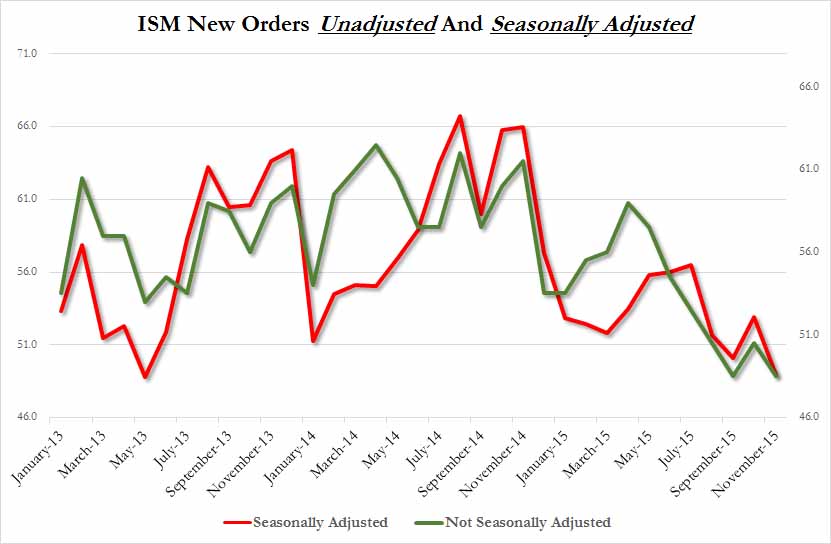

While it is hoped that the economy can continue to expand on the back of the “service” sector alone, history suggests that “manufacturing” continues to play a much more important dynamic that it is given credit for… and that is a major problem as ISM Manufacturing just fell below 50 for the first time since Nov 2012, crashing to 48.6 – the weakest since June 2009. Across the components, new orders collapsed (worst since Aug 2012), and prices paid crashed.

When ISM Manufacturing dropped to this level in early 2008, people largely ignored it at first… then The Fed unleashed QE1 to save the world… same again in 2012…

As New Orders collapsed…

What respondents had to say…

Still – it’s only manufacturing right? As we explained previously,

While it is hoped that the economy can continue to expand on the back of the “service” sector alone, history suggests that “manufacturing” continues to play a much more important dynamic that it is given credit for.

The decline in imports, surging inventories, and weak durable goods all suggest the economy is weaker than headlines, or the financial markets, currently suggest.

For now, however, that detachment can last a while longer as global Central Banks continue to suppress interest rates and flood the financial system with liquidity. With levels of subprime loans for autos and houses, debt issuance and share buybacks once again sharply on the rise, the “party” rages on. However, it is worth remembering what happened when the bartender previously shouted “last call.”

Leave A Comment