Today’s episode of Full Court Finance at Zacks dives into where the stock market stands after the Nasdaq and the S&P 500 tumbled during the first busy week of tech earnings. The episode then looks at three former growth-heavy tech stocks—Shopify (SHOP – Free Report), Pinterest (PINS – Free Report), and Block (SQ – Free Report) —that are trading at least 70% below their highs heading into their Q3 earnings releases to see if investors might want to consider buying.The Nasdaq showed some signs of fight through Friday morning trading before it gave up nearly all of those gains. The bulls need to prove sometime soon they aren’t ready to throw in the towel after the wave of selling earlier this week sent both the S&P 500 and the Nasdaq below their 200-day moving averages and approaching some long-term trend lines that are rarely broken.Despite the hot Q3 GDP data, traders still put a 99% chance on a November pause and 80% odds on the Fed sitting on its hands again in December, according to the CME FedWatch Tool. Of course, the mounting geopolitical fears are also fueling the recent downturn, alongside worries that the economy is finally set to fade, with some earnings outlooks coming in below expectations.All these factors have the Nasdaq approaching its 50-week and 200-week moving averages (which are converging) right now. Still, the overall outlook for earnings remains strong and the Fed is near the end of its tightening cycle.Therefore, investors might want to think about acting on Warren Buffett’s quote about being greedy when others are fearful. Image Source: Zacks Investment ResearchPinterest (PINS) – Q3 Earnings Release on Monday, October 30Pinterest should remain a hit with advertisers, small businesses, entrepreneurs, and others because paid content and ads fit seamlessly into the platform. Pinterest’s 465 million global monthly users come to the platform to find and share ideas and inspirations for clothing, date nights, vacations, home remodels, workouts, and much more.PINS has spent the last two years boosting its ad tech, video features, cutting costs, and other efforts to help transform the firm after the breakneck growth ended.

Image Source: Zacks Investment ResearchPinterest (PINS) – Q3 Earnings Release on Monday, October 30Pinterest should remain a hit with advertisers, small businesses, entrepreneurs, and others because paid content and ads fit seamlessly into the platform. Pinterest’s 465 million global monthly users come to the platform to find and share ideas and inspirations for clothing, date nights, vacations, home remodels, workouts, and much more.PINS has spent the last two years boosting its ad tech, video features, cutting costs, and other efforts to help transform the firm after the breakneck growth ended. Image Source: Zacks Investment ResearchPinterest lands a Zacks Rank #1 (Strong Buy) right now, and its adjusted earnings are expected to soar 56% this year and then pop 20% higher next year. Meanwhile, its sales are projected to climb 8% in 2023 and 16% next year. Pinterest crushed our bottom line estimate by 75% last period, and 15 of the 24 brokerage recommendations Zacks has are “Strong Buys.”Pins is currently trading around where it was when it first went public in 2019 and 35% below its average Zacks price target, having tumbled over 70% from its peaks. Pinterest also has a solid balance sheet. But Wall Street remains worried about its valuation levels. Shopify (SHOP) – Q3 Earnings Release on Thursday, November 2Shopify is an e-commerce firm that continues to thrive as companies, small businesses, and entrepreneurs, have gone all in on e-commerce, digital payments, and beyond as digital commerce grows more essential by the day. Wall Street rewarded Shopify for its massive revenue expansion and then crushed the stock when it became clear its days of 50% or higher YoY sales growth were over.SHOP’s FY22 sales still jumped 21% to $5.6 billion, and Zacks estimates call for another 24% sales growth this year and 18% higher revenue next year to reach $8.16 billion.

