This week we’ll begin with our monthly and weekly forecasts of the currency pairs worth watching. The first part of our forecast is based upon our research of the past 16 years of Forex prices, which show that the following methodologies have all produced profitable results:

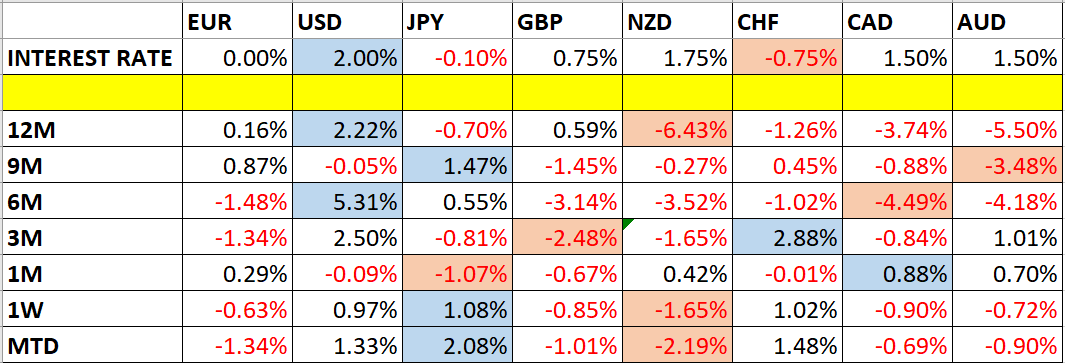

Let’s take a look at the relevant data of currency price changes and interest rates to date, which we compiled using a trade-weighted index of the major global currencies:

Monthly Forecast August 2018

For the month of August, we forecast that the best trades will be short EUR/USD and short GBP/USD. The performance so far is as follows:

Currency Pair

Forecast Direction

Interest Rate Differential

Performance to Date

EUR/USD

Short ?

2.00% (2.00% – 0.00%)

+1.34%

GBP/USD

Short ?

0.75% (0.75% – 0.00%)

+1.78%

Weekly Forecast August 12

Last week, we made no forecasts, as there were no strong counter-trend movements.

This week, we again make no forecast, as there were again no strong counter-trend movements.

This week has been dominated by relative strength in the Japanese Yen, Swiss Franc, and U.S. Dollar, and relative weakness in the New Zealand Dollar and other commodity currency. Sentiment is clearly “risk on” with a flow to safe-haven assets.

Previous Monthly Forecasts

You can view the results of our previous monthly forecasts here.

Leave A Comment