We’re in cash, so we don’t care.

That’s right, remember how we cashed out last week and how we had those disaster hedges in Friday morning’s post? Turns out that was kind of a good idea as the market has whipsawed around and we get to enjoy it from the sidelines.

Our first aggressive hedge idea, the Russell ultra-short ETF (TZA) Oct $10/13 bull call spread with the short Jan $10 puts for net $1,400 is only at $1,610 (up 15%) so far and it has potential to pay back $6,000, which is still a $4,390 profit (272%) even with the late start, so still a good hedge to have – as are the others we discussed.

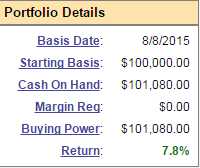

We put our money where our mouth was in our 5% (Montly) Portfolio over at Seeking Alpha and gained $3,000 (3%) yesterday as we timed the sell-off very well by getting more aggressive on our Dow (DIA) shorts, pushing us to close up 7.8% for the month + 1 day. My live chat comment at noon yesterday to our Members was:

In the 5% Portfolio we now have 10 long and 20 short and we’re going to close our remaining 10 long DIA Sept $155 calls at $10.20 and HOPE the short calls expire lower than they are now.

HOPE, however, is not a valid investing strategy so we will protect ourselves with 15 DIA Nov $165 ($5.65)/$170 ($3) bull call spreads at $2.65 ($3,975). That gives us $6,025 of upside protection in case the Dow pops higher than it is now and, of course, if it does, we’ll add more bullish positions.

On the whole, though, it reflects my bearish attitude because I don’t see $167.50 as a big threat and certainly not $170 which is less than 5% up from here (17,250) by next Friday.

As you can see on the chart, our timing was fantastic and the Dow fell off a cliff shortly after so we got the best of both worlds. By simply pulling the long portion of the bullish DIA spread we picked up on 8/24 in what we call a Jenga Play, we were able to cash out the winning portion at the top of the fake rally and then take full advantage of the ride down.

Leave A Comment