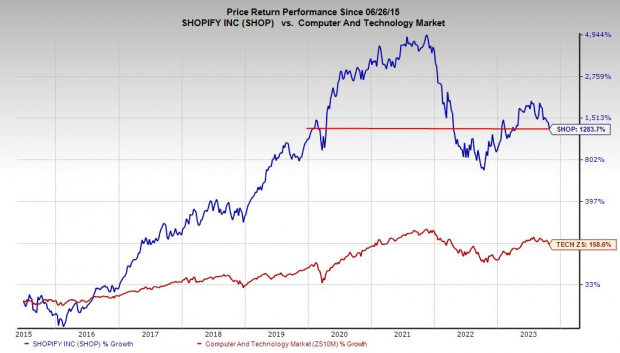

Image Source: Zacks Investment ResearchPinterest lands a Zacks Rank #1 (Strong Buy) right now, and its adjusted earnings are expected to soar 56% this year and then pop 20% higher next year. Meanwhile, its sales are projected to climb 8% in 2023 and 16% next year. Pinterest crushed our bottom line estimate by 75% last period, and 15 of the 24 brokerage recommendations Zacks has are “Strong Buys.”Pins is currently trading around where it was when it first went public in 2019 and 35% below its average Zacks price target, having tumbled over 70% from its peaks. Pinterest also has a solid balance sheet. But Wall Street remains worried about its valuation levels. Shopify (SHOP) – Q3 Earnings Release on Thursday, November 2Shopify is an e-commerce firm that continues to thrive as companies, small businesses, and entrepreneurs, have gone all in on e-commerce, digital payments, and beyond as digital commerce grows more essential by the day. Wall Street rewarded Shopify for its massive revenue expansion and then crushed the stock when it became clear its days of 50% or higher YoY sales growth were over.SHOP’s FY22 sales still jumped 21% to $5.6 billion, and Zacks estimates call for another 24% sales growth this year and 18% higher revenue next year to reach $8.16 billion. Image Source: Zacks Investment ResearchShopify, which lands a Zacks Rank #3 (hold), is expected to grow its adjusted earnings from $0.04 to $0.53 a share this year and then boost its top line by another 48% next year. Plus, Shopify has blown away our bottom-line estimate in the past two quarters. The stock is up 35% in 2023 and it has soared 262% in the last five years vs. the Zacks Tech sector’s 88% run. Shopify’s outperformance even includes its 70% fall from its 2021 records, which has it hovering around where it was in early 2020. Despite the drop, Wall Street appears to think that its valuation levels are still too high at the moment. Block Inc. (SQ) – Q3 Earnings Release on Thursday, November 2Block Inc. formally known as Square, has plummeted roughly 85% from its peaks. Wall Street has dumped the credit card reader turned financial tech standout on the back of rising interest rates, slowing consumer spending, tough-to-compete against periods, increased competition, and other headwinds.Block has made impressive progress toward its goal of becoming a one-stop shop for digital-native banking and financial services for both consumers and businesses. Block posted 86% sales expansion in 2021 and 102% in 2020, which put it in a difficult spot in terms of YoY comparisons. Still, SQ is projected to grow its revenue by 22% this year and 12% next year to help boost its adjusted earnings by 69% and 37%, respectively.

Image Source: Zacks Investment ResearchShopify, which lands a Zacks Rank #3 (hold), is expected to grow its adjusted earnings from $0.04 to $0.53 a share this year and then boost its top line by another 48% next year. Plus, Shopify has blown away our bottom-line estimate in the past two quarters. The stock is up 35% in 2023 and it has soared 262% in the last five years vs. the Zacks Tech sector’s 88% run. Shopify’s outperformance even includes its 70% fall from its 2021 records, which has it hovering around where it was in early 2020. Despite the drop, Wall Street appears to think that its valuation levels are still too high at the moment. Block Inc. (SQ) – Q3 Earnings Release on Thursday, November 2Block Inc. formally known as Square, has plummeted roughly 85% from its peaks. Wall Street has dumped the credit card reader turned financial tech standout on the back of rising interest rates, slowing consumer spending, tough-to-compete against periods, increased competition, and other headwinds.Block has made impressive progress toward its goal of becoming a one-stop shop for digital-native banking and financial services for both consumers and businesses. Block posted 86% sales expansion in 2021 and 102% in 2020, which put it in a difficult spot in terms of YoY comparisons. Still, SQ is projected to grow its revenue by 22% this year and 12% next year to help boost its adjusted earnings by 69% and 37%, respectively. Image Source: Zacks Investment ResearchBlock is now down 40% in the last five years and approaching its Covid-19 selloff lows. In terms of forward earnings, its valuation is still way out of whack. But Block is trading at just 1.1X forward sales vs. the Tech sector’s 3.5X and its own five years median of 5.1X.More By This Author:Bull Of The Day: Lamb Weston Holdings, Inc.

Image Source: Zacks Investment ResearchBlock is now down 40% in the last five years and approaching its Covid-19 selloff lows. In terms of forward earnings, its valuation is still way out of whack. But Block is trading at just 1.1X forward sales vs. the Tech sector’s 3.5X and its own five years median of 5.1X.More By This Author:Bull Of The Day: Lamb Weston Holdings, Inc.

Bear Of The Day: The Clorox Company

Big Tech Earnings: Time To Buy Microsoft, Amazon, And Meta Stock?

Leave A Comment