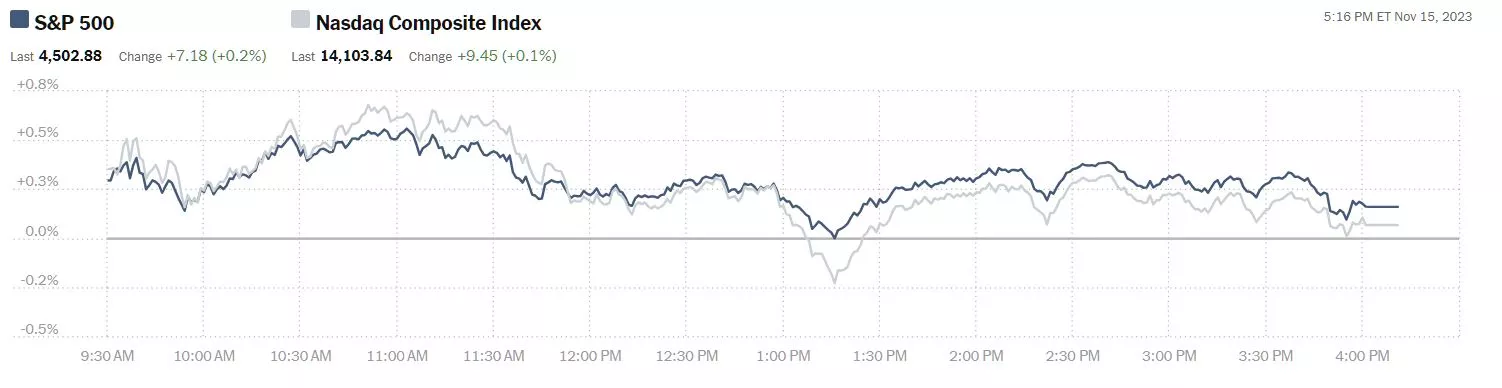

The stock market is firming higher, commentators are saying the Santa Claus rally has arrived (before Thanksgiving), but it is hard to know how far to lean in. FreepikWednesday the S&P 500 closed at 4,503, up 7 points, the Dow closed at 34,991, up 164 points, and the Nasdaq Composite closed at 14,104, up 10 points.

FreepikWednesday the S&P 500 closed at 4,503, up 7 points, the Dow closed at 34,991, up 164 points, and the Nasdaq Composite closed at 14,104, up 10 points. Chart: The New York TimesMost actives were led by Tesla (TSLA), up 2.3%, followed by Amazon (AMZN), down 1.8%, and Advanced Micro Devices (ADM), down 1.6%.

Chart: The New York TimesMost actives were led by Tesla (TSLA), up 2.3%, followed by Amazon (AMZN), down 1.8%, and Advanced Micro Devices (ADM), down 1.6%. Chart: The New York TimesIn morning futures action S&P 500 market futures are trading down 1 point, Dow market futures are trading flat, and Nasdaq 100 market futures are trading down 22 points.TalkMarkets contributor Michael Kramer writes that Stocks Stall As Yield Curve Normalization Process Takes Another Step Forward.

Chart: The New York TimesIn morning futures action S&P 500 market futures are trading down 1 point, Dow market futures are trading flat, and Nasdaq 100 market futures are trading down 22 points.TalkMarkets contributor Michael Kramer writes that Stocks Stall As Yield Curve Normalization Process Takes Another Step Forward. Freepik“Stocks finished flat today, following the slightly stronger-than-expected retail sales and weaker PPI data. Overall, yields and the dollar rose, which helped hold the S&P 500 to a gain of only 16 bps. Additionally, we continue to see yield curve normalization as the 10-year rate moved higher than the 5-year rate and back into positive territory. This isn’t the first time this has happened but appears that the process of a normalized yield curve is happening…

Freepik“Stocks finished flat today, following the slightly stronger-than-expected retail sales and weaker PPI data. Overall, yields and the dollar rose, which helped hold the S&P 500 to a gain of only 16 bps. Additionally, we continue to see yield curve normalization as the 10-year rate moved higher than the 5-year rate and back into positive territory. This isn’t the first time this has happened but appears that the process of a normalized yield curve is happening… The S&P 500 hit some solid fib levels today, at the 78.6% retracement level from the July to October decline. It also reached the 61.8% extension of wave A. The structure from July to October is a clear five waves, and the structure off the October lows is a straightforward three waves. If the rally stops here, this marks the end of wave 2, and we will be entering wave 3, which would mean we would easily surpass the lows of October at 4,100 on the S&P 500. Of course, this could all be invalidated with the index reaching the July highs. But at this point, I don’t have a count for that…

