The day started off badly with — European stocks fell to the lowest level in 10 days as concern about potential antitrust collusion sent carmakers toward the worst decline in more than a year. Euro Stoxx 600 has now erased all the gains from the French Election euphoria…

Nasdaq failed to achieve its 11th day in a row of gains as early European weakness was just too much for the machines to overcome… though they tried… (11 days would have been the longest winning streak since July 2009) Dow ended the week red, Trannies worst week since Brexit

LPL’s Ryan Detrick notes that the Nasdaq has been up for 10 consecutive sessions for the first time since Feb ’15. Since 1980, this has happened 21 other times, and the next month on average for Nasdaq was +2.6%, higher 16 of those 21 times overall.

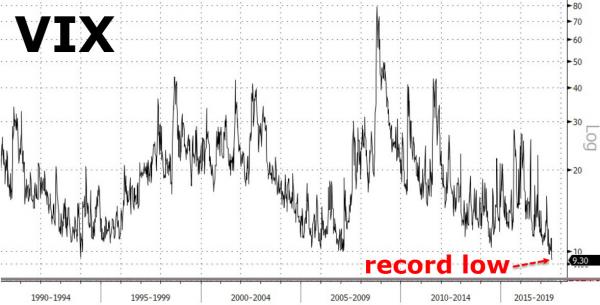

VIX was clubbed to new lows in an effort to pump up stocks and go for the 11th daily win… but failed…

VIX closed at 9.31!! That is the lowest weekly VIX close in history

Utes were the week’s best-performing sector (not exactly growth) and financials worst…

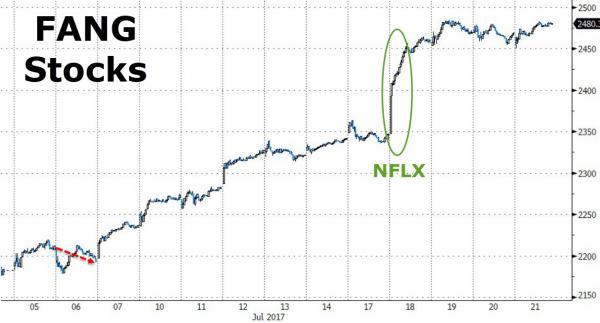

FANG Stocks are up 11 days in a row and had their best week since Oct 2016 (thanks to NFLX) and the best 2-week gains (11%!) since July 2015

Bonds and Stocks recoupled this week…

As a reminder this has been an epic short-squeeze – the last time shorts were this low was at the peak for the S&P in Q2007…

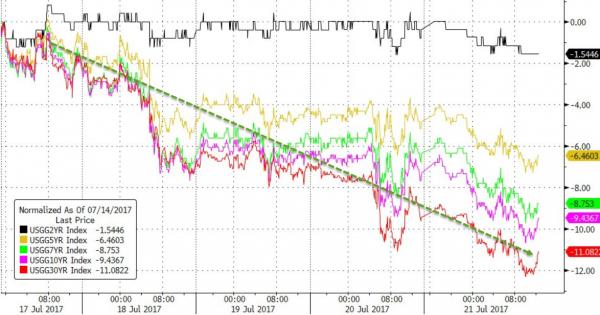

Treasury yields tumbled this week… first weekly close lower in yields in the last 4 (2nd biggest weekly yield decline in 4 months)

With 10Y back below 2.25% back to pre-Fed-rate-hike levels…

The yield curve flattened dramatically this week – 2s10s down 9bps – biggest drop since the first week of 2017

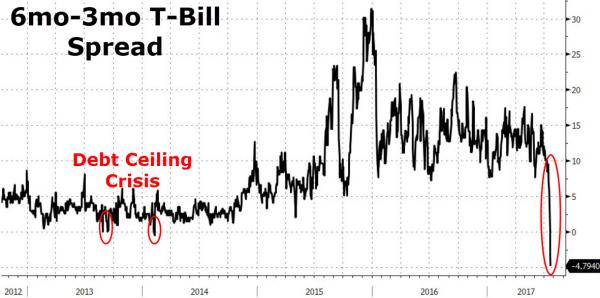

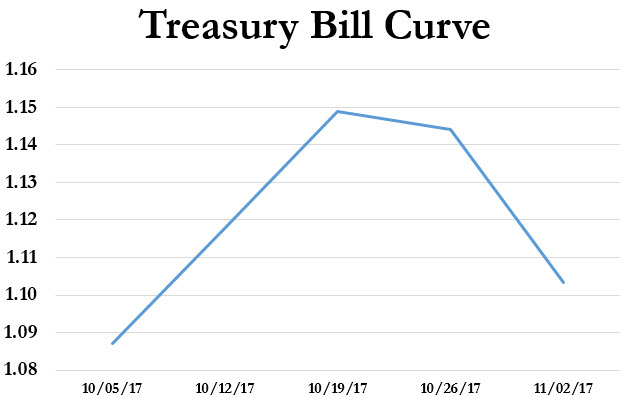

Debt Ceiling concerns are really beginning to accelerate in short-term debt markets…

h/t @macropabst

The Dollar Index was crushed this week, down 1% for the second week in a row to its lowest since May 2016.

Leave A Comment