Is Stock Market Valuation in Bubble Territory?

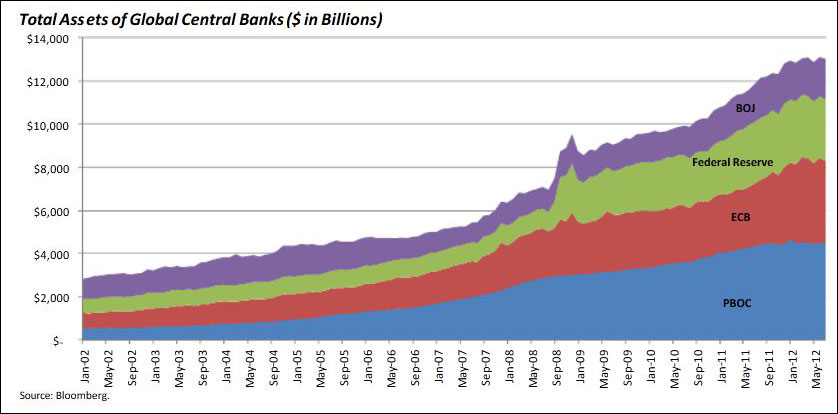

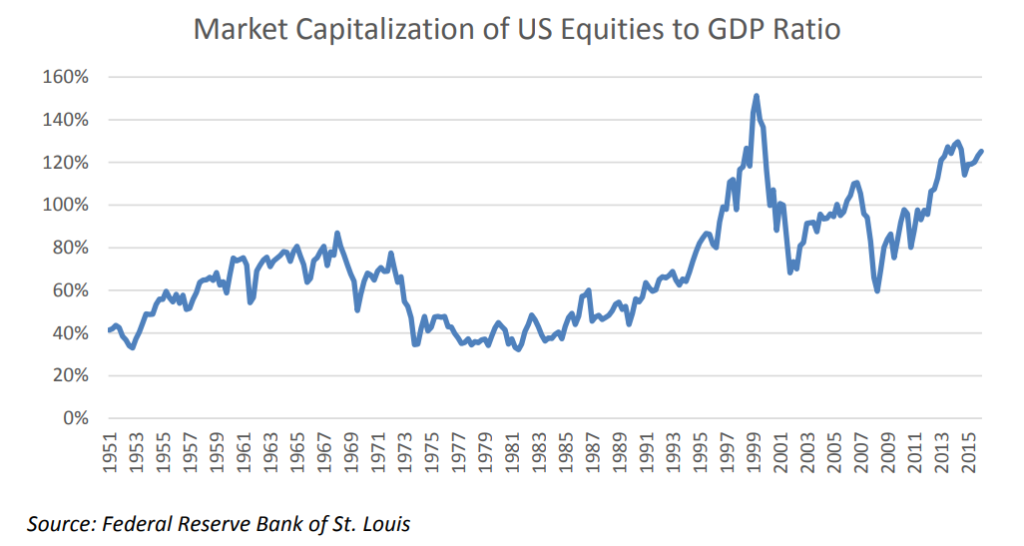

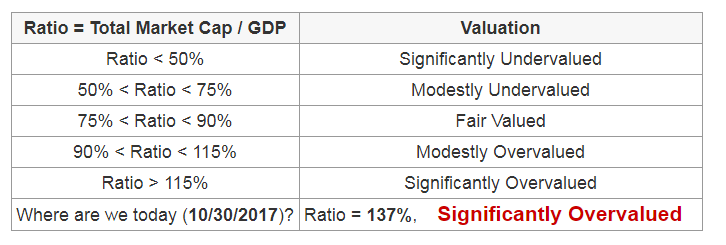

Many analysts and forecasters argue that the stock market is in bubble territory and about to do a significant correction or even a crash. There’s a lot of reasons given, both from fundamental and technical points of view. For example, some popular reasons are:

These are just 3 reasons and there’s plenty of others. These reasons could be right and the stock market may indeed be overvalued. However, the problem is the market can stay irrational much longer than you as traders can stay solvent holding the wrong position. Stock markets should eventually form a peak and do a large correction. However, although the direction could eventually be right, if the timing of the call is 5 years too early, then what good is it?

For the average traders, the worst case that can happen is listening to all these warnings and picking a top and trying to short against a clear trend. This could lead to a very big loss to the equity. If traders make trading decisions based on these reasons and short the market in the past 3-5 years, they would not have money left to trade as the market keeps going up and squeeze them. As traders, our priority should be how to make profit and control the risk. Most importantly, traders should follow the trend until it’s over. There’s a popular saying in trading “don’t fight against the trend” but in reality a lot of people like to pick top and bottom. Traders should trade what they see, not what they feel. Algos and machines trade based on trend and sequence and they don’t have feeling.

Leave A Comment