The S&P 500 hit some solid fib levels today, at the 78.6% retracement level from the July to October decline. It also reached the 61.8% extension of wave A. The structure from July to October is a clear five waves, and the structure off the October lows is a straightforward three waves. If the rally stops here, this marks the end of wave 2, and we will be entering wave 3, which would mean we would easily surpass the lows of October at 4,100 on the S&P 500. Of course, this could all be invalidated with the index reaching the July highs. But at this point, I don’t have a count for that… Nasdaq (NDX)I know my analysis doesn’t go with the seasonality charts plastered all over the internet. However, this comparison of the Nasdaq 100 of today with 2022 could just as easily be made to fit as all those seasonality charts. The point is to remain open to the possibility that markets don’t always go up, and just because it is the fourth quarter, it doesn’t mean we will have a solid finish to the year…

Nasdaq (NDX)I know my analysis doesn’t go with the seasonality charts plastered all over the internet. However, this comparison of the Nasdaq 100 of today with 2022 could just as easily be made to fit as all those seasonality charts. The point is to remain open to the possibility that markets don’t always go up, and just because it is the fourth quarter, it doesn’t mean we will have a solid finish to the year… And if the yield curve is steepening, the days of stock price movement are closer to the end than the beginning based on historical data.”See Kramer’s full article for additional stock charts and details.Contributors Chris Turner, Francesco Pesole, Frantisek Taborsky note that the US Dollar will likely stay strong in FX Daily: Government Shutdown Averted.”The dollar continues to claw back some of Tuesday’s losses after US October retail sales suggested that the consumer is still spending. Also helping has been the Senate’s support of a stop-gap funding bill that kicks the risk of a government shutdown into 2024. Expect more rangy price action in FX markets today, with the focus on speakers and US claims data.”

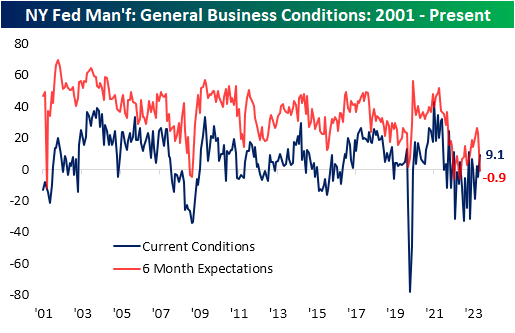

And if the yield curve is steepening, the days of stock price movement are closer to the end than the beginning based on historical data.”See Kramer’s full article for additional stock charts and details.Contributors Chris Turner, Francesco Pesole, Frantisek Taborsky note that the US Dollar will likely stay strong in FX Daily: Government Shutdown Averted.”The dollar continues to claw back some of Tuesday’s losses after US October retail sales suggested that the consumer is still spending. Also helping has been the Senate’s support of a stop-gap funding bill that kicks the risk of a government shutdown into 2024. Expect more rangy price action in FX markets today, with the focus on speakers and US claims data.” Freepik“The dollar is drifting higher as investors continue to assess whether the large drop on Tuesday was the start of something meaningful or just more noise in an uncertain environment. We have heard a couple of Federal Reserve speakers still holding out the risk of a further hike, but for the time being, US money markets seem pretty confident that the Fed cycle is over and have now priced 90bp of easing in 2024. Yesterday’s release of US October retail sales failed to kindle this week’s dollar bear trend and the Senate’s support for a stopgap funding bill has removed the risk of a dollar bearish government shutdown at midnight on Friday.Where does that leave us? Confidence that the Fed tightening cycle is over should be positive for the rest of the world currencies – especially those that are very sensitive to higher interest rates. Yet with overnight rates in the US at 5.4%, the dollar is an expensive sell and the bar is high to invest elsewhere. That is why – as we conclude in our 2024 FX Outlook: Waiting for the tide to come in – the dollar bear trend is going to take some time to build and its more intense period may not be until 2Q24.For today, the focus will be on the weekly jobless claims data and industrial production. Any spike in jobless claims could hit the dollar.”The Staff at Bespoke Investment Group headlines with Bad Expectations Out Of New York.”The New York Fed gave us the first regional reading on manufacturing conditions this morning with the release of the Empire State Manufacturing Survey. The headline number rose back into expansion at 9.1, well above expectations of an improvement to only -3. Although the current conditions index improved, expectations dropped a massive 24 points month over month. That ranks as the fourth largest one-month decline in this reading on record behind September 2001 and January 2009.”

