What a difference a week makes!

Last week, we were on very firm ground in noting that President Trump’s proposed tariffs were having very little impact on stock prices, where we closed our weekly observations with the following comment:

We’re making a point of noting the major international trade-related headlines, where U.S. President Trump’s planned tariffs are certainly getting lots of attention, but through the first half of March 2018, we’ll agree with Goldman Sachs’ assessment that stock prices really aren’t reflecting much of a concern over the probability of a broad trade war. Despite what the headlines are indicating, what we are seeing so far is mostly consistent with the typical levels of noise that have historically characterized the day-to-day volatility of stock prices. We’ll continue paying attention to both trade headlines and stock prices to see if that apparent investor response continues.

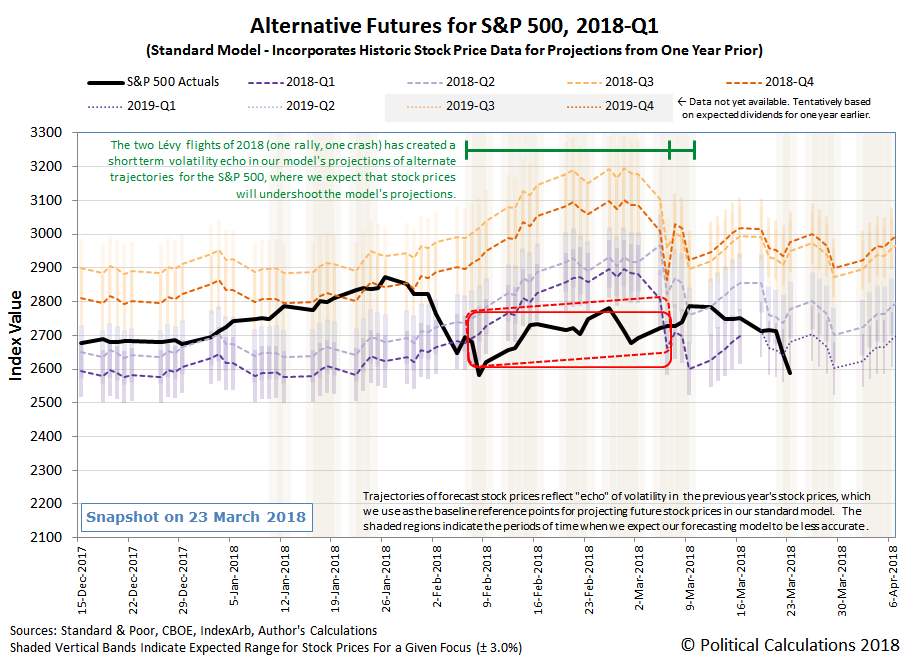

That remained through through Thursday, 22 March 2018, where we observed the investors complete their transition in shifting their forward-looking attention from 2018-Q2 just over a week ago to the much more distant future quarter of 2019-Q1.

That transition marked, by our count, the fourth complete Lévy flight event for the U.S. stock market in 2018, which occur whenever investors shift their forward-looking focus from one distinct point of time in the future toward another, where differences in the change of the rate of growth of dividends per share expected at the different points of time are large enough to drive larger changes in stock prices than would be expected if they genuinely followed a “normal” random walk (they don’t!) Here’s our tally of the Lévy flight events that we’ve observed since 2018 began:

Leave A Comment