Image Source: PexelsInvestors may turn their attention to gold amid heightened market volatility with Friday’s jobs report showing the US labor force cooled while the unemployment rate rose to 4.3%, its highest peak since 2021.With gold often sought out for defensive safety during economic uncertainty it’s noteworthy that the Zacks Mining-Gold Industry is currently in the top 22% of over 250 Zacks industries. That said, here are three of these top gold mining stocks to consider at the moment.Agnico Eagle Mines (AEM – Free Report)Zacks Rank #2 (Buy)Agnico Eagle Mines has been one of the most intriguing gold producers with its stock soaring over +37% this year to impressively top the broader indexes and the Zacks Mining-Gold Market’s +21%.Agnico Eagle Mines’ increased profitability has been the catalyst for its extended rally with fiscal 2024 EPS now expected to soar 58% to $3.52 versus $2.23 per share last year. Notably, Agnico Eagle Mines checks an “A” Zacks Style Scores grade for Growth, and its 2.1% annual dividend yield has kept investors engaged as well.

Image Source: PexelsInvestors may turn their attention to gold amid heightened market volatility with Friday’s jobs report showing the US labor force cooled while the unemployment rate rose to 4.3%, its highest peak since 2021.With gold often sought out for defensive safety during economic uncertainty it’s noteworthy that the Zacks Mining-Gold Industry is currently in the top 22% of over 250 Zacks industries. That said, here are three of these top gold mining stocks to consider at the moment.Agnico Eagle Mines (AEM – Free Report)Zacks Rank #2 (Buy)Agnico Eagle Mines has been one of the most intriguing gold producers with its stock soaring over +37% this year to impressively top the broader indexes and the Zacks Mining-Gold Market’s +21%.Agnico Eagle Mines’ increased profitability has been the catalyst for its extended rally with fiscal 2024 EPS now expected to soar 58% to $3.52 versus $2.23 per share last year. Notably, Agnico Eagle Mines checks an “A” Zacks Style Scores grade for Growth, and its 2.1% annual dividend yield has kept investors engaged as well.

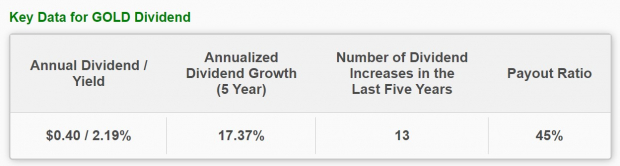

Image Source: Zacks Investment ResearchBarrick Gold (GOLD – Free Report)Zacks Rank #2 (Buy)As one of the largest gold producers in the world, Barrick Gold is certainly worthy of consideration with its stock trading under $20 and at 15.7X forward earnings. Furthermore, Barrick Gold’s EPS is projected to soar 38% this year with FY25 earnings slated to climb another 32% to $1.53 per share.Making Barrick Gold’s stock more luring is a 2.19% annual dividend which it has increased 13 times in the last five years. Plus, its 45% payout ratio suggests there is plenty of room for more dividend hikes.

Image Source: Zacks Investment ResearchFrancoNevada (FNV – Free Report)Zacks Rank #1 (Strong Buy)Rounding out the list is Franco-Nevada Corporation which operates as a gold-focused royalty and stream company with additional interest in silver and platinum group metals among other resource assets. Franco-Nevada offers a 1.13% annual dividend which it has increased 14 times in the last five years with its payout ratio at 41%.Indicative that now is an ideal time to buy Franco-Nevada’s stock is that earnings estimate revisions have continued to rise over the last quarter with FY24 and FY25 EPS estimates up 10% and 8% in the last 30 days respectively.

Image Source: Zacks Investment ResearchTakeawayWith investors likely to shift their focus to equities that can offer defensive safety these top gold mining stocks should be viable options amid heightened market volatility.More By This Author:3 Utility Stocks To Buy For Defensive Safety Amid Heightened Market Volatility 3 Standout Stocks Of This Week’s Busy Earnings Lineup Bull of the Day: Badger Meter (BMI)

Leave A Comment