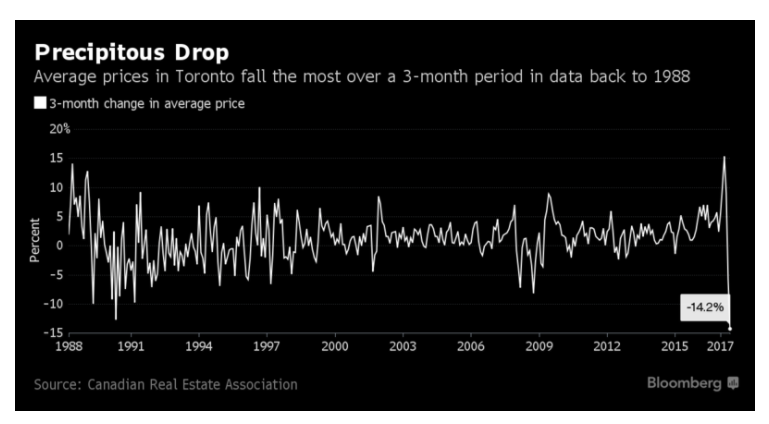

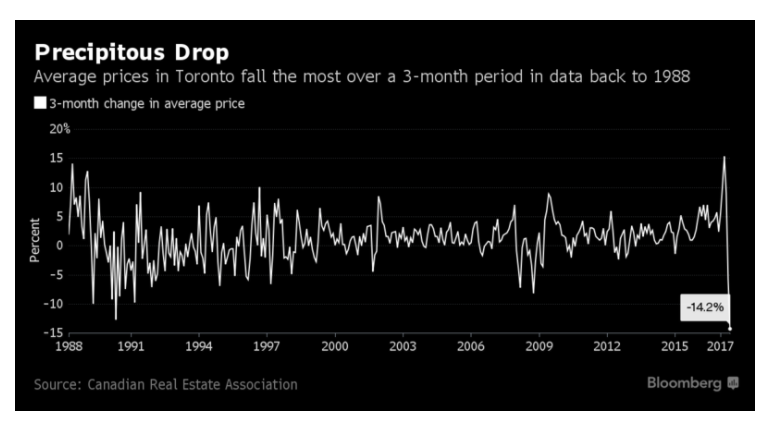

The three-month average home price in the Toronto area is down a record 14.2% following a flood of new listings and an interest rate hike by the Bank of Canada.

Sales fell most in eight years. Did Canada’s housing bubble just burst?

Bloomberg reports Chill Descends on Toronto Housing as Prices Drop Most Since 1988.

Total home sales in Greater Toronto dropped to 5,977 in June, the lowest level since 2010 and down 15.1 percent from the month prior, data from the Canadian Real Estate Association show. Average prices are down 14.2 percent since March — the fastest 3-month decline in the history of the data back to 1988 — while the ratio of sales to new listings sits at its lowest level since 2009.

The June data comes after a series of measures by policy makers to tighten access to the market — and before the Bank of Canada hiked its benchmark interest rate last week, the first increase since 2010 that will further pinch mortgage eligibility. Prices and sales also fell in nearby regions such as Hamilton-Burlington and Kitchener-Waterloo, CREA data show.

Lawmakers, concerned that escalating prices could lead to a disorderly correction, imposed measures including tightened mortgage eligibility rules and a tax on foreign buyers. Toronto’s market has lost momentum, while in Vancouver sales plummeted last year on similar measures but have since rebounded.

The economists expect Toronto to follow Vancouver’s path — price adjustment at the top of the market with less impact at lower prices. Meanwhile, cities like Montreal and Ottawa look strong.

Vancouver rebounded after the restrictions and economists expect Toronto will do the same.

But at some point sanity will return. The bottom in both markets is a long way down.

The same holds true in Australia. For discussion, please see “Bargain” $2 Million Homes in Australia: “Super Saturday” Auction Results Posted.

Leave A Comment