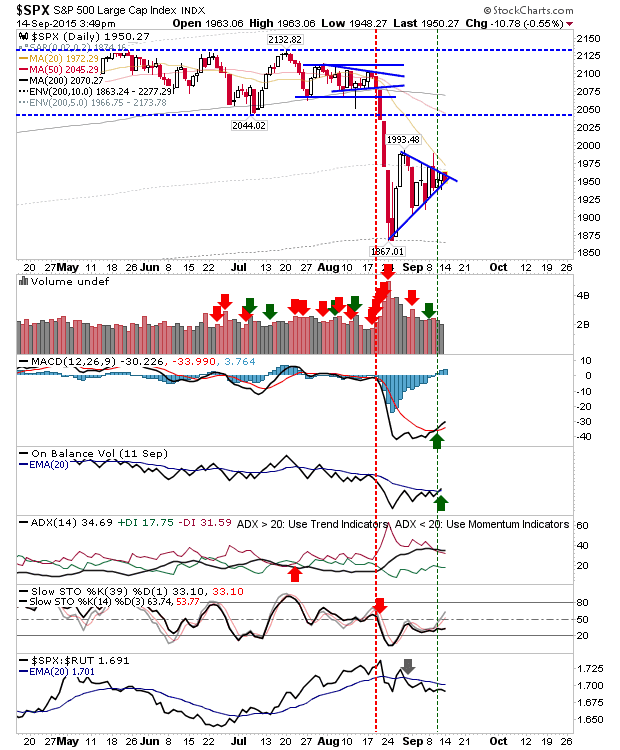

Everything is really gearing towards Thursday’s rate decision, but there may be a fake move before then. Shorts may find joy in the Tech indices given the favourable risk:reward, but I wouldn’t be surprised if such short positions were whipped out before then – so buyers and sellers beware.

The S&P is balancing under performance against the Russell 2000 with ‘buy’ triggers the MACD and On-Balance-Volume. As today’s action finished lower the expectation will be for a consolidation breakdown tomorrow, but take nothing for granted. Trade the break.

The Nasdaq is also experiencing mixed action. An index which is enjoying excellent relative strength is offset by some mixed technical action. Momentum is struggling near the mid-line despite the index’s outperformance.

The Russell 2000 is hogging the support line of a possible ‘bear flag’ and resistance of the 20-day MA. Shorts may look to play the squeeze off the 20-day MA.

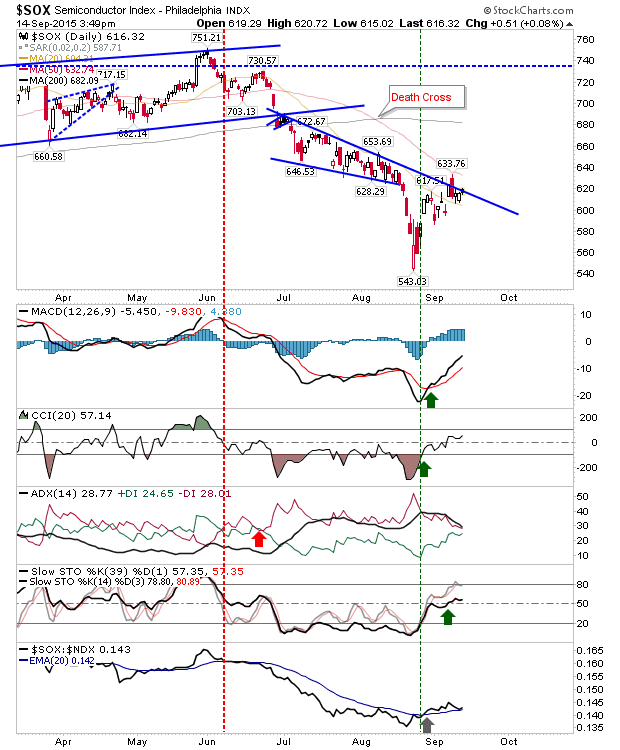

The Semiconductor Index is up against declining resistance, but is at least above its 20-day MA. Watch it (and the Nasdaq) for corresponding leads.

Tomorrow may yet see more of the same, but current consolidations are playing for a big reactionary move. Thursday will force some reaction.

Leave A Comment