Not feeling terribly inspired on this quiet Sunday, so I’ll just share with you a couple of positions I’ve got focused on bond funds. The first of these is the high-yield bond fund symbol HYG, which broken beneath this massive pattern below and has been in the throes of rolling over for some time now.

Looking closely, you can see the failure of the blue trendline and the going-nowhere-fast action of the past few weeks. A failure of the green horizontal line would really get things kicking.

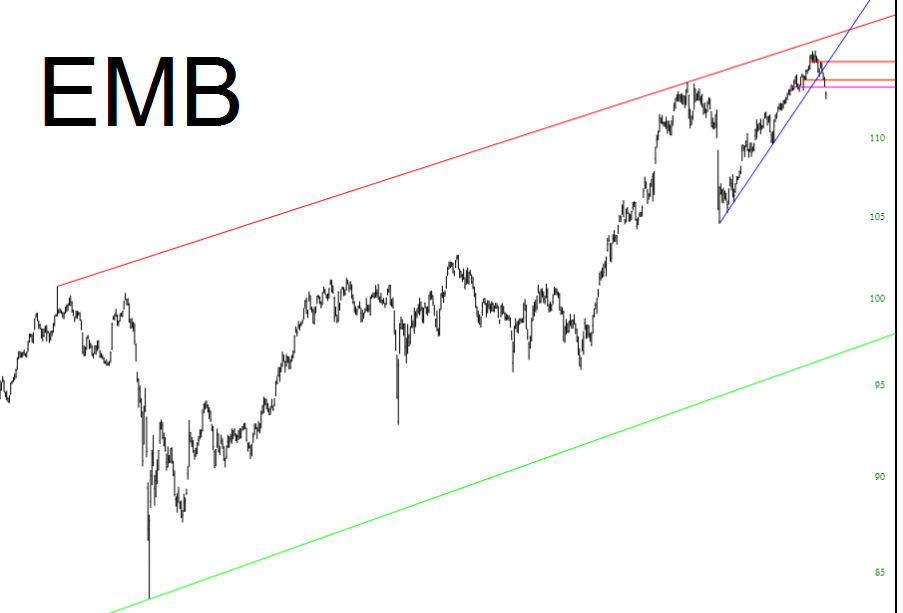

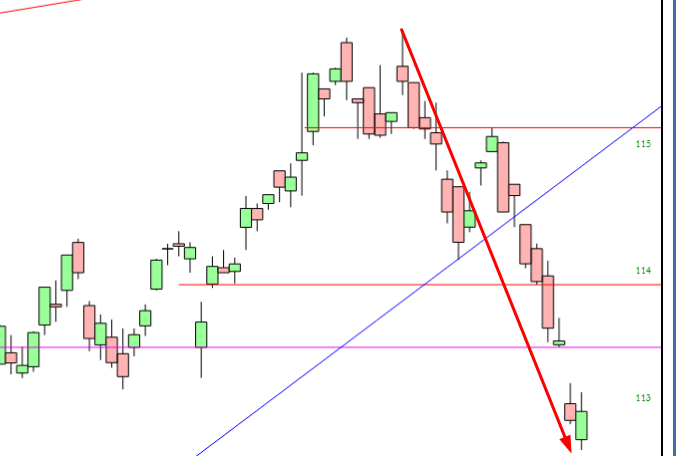

I’ve got an especially large short position in the emerging markets bond fund, below. The channel goes back for years, and even though we’ve already dropped some, we’re quite high (relatively speaking) within the confines of this channel.

Once more, looking closer, the drop on this one has been steadier than on HYG (note the red arrow – – my kind of market) and I’m comfortable suffering through any bounce as long as it doesn’t penetrate above the magenta horizontal below (where the gap is).

I am presently positioned with 48 shorts, concentrated in energy, retail, and the above two funds, and I’m fairly aggressively using margin.

Leave A Comment