Tocagen Inc. (Pending:TOCA) expects to raise $70 million in its upcoming IPO ($81.5 million, if the underwriters exercise their option to purchase additional shares).

Based in San Diego, California, Tocagen is a clinical-stage company that is developing gene therapies to activate a patient’s immune system against cancer.

The company will offer 7.25 million shares at an expected price range of $10-12. If the underwriters price the IPO at the midpoint of that range, TOCA will have a market capitalization of $200 million.

TOCA filed for the IPO on March 9, 2017. The lead underwriters are Evercore Group, Leerink Partners and Stifel Nicolaus & Company. The IPO has no selling group.

Business Summary: Clinical-Stage Company Developing Gene Therapies Targeting Cancer

(Source: Tocagen S-1 filing, April 3, 2017)

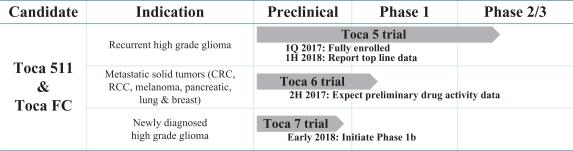

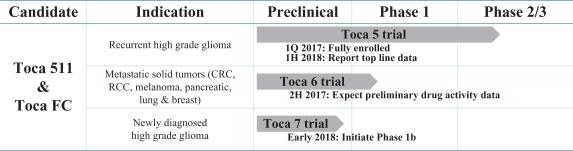

Tocagen Inc. focuses on developing gene therapy candidates to activate a patient’s immune system against cancer. The company is developing Toca 511 and Toca FC, currently in Phase II/III clinical trial for patients with recurrent high grade glioma (HGG) and in Phase Ib clinical trial for the intravenous treatment of renal, melanoma, lung, breast, pancreatic and metastatic colorectal cancers. Tocagen is also developing other retroviral replicating vectors to deliver genes to cancer cells.

The company develops the cancer-selective gene therapies on a platform built on retroviral replicating vectors (RRVs), which selectively deliver the therapeutic genes directly into the DNA of cancer cells. Tocagen has retained worldwide rights to the development and commercialization of its product candidates, and the company has intellectual property protection in major markets worldwide, including 58 issued and granted patents and 75 patent applications (foreign and domestic) on its technology and product candidates.

Use of Proceeds And Risk Factors

Tocagen acknowledges that it has no products currently approved for sale, and it has generated no revenue from any product sales. Its operations have been funded primarily through private placement of convertible preferred stock, the issuance of notes payable, issuance of convertible promissory notes payable and private and federal grants.

Leave A Comment