A slim majority of hedge fund managers are in the red year to date, through April, according to the latest report from Eurekahedge. Specifically, 51.4% of managers have negative YTD performance. Over the same period in 2015, the analogous number was only 21.2%. That is a good indication of what a difficult period this is for the AI industry worldwide.

On the other hand, long/short equity funds were the only strategy in the negative YTD. It was down 1.35%, which is its worst YTD figure since 2008.

Yet even long-short equity funds were positive for the month of April. All the strategic mandates were up for the month so often associated with its showers, with the best performance coming from the managers of relative value funds, up 1.96%.

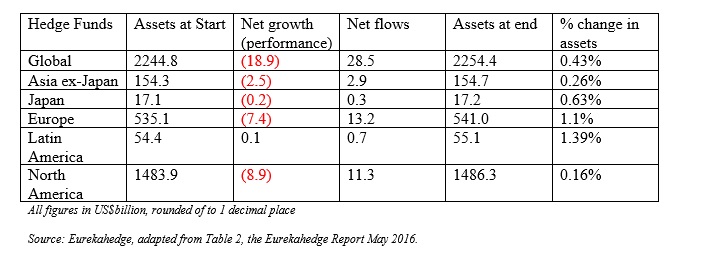

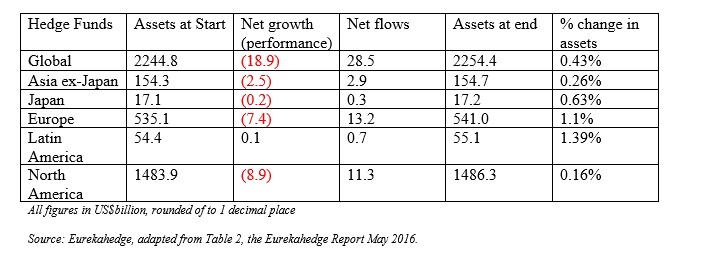

On a regional basis (and once again looking for YTD figures), everybody has had positive net flows, and everybody has had a positive total change in assets.

But – confirming the sense that this is an especially tricky time – only one of the regions has recorded a positive net growth in performance thus far in 2016. That’s Latin America. See the table below for more figures.

Versus Underlying Markets

Eurekahedge emphasizes that hedge funds outperformed their underlying markets in April and ended the month up 0.88% overall. Underlying markets, as represented by the MSCI World Index, gained only 0.67%.

Emerging market managers performed well in April and the commentary attributes this to “resilient oil and commodity prices which helped inject some investor optimism.” Also, the outlook turned up for China over the month of April, which itself helps across the commodity space.

Nonetheless, Eurekahedge’s commentary cautions that there is a “delicate balance” in the commodities world, and it might easily be upset, for example by “the Iran factor.”

Canada’s Globe & Mail put a point regarding Iran rather well, in an April 22 analysis by Mary Gooderham. Although the lifting of sanctions earlier this year created hopes of “a bonanza for those who want to get in on the ground floor” of a newly connected Iran, Gooderham wrote, subsequent weeks and months have been disillusioning.

Leave A Comment