Freepik“The dollar is drifting higher as investors continue to assess whether the large drop on Tuesday was the start of something meaningful or just more noise in an uncertain environment. We have heard a couple of Federal Reserve speakers still holding out the risk of a further hike, but for the time being, US money markets seem pretty confident that the Fed cycle is over and have now priced 90bp of easing in 2024. Yesterday’s release of US October retail sales failed to kindle this week’s dollar bear trend and the Senate’s support for a stopgap funding bill has removed the risk of a dollar bearish government shutdown at midnight on Friday.Where does that leave us? Confidence that the Fed tightening cycle is over should be positive for the rest of the world currencies – especially those that are very sensitive to higher interest rates. Yet with overnight rates in the US at 5.4%, the dollar is an expensive sell and the bar is high to invest elsewhere. That is why – as we conclude in our 2024 FX Outlook: Waiting for the tide to come in – the dollar bear trend is going to take some time to build and its more intense period may not be until 2Q24.For today, the focus will be on the weekly jobless claims data and industrial production. Any spike in jobless claims could hit the dollar.”The Staff at Bespoke Investment Group headlines with Bad Expectations Out Of New York.”The New York Fed gave us the first regional reading on manufacturing conditions this morning with the release of the Empire State Manufacturing Survey. The headline number rose back into expansion at 9.1, well above expectations of an improvement to only -3. Although the current conditions index improved, expectations dropped a massive 24 points month over month. That ranks as the fourth largest one-month decline in this reading on record behind September 2001 and January 2009.” “The report indicated weak demand as new orders currently remain in contraction. Meanwhile, Unfilled Orders are far more depressed at -23.2 making the November reading the lowest since December 2014. Shipments have been increasingly choppy during the post-pandemic period, but the November reading did improve up to 10, slightly below the historical median. Meanwhile, Inventories were much more elevated. Rising 11.2 points month over month, inventories are now in the top decile of their historical range with the first expansionary reading in six months…Employment metrics were also weak with both the number of employees and average workweek indices sitting in contraction. However, these were also two of the strongest categories relative to historical ranges of anywhere in the report. In fact, Average Workweek expectations hit the highest level since March of last year. While those labor expectations remain healthy, the same cannot be said for capital spending. Expected tech spending hit a new post-pandemic low while capital expenditure plans likewise returned to the low end of its range.”See the full article for additional recession-inducing comments and charts.TM contributors Bruno Venditti and Miranda Smith take a stab at Visualizing America’s $1 Trillion Credit Card Debt.”Americans’ collective credit card debt surpassed $1 trillion for the first time in Q2 2023.Between April 1 and June 30, total credit card balances rose by $45 billion compared to Q1 2023, to $1.03 trillion.”

