Here are some things I think I am thinking about:

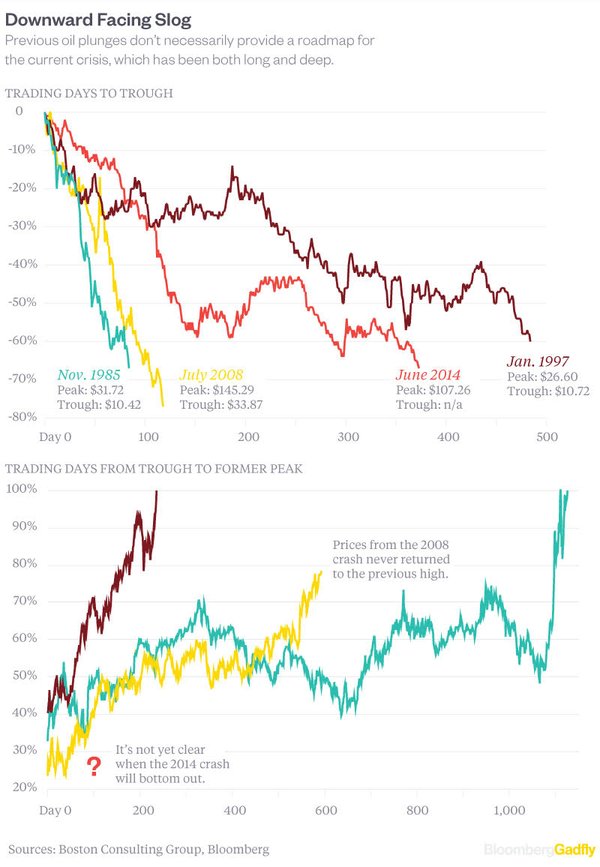

1) Called out by Andreessen. Last week on Twitter I mentioned that oil prices were on the verge of their worst decline in decades. Marc Andreessen of Netscape and Venture Capital fame called me out for posting this chart and calling it “the worst decline”:

“Best.” @cullenroche https://t.co/aObXfp1br8

— Marc Andreessen (@pmarca) December 18, 2015

@cullenroche Perhaps, but there have been massive technological advances in extraction over the last decade. And geopolitical shifts…

— Marc Andreessen (@pmarca) December 18, 2015

@pmarca Totes magotes. As I like to say, a long-term bet on commodities is a bet against human innovation.

— Cullen Roche (@cullenroche) December 18, 2015

Great points by Marc. But that raises a more interesting discussion – are commodity price declines necessarily good or bad? I think the answer is it depends. Over long periods of time commodity prices tend to decline or remain flat in real-terms. That makes sense since commodities make up a good chunk of the inputs in inflation. But as we move to an increasingly service oriented economy and one in which technology is driving down the cost of everything, we have to keep things in the right context. Commodity prices should fall in real terms over the long-term, but in the short-term these commodity price declines could be more consistent with sharp declines in aggregate demand (or the result of unsustainable booms in demand) as appears to be the case with the current state of the markets. So, I don’t think it’s totally wrong to call this commodity price decline “bad” as it seems to be consistent with a global environment that is more “bad” than “good” in the short-term.

2) Barry & Paul blame the banks. Here is a piece by Paul Krugman citing a piece by Barry Ritholtz in which both blame the banks for the financial crisis. I have to admit that I find this blame game rather boring. Can anyone really be so confident about such a complex event that they can blame one group? Worse, Paul and Barry are sympathetic to aggregate demand driven economics (as am I), but here we find them blaming supply side mechanics for an entire economic downturn. How does that fit? After all, banks are simply suppliers of credit. They don’t force people to borrow. Nobody takes out a new loan with a gun to their head. Yes, there was widespread fraud and all that, but isn’t it safe to say that the blame for the crisis was pretty widespread as well? Borrowers were greedy and speculating on houses. Bankers were greedy and loosened lending standards. The government emphasized policy that promoted home ownership. Who should we blame the most? I don’t know, but if you’re a believer in aggregate demand driven economics then it’s very hard to blame the boom in housing primarily on supply side mechanics….

Leave A Comment