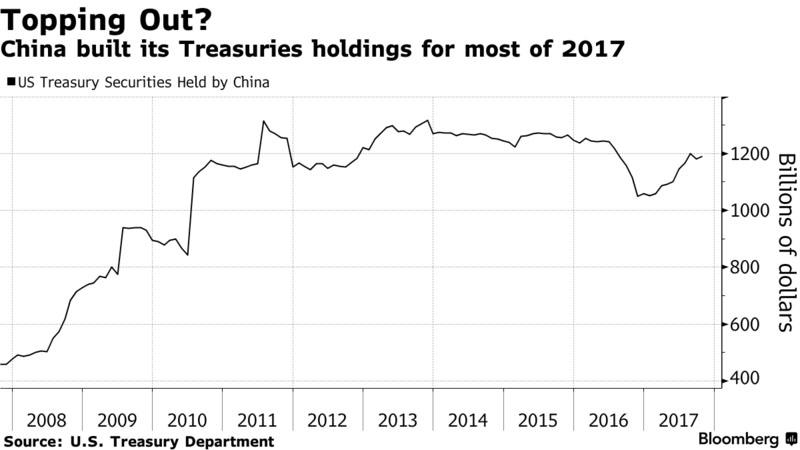

The treasuries complex has sold off aggressively across the curve after the following flashing red Bloomberg headline:

– CHINA OFFICIALS ARE SAID TO VIEW TREASURIES AS LESS ATTRACTIVE.

– CHINA OFFICIALS SAID TO RECOMMEND SLOWING OR HALTING TSY BUYING

As Bloomberg reports, “Officials reviewing China’s FX holdings have recommended slowing or halting purchases of US Treasuries, according to people familiar with the matter.”

The reasoning given is that the market for US government bonds is becoming less attractive relative to other assets, while trade tensions with the US may provide a reason to slow or stop buying American debt.

As Bloomberg further notes “The people didn’t specify why trade tensions would spur a cutback in Treasuries purchases, though foreign holdings of US securities have sometimes been a geopolitical football in the past.”

The news has been interpreted as Beijing wanting to send a signal to the US that it is willing to use financial means to respond to any shifts in US policy on issues such as trade.

Amusingly, with the GOP selling out, at least one deficit hawk remains: China.

The investment strategies discussed in China’s review don’t concern daily purchases and sales, said the people. The officials recommended that China closely watch factors such as the outlook for supply of U.S. government debt, along with political developments including trade disputes between the world’s two biggest economies, when deciding whether to cut some Treasury holdings, the people said.

While there is no official confirmation, this understandably has fixed income spooked. China is the single biggest foreign holder of Treasuries with $1.2 trillion in notional, so this report – if true – has massive implications.

As a consequence, US yields have more than retraced intraday losses, with the 30y trading to 2.92% and the 10y up 2bps. The rest of fixed income has followed through, with a similar spike in European yields.

Leave A Comment