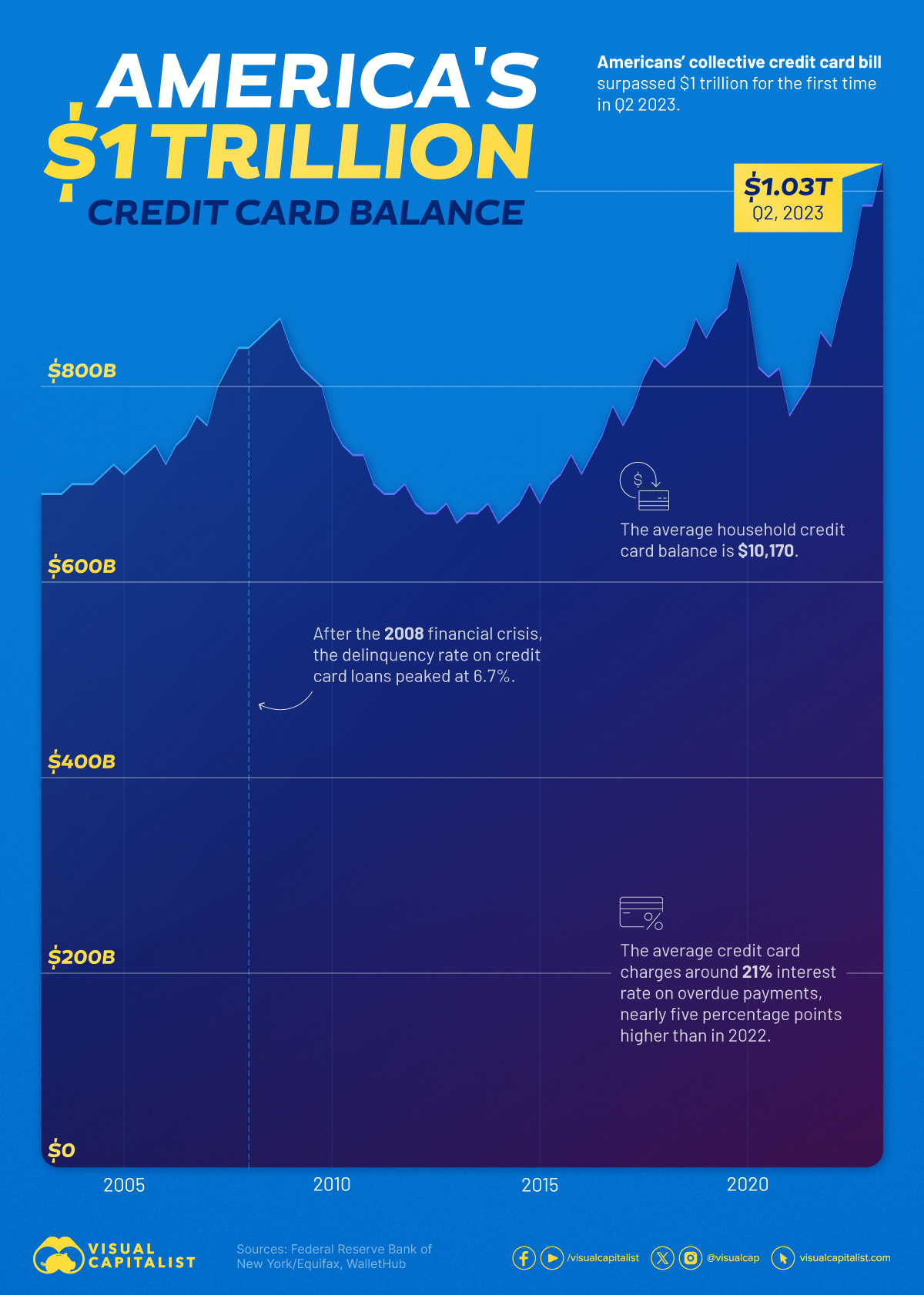

“The report indicated weak demand as new orders currently remain in contraction. Meanwhile, Unfilled Orders are far more depressed at -23.2 making the November reading the lowest since December 2014. Shipments have been increasingly choppy during the post-pandemic period, but the November reading did improve up to 10, slightly below the historical median. Meanwhile, Inventories were much more elevated. Rising 11.2 points month over month, inventories are now in the top decile of their historical range with the first expansionary reading in six months…Employment metrics were also weak with both the number of employees and average workweek indices sitting in contraction. However, these were also two of the strongest categories relative to historical ranges of anywhere in the report. In fact, Average Workweek expectations hit the highest level since March of last year. While those labor expectations remain healthy, the same cannot be said for capital spending. Expected tech spending hit a new post-pandemic low while capital expenditure plans likewise returned to the low end of its range.”See the full article for additional recession-inducing comments and charts.TM contributors Bruno Venditti and Miranda Smith take a stab at Visualizing America’s $1 Trillion Credit Card Debt.”Americans’ collective credit card debt surpassed $1 trillion for the first time in Q2 2023.Between April 1 and June 30, total credit card balances rose by $45 billion compared to Q1 2023, to $1.03 trillion.” “After a sharp contraction in the first year of the pandemic, credit card balances have experienced seven consecutive quarters of year-over-year growth.In Q2 2023, credit card balances saw the most significant increase among all debt types, including auto loans, student loans, and mortgages.The average household credit card balance was $10,173.87 in June, $2,242.77 below the record set in Q4 2007…Credit cards stand out as the most prevalent form of household debt in the U.S. and this prevalence is on an upward trajectory.According to the Federal Reserve Bank of New York, credit card issuance has been steady over the last few years, averaging about 92 million newly issued cards each year between 2017 and 2019. The pandemic caused a sharp contraction in new credit card issuance, but lending returned across all credit score groups in 2021.There are currently 70 million more credit card accounts open than in 2019. Approximately 69% of Americans now possess at least one credit card.“American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience,” New York Fed researchers wrote.“However, rising balances may present challenges for some borrowers,” they added, “and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers.””TalkMarkets contributor and economist Menzie Chinn discusses charting GDP And Interest Rate Forecasts And Recession.”The Q4 Survey of Professional Forecasters was released Monday. Accelerated growth is forecast, no yield curve dis-inversion, and triggering of the Sahm rule.First, GDP:

