Image Source: PixabayWhile the Fed will likely cut interest rates in the coming weeks, September has historically been the most challenging month for stocks.Known as the September Effect, economic policy decisions and higher trading volumes following the end of the summer typically lead to this lackluster seasonality in the stock market.Often sought out for defensive protection amid heightened market volatility, medical stocks may be of interest to investors in September. To that point, investors tend to rebalance their portfolios in September which leads to the spike in trading volumes.Balancing the portfolio with healthcare as opposed to risk assets that don’t offer essential services may be at the forefront of investors’ minds.That said, here are three top medical stocks to hedge against the September Effect.DaVita (DVA – Free Report)Zacks Rank #1 (Strong Buy)With its stock soaring over +40% year to date, DaVita has a strong buy rating as the leading provider of dialysis services to patients suffering from chronic kidney failure in the United States.Despite the YTD rally, DaVita’s stock still trades at 15.1X forward earnings and is at the optimum level of less than 1X sales. Correlating with such, DaVita checks an “A” Zacks Style Scores grade for Value.

Image Source: PixabayWhile the Fed will likely cut interest rates in the coming weeks, September has historically been the most challenging month for stocks.Known as the September Effect, economic policy decisions and higher trading volumes following the end of the summer typically lead to this lackluster seasonality in the stock market.Often sought out for defensive protection amid heightened market volatility, medical stocks may be of interest to investors in September. To that point, investors tend to rebalance their portfolios in September which leads to the spike in trading volumes.Balancing the portfolio with healthcare as opposed to risk assets that don’t offer essential services may be at the forefront of investors’ minds.That said, here are three top medical stocks to hedge against the September Effect.DaVita (DVA – Free Report)Zacks Rank #1 (Strong Buy)With its stock soaring over +40% year to date, DaVita has a strong buy rating as the leading provider of dialysis services to patients suffering from chronic kidney failure in the United States.Despite the YTD rally, DaVita’s stock still trades at 15.1X forward earnings and is at the optimum level of less than 1X sales. Correlating with such, DaVita checks an “A” Zacks Style Scores grade for Value.

Image Source: Zacks Investment ResearchFurthermore, DaVita is projected to post steady growth on its top line in fiscal 2024 and FY25 with projections edging north of $13 billion.

Image Source: Zacks Investment ResearchMore intriguing is DaVita’s increased profitability with double-digit EPS growth in the forecast. Plus, FY24 and FY25 EPS estimates have risen 4% and 11% in the last 30 days respectively.

Image Source: Zacks Investment ResearchHCA Healthcare (HCA – Free Report)Zacks Rank #1 (Strong Buy)Predicated on its attractive valuation and the trend of positive earnings estimate revisions, HCA Healthcare’s stock has also soared over 40% YTD and retains a strong buy rating. HCA is the nation’s largest operator of non-governmental acute care hospitals and lands an “A” Zacks Style Scores grade for Value as well.Trading at a reasonable 17.5X forward earnings multiple, HCA’s EPS is now projected to expand 18% this year to $22.50 versus $19.01 per share in 2023. Even better, FY25 EPS is forecasted to rise another 9%. Reassuringly, FY24 and FY25 EPS estimates have continued to rise over the last quarter and are slightly up in the last month.

Image Source: Zacks Investment ResearchSeeing an uptick in admissions and emergency room visits during Q2, HCA’s stock trades at 1.4X sales with its enticing top line expansion set to continue. HCA’s total sales are expected to increase 9% in FY24 and are slated to rise another 5% in FY25 to $74.25 billion.

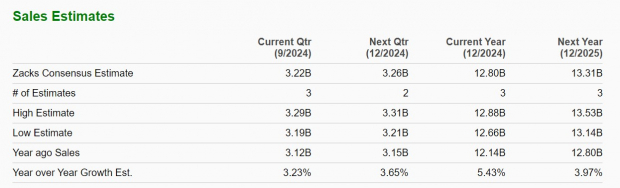

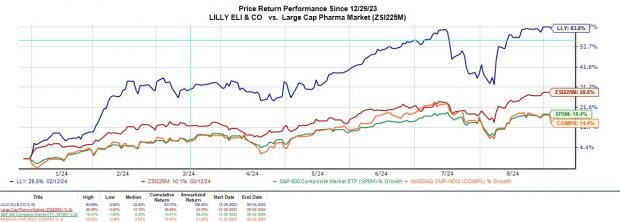

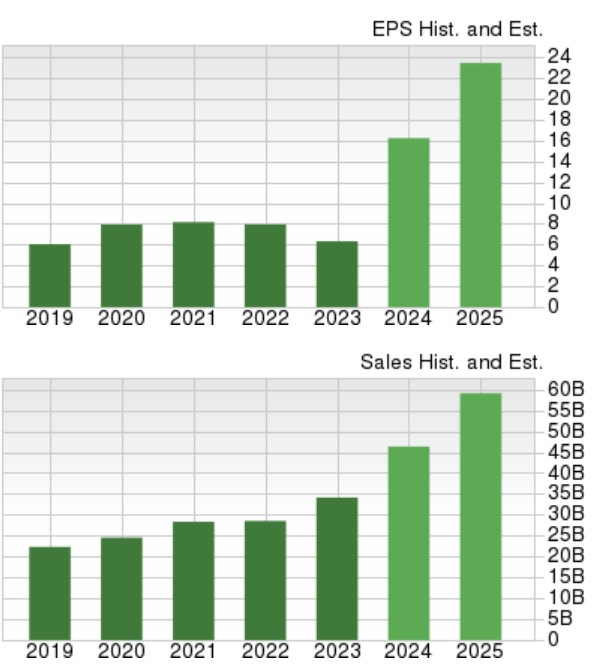

Image Source: Zacks Investment ResearchEli Lilly (LLY – Free Report)Zacks Rank #2 (Buy)Rounding out the list is Eli Lilly which has been one of the market’s top performers this year thanks to positive sentiment surrounding its innovative drug pipeline. The pharmaceutical giant continues to address a sizable market of Type 2 diabetics with its GLP-1 drugs for the treatment of both diabetes and obesity.

Image Source: Zacks Investment ResearchBuilding on what had been a somewhat untapped market in regards to weight loss drugs, Ely Lilly is projected to post high double-digit top and bottom line growth in FY24 and FY25. This continues to support the premium Eli Lilly commands regarding its valuation metrics along with the fact that earnings estimate revisions for LLY have soared over the last 30 days.

Image Source: Zacks Investment ResearchBottom LineAmid increased market volatility these top medical stocks will be worthy of consideration. This is especially true when guarding against the potential September Effect as rising earnings estimate revisions continue to suggest more upside for DaVita, HCA Healthcare, and Eli Lilly’s stock.More By This Author:2 Small Caps Recently Upgraded To Outperform – Sunday, Sept. 13 Concrete & Aggregates Industry Stocks Thriving In Tough TimesTime To Buy Salesforce Stock After Strong Q2 Results?

Leave A Comment