Well, it’s confession time: I’m scared.

I know as the designated martyr for equity bears, I should show more steely-eyed steadfastness, but the past six years have put the zap on my brain, and memories of what this jackass did a year ago still haunt me.

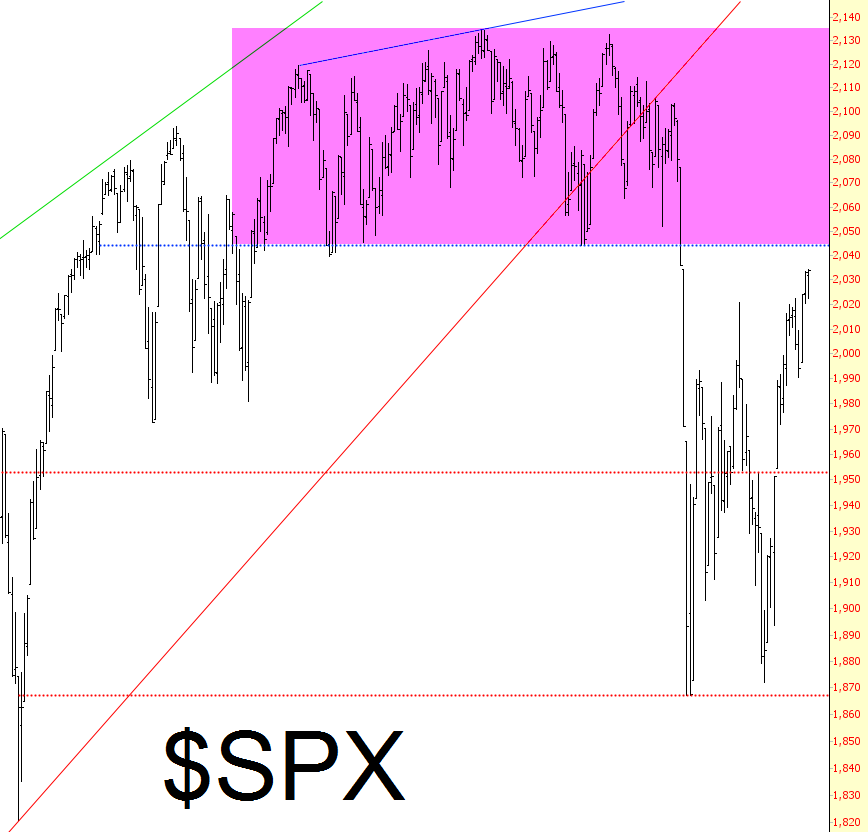

In a strange way, though, my fear is borne from the suspicion that the charts I am seeing are simply too good to be true. If I were to contribute a chapter to a book on charting called This Is What A Top Looks Like, the hypothetical, idealized charts would look like this:

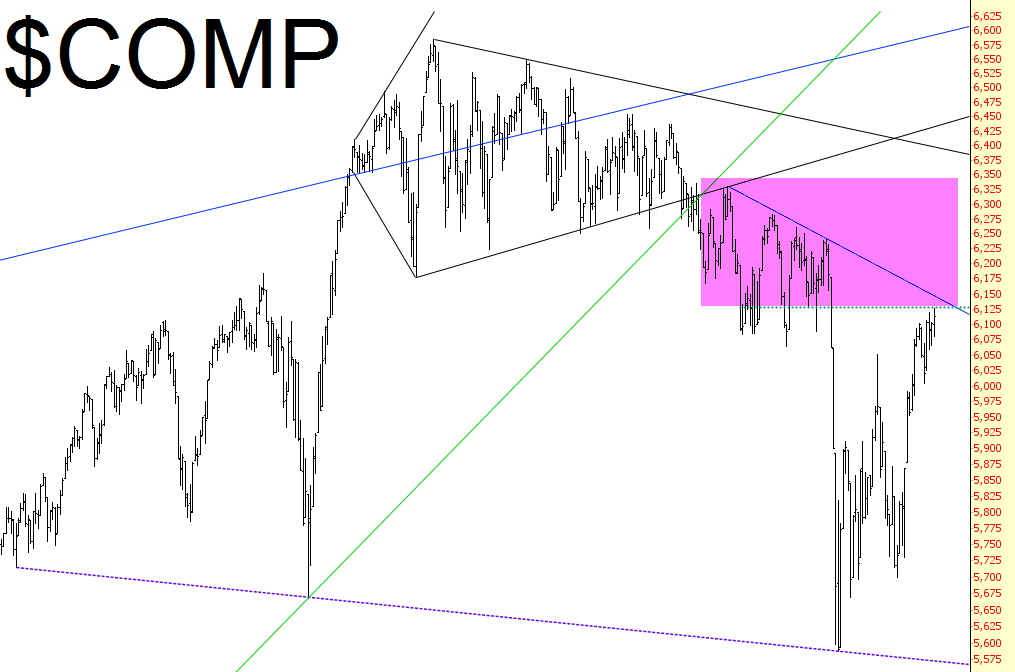

………and this…….

………..and this……….

But, as I’ve intimated, it’s Central Banking Shenanigans that have given me sleepless nights, and next week is when I’m really going to start getting woozy. Witness this maelstrom next Wednesday and Thursday:

I’m actually considering our own FOMC meeting to be a pointless joke, since they won’t change one iota of their last statement. It’s Japan that I’m worried about.

Of course, this could all be much ado about nothing, because – – as with the 17th of September – – the central bankers could unwittingly offer up the bears exactly what they need to really get the ball rolling. But I’ve been so frustrated – and impatient! – waiting for the tide to once more turn south, I’m starting to feel my will slip away. Lord knows that fear has completely exited the market since August 24th.

If nothing else, I’ll try to remember what’s on Slope’s own rules page.

Leave A Comment