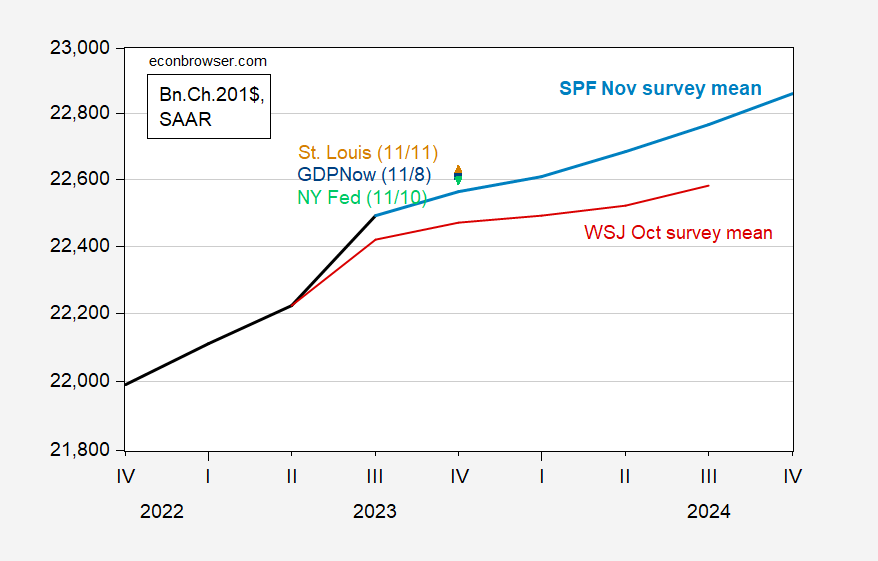

“After a sharp contraction in the first year of the pandemic, credit card balances have experienced seven consecutive quarters of year-over-year growth.In Q2 2023, credit card balances saw the most significant increase among all debt types, including auto loans, student loans, and mortgages.The average household credit card balance was $10,173.87 in June, $2,242.77 below the record set in Q4 2007…Credit cards stand out as the most prevalent form of household debt in the U.S. and this prevalence is on an upward trajectory.According to the Federal Reserve Bank of New York, credit card issuance has been steady over the last few years, averaging about 92 million newly issued cards each year between 2017 and 2019. The pandemic caused a sharp contraction in new credit card issuance, but lending returned across all credit score groups in 2021.There are currently 70 million more credit card accounts open than in 2019. Approximately 69% of Americans now possess at least one credit card.“American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience,” New York Fed researchers wrote.“However, rising balances may present challenges for some borrowers,” they added, “and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers.””TalkMarkets contributor and economist Menzie Chinn discusses charting GDP And Interest Rate Forecasts And Recession.”The Q4 Survey of Professional Forecasters was released Monday. Accelerated growth is forecast, no yield curve dis-inversion, and triggering of the Sahm rule.First, GDP: Figure 1: GDP as reported (bold black), GDPNow of 11/8 (blue square), NY Fed nowcast as of 11/10 (green inverted triangle), St. Louis Fed news nowcast (brown triangle), WSJ survey mean (bold dark red), SPF median (light blue), all in billions Ch.2017$, SAAR. Levels calculated on basis on advance GDP release figure. Note on log scale. Source: BEA 2023Q3 advance, Atlanta Fed, NY Fed, St.Louis Fed via FRED, WSJ, Survey of Professional Forecasters, and author’s calculations. The path of unemployment can be interpreted in light of the Sahm Rule.

