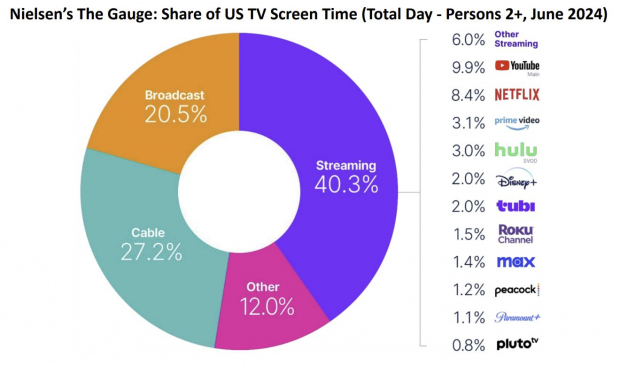

Image Source: Zacks Investment ResearchNetflix Dominates the Streaming MarketIn the report, the company shared a graphic from Nielsen that demonstrates just how much viewers consume Netflix’s streaming service.From the report: According to Nielsen, streaming accounts for 40% of total TV time in the US today, with Netflix and YouTube the clear leaders in direct-to-consumer entertainment. Collectively our two services account for almost half of all streaming TV watch time in the US.In H1 2024 (and despite headwinds from paid sharing) Netflix generated more view hours in the Nielsen Top 10 across film, series and licensed titles than all the other streamers combined.This shows Netflix’s clear edge over competitors Amazon (AMZN – Free Report), Disney (DIS – Free Report) and other streaming competitors. Although Amazon and Disney continue to expand offerings like Netflix, there are none who are quite so impressive at the streaming maverick.

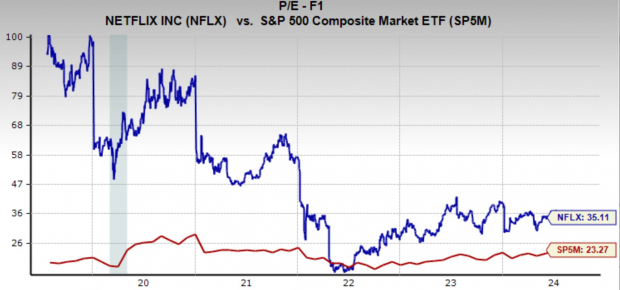

Image Source: Zacks Investment ResearchNetflix Dominates the Streaming MarketIn the report, the company shared a graphic from Nielsen that demonstrates just how much viewers consume Netflix’s streaming service.From the report: According to Nielsen, streaming accounts for 40% of total TV time in the US today, with Netflix and YouTube the clear leaders in direct-to-consumer entertainment. Collectively our two services account for almost half of all streaming TV watch time in the US.In H1 2024 (and despite headwinds from paid sharing) Netflix generated more view hours in the Nielsen Top 10 across film, series and licensed titles than all the other streamers combined.This shows Netflix’s clear edge over competitors Amazon (AMZN – Free Report), Disney (DIS – Free Report) and other streaming competitors. Although Amazon and Disney continue to expand offerings like Netflix, there are none who are quite so impressive at the streaming maverick. Image Source: NetflixNetflix Boasts a Fair ValuationAs of today, Netflix is trading at a very reasonable valuation considering its dominant role in the streaming industry and impressive growth prospects.The company is trading at a one year forward earnings multiple of 35.1x, which is well below its five-year median of 40.6x and above the broad market average.EPS are forecast to grow 25.3% annually over the next three to five years.

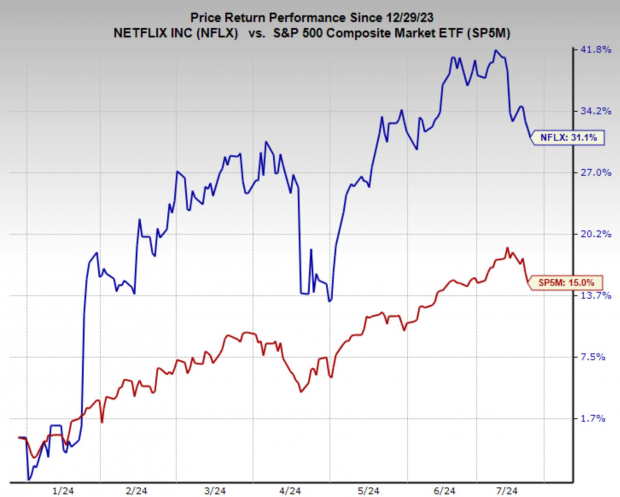

Image Source: NetflixNetflix Boasts a Fair ValuationAs of today, Netflix is trading at a very reasonable valuation considering its dominant role in the streaming industry and impressive growth prospects.The company is trading at a one year forward earnings multiple of 35.1x, which is well below its five-year median of 40.6x and above the broad market average.EPS are forecast to grow 25.3% annually over the next three to five years. diImage Source: Zacks Investment ResearchBottom LineNetflix’s impressive earnings report, highlighted by strong revenue and earnings growth, expanded margins and accelerating subscriber additions, underscores its dominant position in the streaming landscape.While the broader market’s weakness has temporarily pushed the stock lower, the company’s robust performance and reasonable valuation make it a compelling investment opportunity. The potential for continued growth, driven by factors like ad revenue expansion, live content and other new content offerings, further strengthens Netflix’s investment case.Investors seeking exposure to the thriving streaming sector should seriously consider adding Netflix to their portfolios.More By This Author:Is Tesla A Buy Heading Into Its Q2 Earnings Release? Top Stocks To Buy For Growth As Earnings Approach Don’t Overlook These 2 Top-Rated Stocks After Earnings

diImage Source: Zacks Investment ResearchBottom LineNetflix’s impressive earnings report, highlighted by strong revenue and earnings growth, expanded margins and accelerating subscriber additions, underscores its dominant position in the streaming landscape.While the broader market’s weakness has temporarily pushed the stock lower, the company’s robust performance and reasonable valuation make it a compelling investment opportunity. The potential for continued growth, driven by factors like ad revenue expansion, live content and other new content offerings, further strengthens Netflix’s investment case.Investors seeking exposure to the thriving streaming sector should seriously consider adding Netflix to their portfolios.More By This Author:Is Tesla A Buy Heading Into Its Q2 Earnings Release? Top Stocks To Buy For Growth As Earnings Approach Don’t Overlook These 2 Top-Rated Stocks After Earnings

Leave A Comment