Official inflation rates for the US are still low, but the Treasury market is expecting firmer pricing pressure in 2018.

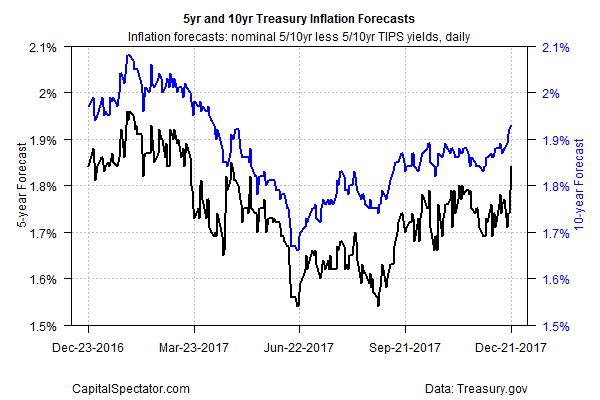

The implied inflation rate based on the yield spread for the nominal 10-year Note less its inflation-indexed counterpart rose to 1.93% on Thursday (Dec. 21), according to daily figures published by Treasury.gov. The increase marks the highest level since April. The inflation estimate via 5-year Treasuries — 1.84% — also increased to an eight-month peak for these maturities.

The market’s firmer inflation outlook suggests that the Federal Reserve may be on track for achieving its policy target of two percent in 2018. Keep in mind, however, that the rebound in the Treasury market’s estimates follow a disinflation trend for the securities in the first half of this year. As a result, the latest Treasury inflation forecasts are more or less flat vs. expectations from a year ago. The question is whether the recent pop is just another round of noise or an early signal that inflationary pressures are set to rise in the new year?

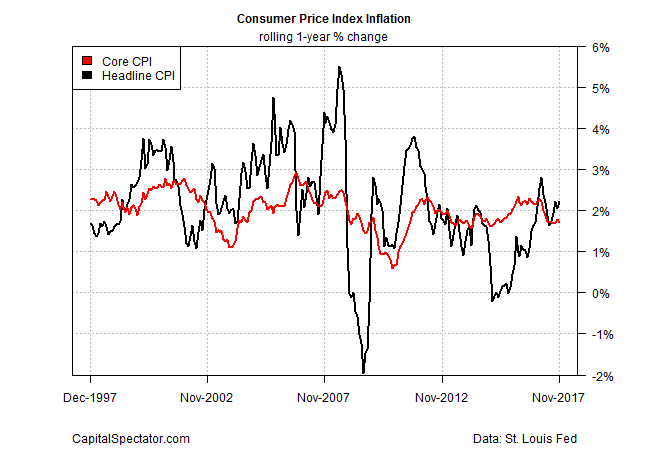

Last week’s update of the consumer price index (CPI) for November paints a mixed profile. Although year-over-year headline inflation was slightly above the Fed’s 2% target, core CPI – considered a more reliable measure of the trend – ticked down to 1.7%, which matches recent data that marks the slowest pace in more than two years.

Other sources paint a mixed outlook for inflation. The New York Fed’s latest consumer survey, for example, points to higher levels of pricing pressure – the median estimate for the November polling was unchanged for the one-year projection (2.6%) and the three-year outlook (at 2.8%). Both forecasts are moderately above the Fed’s target and the Treasury market’s current estimates, but that’s been true all year for the New York survey and the latest figures suggest that the public’s expectations remain stable. The implication: the recent revival in the Treasury market’s inflation estimates are less about a dramatic rise in inflation pressures vs. a repricing of government securities to reflect something closer to the consumer outlook that’s prevailed all along.

Leave A Comment