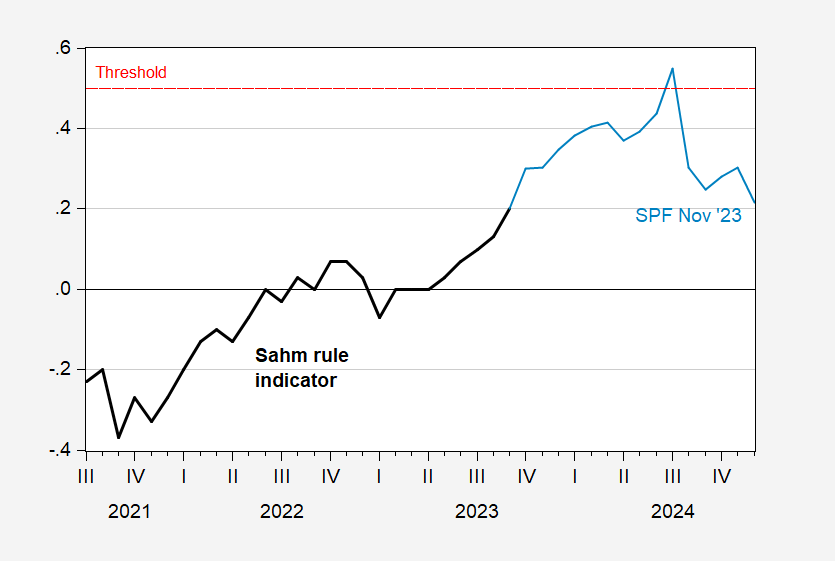

Figure 1: GDP as reported (bold black), GDPNow of 11/8 (blue square), NY Fed nowcast as of 11/10 (green inverted triangle), St. Louis Fed news nowcast (brown triangle), WSJ survey mean (bold dark red), SPF median (light blue), all in billions Ch.2017$, SAAR. Levels calculated on basis on advance GDP release figure. Note on log scale. Source: BEA 2023Q3 advance, Atlanta Fed, NY Fed, St.Louis Fed via FRED, WSJ, Survey of Professional Forecasters, and author’s calculations. The path of unemployment can be interpreted in light of the Sahm Rule. Figure 2: Sahm rule real time indicator, in % (bold black), and forecasted indicator from SPF (light blue). Quarterly forecasted figures quadratic interpolation to monthly. Dashed red line is 0.50% threshold. Source: FRED, Philadelphia Fed SPF, and author’s calculations.This suggests Sahm rule trigger in July, although the interpolation procedure makes timing the exact month tricky.The interest rate forecast is for rates peaking in 2023Q4.

