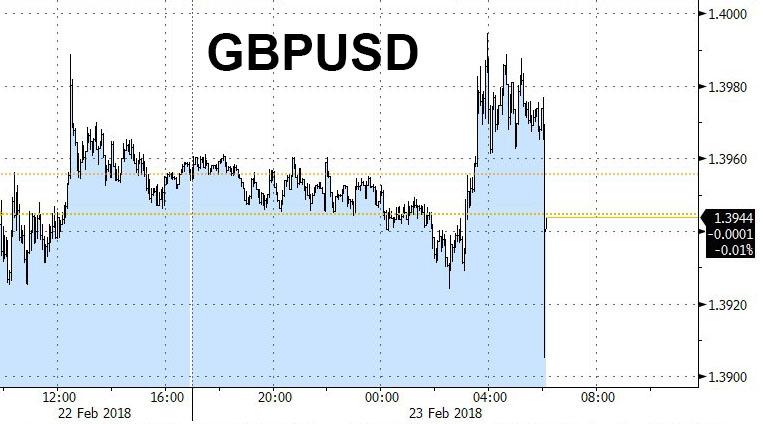

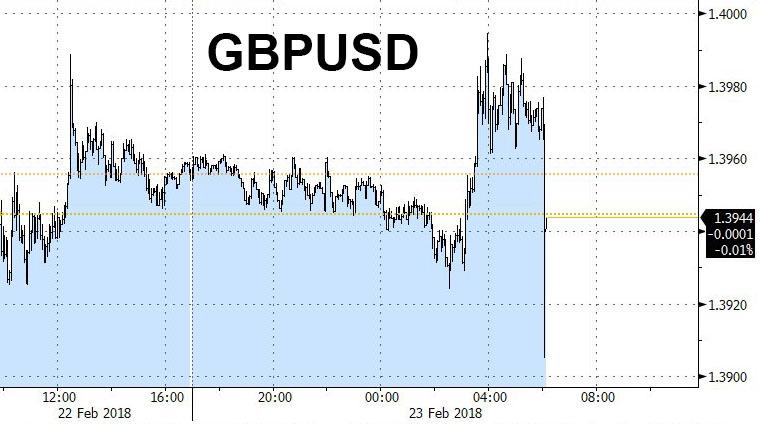

Traders are scratching their heads over the latest flash crash in the pound, a currency which over the past 2 years has had more than its share of bizarre, sharp moves lower, when just as 6am ET, GBPUSD plunged 64 pips in seconds on no news (note that May’s big Brexit speech was announced for next Friday after the move).

GBPUSD is hitting a fresh day low at 1.3905, versus day high at 1.3995.

Ahead of the move, traders had reported another typical low liquidity Friday, with volumes on the light side, as such as large block could have weighed on the pound.

To explain the move, Bloomberg quotes an unnamed trader who suggests that it may have been “triggered by an incorrect amount input for the 11am fix” when “just under GBP700m was sold on one platform alone.”

Here, however, Citi warns to take this with a pinch of salt given the report cites an anonymous trader; the bank also notes that other UK assets did not follow the move, and that “given the quick retracement of the move, there is speculation that this was probably related to flows/orders as early NY wakes up.”

Ultimately, trading GBP continues to depend on broader markets, with your usual dose of those pesky Brexit headlines.

And confirming that it is now officially a robo-market, just an hour after today’s unexplained flash crash, cable was trading at session highs, wiping out the entire drop, and back to session highs of 1.3999, approaching the 21DMA at 1.4010.

Leave A Comment