Homebuyers are rushing into the market as the spring selling season heats up. Existing home sales jumped 4.4% from February to an adjusted annual rate of 5.71 million in March–their strongest pace in a decade. This was much better than the economists’ estimate of a 2.2% gain to 5.6 million. Sales were particularly strong in the Northeast and the Midwest regions.

“Bolstered by strong consumer confidence and underlying demand, home sales are up convincingly from a year ago nationally and in all four major regions despite the fact that buying a home has gotten more expensive over the past year,” according to the National Association of Realtors.

Improving jobs market, rising wages and low interest rates have supported the housing market even though the inventory remains low and prices have been rising. However, with completions of new homes up 3.2% compared with last month and 13% year-over-year, housing market could see some easing in supply shortages.

While rising prices have been a concern, the recent decline in mortgage rates has improved affordability and could further boost the housing market.

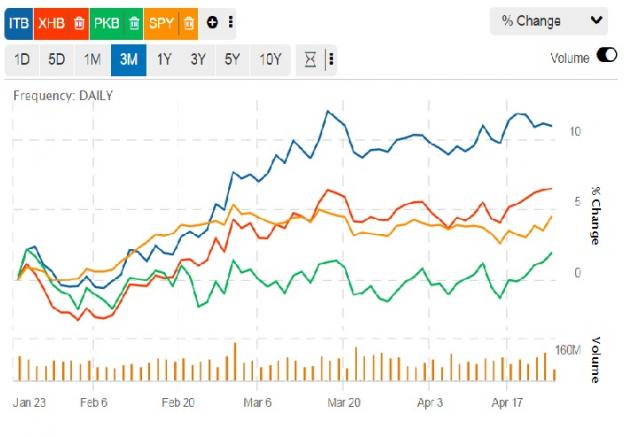

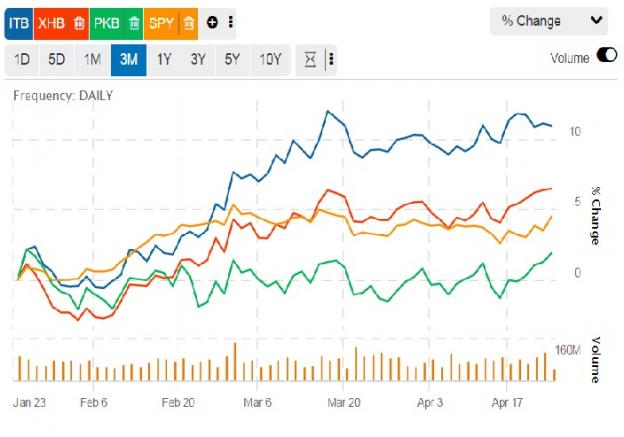

With the key spring selling season off to a strong start, investors should take a look at housing ETFs that have been outperforming the market this year.

A Deeper Dive into Housing ETFs

From their names, the iShares Dow Jones US Home Construction ETF (ITB – Free Report) and the SPDR S&P Homebuilders ETF (XHB – Free Report) sound pretty similar. However, if you look deeper, these funds are quite different.

ITB has approximately two-thirds of its portfolio allocated to homebuilders, 15% to building products companies and 7% to the home improvement retail. It is a market cap weighted product and leading names—DR Horton (DHI – Free Report) and Lennar (LEN – Free Report) —account for almost a quarter of total assets. It has an expense ratio of 43 basis points.

Leave A Comment