Tiffany & Co. (TIF) customers know the company for its famous blue boxes. Investors should come to know the company, for its high dividend growth.

Tiffany stock has a mix of a long history of dividend growth, coupled with a high dividend growth rate. It typically increases its dividend by 10% or more each year.

On May 25th, Tiffany increased its dividend by 11%. It has raised its dividend for the past 15 years.

This makes Tiffany a Dividend Achiever, a group of 265 stocks with 10+ years of consecutive dividend increases.

This article will discuss Tiffany’s business model, and why it could be an attractive stock for dividend growth.

Business Overview

Tiffany was founded all the way back in 1837. It is a jeweler and specialty retailer. It has a wide range of merchandise offerings, including jewelry, timepieces, sterling silverware, china, crystal, stationery, fragrances and accessories.

The company’s main focus is jewelry, which accounted for 92% of worldwide net sales in fiscal 2016.

Tiffany has a significant international presence. More than half of its sales come from outside the U.S.

It generates revenue from the following countries:

The ‘other’ segment includes retail sales and wholesale distribution in the emerging markets, wholesale diamond sales, and licensing agreements.

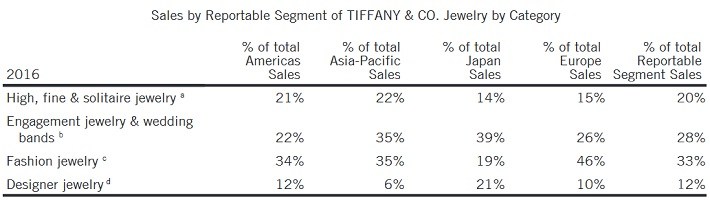

In terms of product category, Tiffany’s sales are as follows:

Source: 2016 Annual Report, page 14

2016 was a challenging year for Tiffany, due to softness in most of its core geographic regions. Worldwide sales of $4 billion represented a 3% decline from the previous year.

Comparable-store sales, a key performance metric for retailers, which measures sales at stores open at least one year, declined 5% for the year.

Adjusted earnings-per-share fell 2% to $3.75, as sales declines were somewhat offset by cost cuts.

Leave A Comment