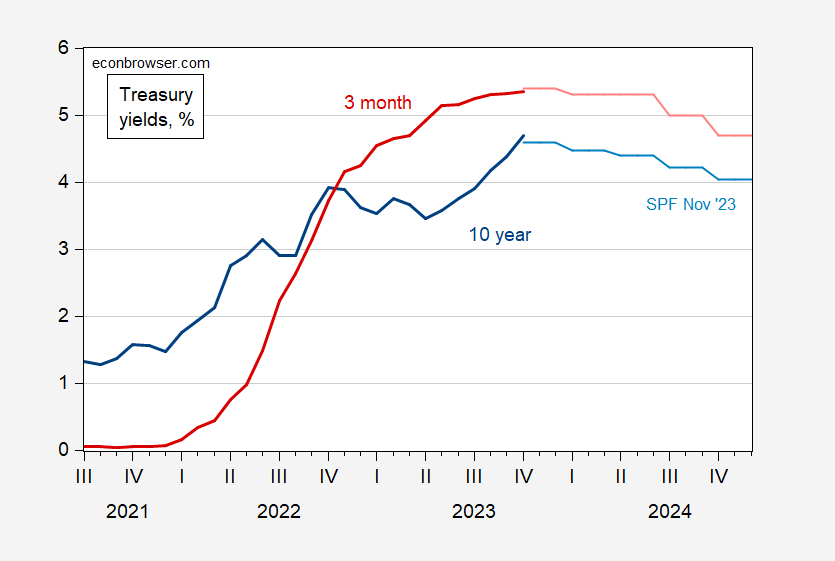

Figure 2: Sahm rule real time indicator, in % (bold black), and forecasted indicator from SPF (light blue). Quarterly forecasted figures quadratic interpolation to monthly. Dashed red line is 0.50% threshold. Source: FRED, Philadelphia Fed SPF, and author’s calculations.This suggests Sahm rule trigger in July, although the interpolation procedure makes timing the exact month tricky.The interest rate forecast is for rates peaking in 2023Q4. Figure 3: Three month Treasury yield (bold dark red), and forecasted three month yield (red), and ten year Treasury yield (bold dark blue), and forecasted ten year (light blue), all in %. Source: Treasury via FRED, and Philadelphia Fed SPF. For 2023Q4, forecasted 10yr is 4.6%, vs. 3.9% in the previous survey (August). The peak rate is moved back to 2023Q4 from 2023Q3.”In the “Where To Invest Department” contributor Tim Fries takes A Quick Look At Berkshire Hathaway’s Recent Moves.”New securities filings by Wall Street’s most astute investors came to light this week, including those that revealed the latest holdings of Warren Buffett’s Berkshire Hathaway (NYSE: BRK-A). Among several adjustments, the financial powerhouse sold its stakes in Activision Blizzard (Nasdaq: ATVI) and General Motors (NYSE: GM), reduced its stake in Amazon (Nasdaq: AMZN), and closed positions in Johnson & Johnson (NYSE: JNJ) and Procter & Gamble (NYSE: PG).

Figure 3: Three month Treasury yield (bold dark red), and forecasted three month yield (red), and ten year Treasury yield (bold dark blue), and forecasted ten year (light blue), all in %. Source: Treasury via FRED, and Philadelphia Fed SPF. For 2023Q4, forecasted 10yr is 4.6%, vs. 3.9% in the previous survey (August). The peak rate is moved back to 2023Q4 from 2023Q3.”In the “Where To Invest Department” contributor Tim Fries takes A Quick Look At Berkshire Hathaway’s Recent Moves.”New securities filings by Wall Street’s most astute investors came to light this week, including those that revealed the latest holdings of Warren Buffett’s Berkshire Hathaway (NYSE: BRK-A). Among several adjustments, the financial powerhouse sold its stakes in Activision Blizzard (Nasdaq: ATVI) and General Motors (NYSE: GM), reduced its stake in Amazon (Nasdaq: AMZN), and closed positions in Johnson & Johnson (NYSE: JNJ) and Procter & Gamble (NYSE: PG).  Image courtesy of 123rf.comAlthough Buffett’s Berkshire mainly cashed out, its adjustments in the third quarter also included some new investments.The investment firm bought shares of three new companies in the latest period, including mass media company Liberty Media Corporation (Nasdaq: LSXMA), broadcasting firm Sirius XM Holdings (Nasdaq: SIRI), and Atlanta Braves Holdings. According to Yahoo Finance, Berkshire invested $161.26 million, $43.77 million, and $7.99 million into these three stocks. The Atlanta Braves had been split off from Liberty Media, another Berkshire bet, earlier this year. As of September 30, Berkshire’s equity portfolio totaled $318.6 billion. Over 2023, the firm has offloaded stocks amounting to $23.6 billion more than it acquired. These divestments have bolstered Berkshire’s unprecedented cash reserves, now equivalent to its substantial $156.8 billion stake in Apple.”Caveat Emptor.Have a good one.

Image courtesy of 123rf.comAlthough Buffett’s Berkshire mainly cashed out, its adjustments in the third quarter also included some new investments.The investment firm bought shares of three new companies in the latest period, including mass media company Liberty Media Corporation (Nasdaq: LSXMA), broadcasting firm Sirius XM Holdings (Nasdaq: SIRI), and Atlanta Braves Holdings. According to Yahoo Finance, Berkshire invested $161.26 million, $43.77 million, and $7.99 million into these three stocks. The Atlanta Braves had been split off from Liberty Media, another Berkshire bet, earlier this year. As of September 30, Berkshire’s equity portfolio totaled $318.6 billion. Over 2023, the firm has offloaded stocks amounting to $23.6 billion more than it acquired. These divestments have bolstered Berkshire’s unprecedented cash reserves, now equivalent to its substantial $156.8 billion stake in Apple.”Caveat Emptor.Have a good one.

Thoughts For Thursday: Staying On Top – Barely

Tuesday Talk: Market Is Up, But Uncertainty Lingers

Leave A Comment