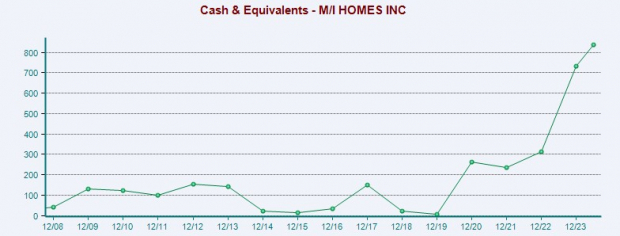

Image Source: Zacks Investment ResearchMI Homes (MHO – Free Report)Among homebuilders, MI Homes stands out as one the leading builders of single-family homes in the United States. Notably, the Zacks Building Products-Home Builders Industry is in the top 6% of all Zacks industries.MI Homes’ earnings potential is very lucrative with its robust bottom line expected to expand 21% this year to $19.58 per share versus EPS of $16.21 in 2023. Even better, MI Homes trades at just 8.4X forward earnings with FY25 EPS projected to rise another 7%.Investors may also be drawn to MI Homes’ balance sheet as its cash and equivalents have skyrocketed from $6 million in 2019 to $837 million at the end of Q2 2024. Furthermore, MI Homes has $4.34 billion in total assets which is nicely above its $1.59 billion in total liabilities. Image Source: Zacks Investment ResearchCentury Communities (CCS – Free Report)Also belonging to the top-rated Zacks Building Products-Homebuilders Industry is Century Communities. Century Communities engages in the acquisition of land and construction for single-family detached and attached residential home projects.Century Communities’ has a solid balance sheet as well with high double-digit top and bottom line growth in the forecast for FY24. Trading at 9.5X forward earnings, Century Communities FY25 EPS is expected to increase another 15% to $12.24 per share.

Image Source: Zacks Investment ResearchCentury Communities (CCS – Free Report)Also belonging to the top-rated Zacks Building Products-Homebuilders Industry is Century Communities. Century Communities engages in the acquisition of land and construction for single-family detached and attached residential home projects.Century Communities’ has a solid balance sheet as well with high double-digit top and bottom line growth in the forecast for FY24. Trading at 9.5X forward earnings, Century Communities FY25 EPS is expected to increase another 15% to $12.24 per share.

Image Source: Zacks Investment ResearchBottom LineIn correlation with their strong business industries, earnings estimate revisions have gone up for these highly-ranked building products stocks. This makes now an ideal time to buy considering their favorable growth trajectories and reasonable valuations. More By This Author:BTC Rallies As Fed Signals Rate Cuts: NVDA, COIN, SQ to Gain

Time To Buy The Post Earnings Rally In Cava Group’s Stock?

4 Integrated Energy Stocks To Watch Amid Industry Turbulence

Leave A Comment