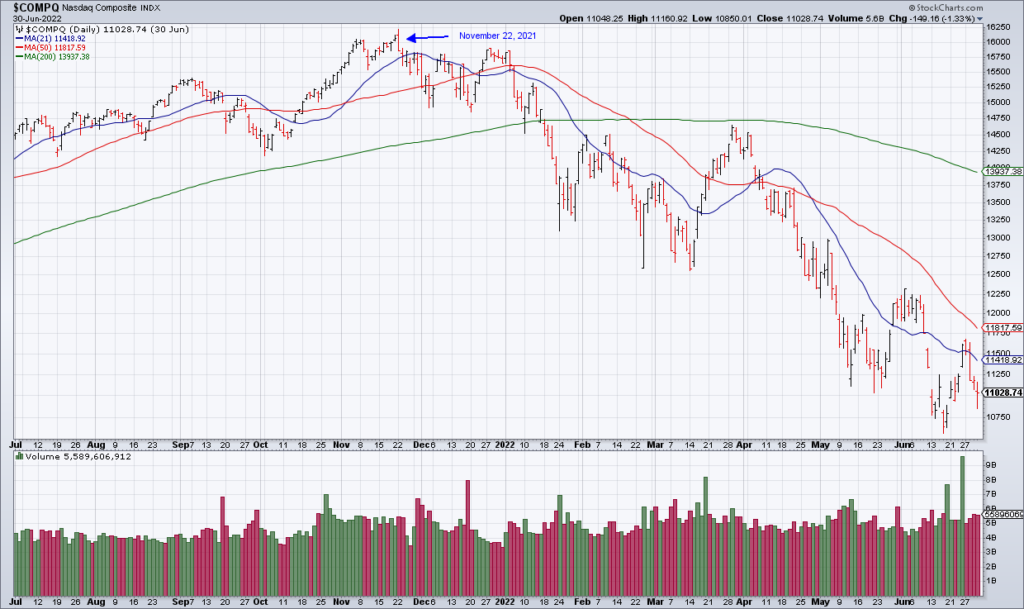

The market was cruising along as usual Thursday before reversing hard to the downside starting around 2 pm EST. At the time, it wasn’t clear if the catalyst was a speech by Fed President Neel Kashkari in which he said the Fed might not cut rates at all this year or some news out of the Middle East. Since long term treasuries (TLT) rallied, that’s more consistent with the latter than the former. While Sentiment Trader’s Jason Goepfert had a number of tweets suggesting that this hasn’t led to significant further declines in the past, personally it reminded me of November 22, 2021 – the day the Nasdaq topped before the bear market of 2022 (“Huge Intraday Reversal Suggests The Top Is In”, Top Gun Financial, November 22, 2021).

The market was cruising along as usual Thursday before reversing hard to the downside starting around 2 pm EST. At the time, it wasn’t clear if the catalyst was a speech by Fed President Neel Kashkari in which he said the Fed might not cut rates at all this year or some news out of the Middle East. Since long term treasuries (TLT) rallied, that’s more consistent with the latter than the former. While Sentiment Trader’s Jason Goepfert had a number of tweets suggesting that this hasn’t led to significant further declines in the past, personally it reminded me of November 22, 2021 – the day the Nasdaq topped before the bear market of 2022 (“Huge Intraday Reversal Suggests The Top Is In”, Top Gun Financial, November 22, 2021). In less than two hours (8:30 am EST), the BLS will release the March Jobs Reports. The median estimate is for 215k new jobs with a range of estimates from 150k to 250k. Anything within that range shouldn’t be a big deal as it would suggest the economy is still doing fine without preventing the Fed from cutting rates in June. Anything above might put a June Fed rate cut in doubt while anything below would raise concerns about the economy.More By This Author:Fed Rate Hiking Cycles And Recessions: A History LessonThe Mag 7 Is Now The Fab 5, TSLA 1Q Deliveries, PVH -20%Gold Hedges Against More Than Just Inflation

In less than two hours (8:30 am EST), the BLS will release the March Jobs Reports. The median estimate is for 215k new jobs with a range of estimates from 150k to 250k. Anything within that range shouldn’t be a big deal as it would suggest the economy is still doing fine without preventing the Fed from cutting rates in June. Anything above might put a June Fed rate cut in doubt while anything below would raise concerns about the economy.More By This Author:Fed Rate Hiking Cycles And Recessions: A History LessonThe Mag 7 Is Now The Fab 5, TSLA 1Q Deliveries, PVH -20%Gold Hedges Against More Than Just Inflation

Leave A Comment