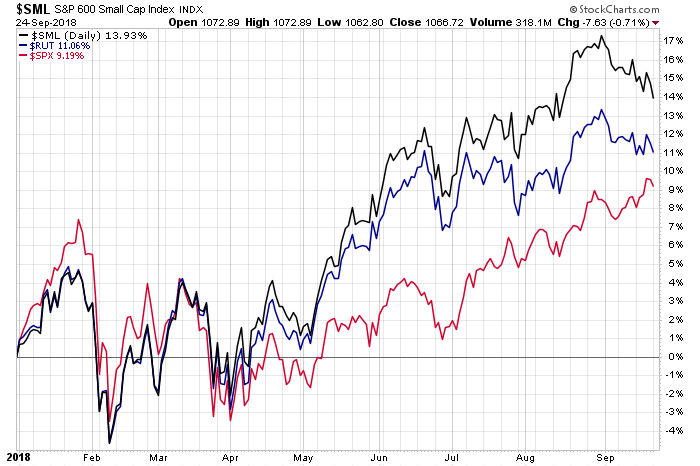

Small caps are still comfortably in the lead over large caps year to date, but trading in September has witnessed a reversal of fortunes for this formerly red-hot slice of the US equity market. For a closer look, let’s start by recognizing that two widely followed small-cap benchmarks continue to beat the broad market via the S&P 500 ($SPX) for 2018 through yesterday’s close (Sep. 24). The Russell 2000 Index ($RUT) is up a solid 11.1% this year and the S&P 600 ($SML) is doing even better with a 13.9% total return year to date. In both cases, the performances represent healthy premiums over the S&P 500’s 9.2% gain so far this year.

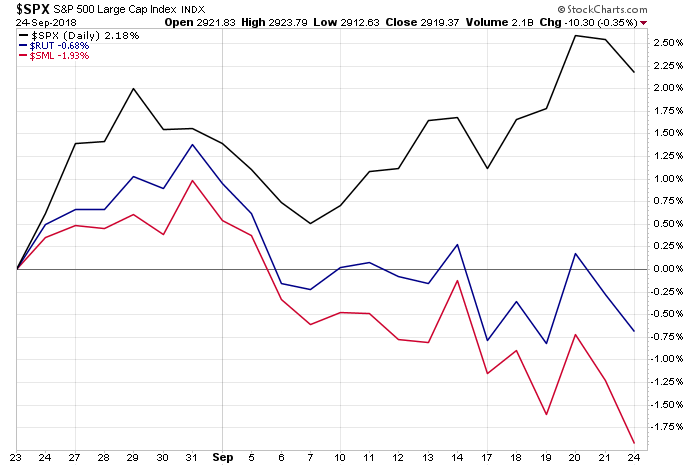

It’s premature to read too much into recent history, but it’s hard not to wonder if the small-cap rally’s low- hanging fruit has now been picked. Consider how performances stack up for the past month. While the broad market via the S&P 500 remains in positive terrain, the two small-cap indexes have stumbled are now in the red over the trailing one-month period.

Another worrisome sign for small-cap bulls is the partial deterioration in the technical profile for $SML. For the first time since May, the S&P 600 fell below its 50-day moving average yesterday. That alone is hardly a definitive sign that a bear market in small caps is now destiny. Perhaps it’s merely a healthy consolidation after a strong run.

Whatever the future holds for small caps, investors will be mindful that headwinds from macro factors may be lurking. The escalating US-China trade war, in particular, is front and center these days for looking ahead. Small-cap stocks have been widely hailed this year as a port in the storm for rising international tensions, courtesy of a relatively high domestic focus for many of these firms. But it remains to be seen how much of a moat that focus will be if the blowback from a trade war pinches the US economy.

Leave A Comment