Introduction

Tax reform is never easy. There are with lobbying groups aligned on all sides to protect their special interests and create new ones. This makes tax reform one of the most difficult political feats to accomplish. At this point, only the broad outlines of Trump’s tax reform plan are available. Below, the numbers on what is known are presented. There appear to be some problems.

The President’s Budget

The Congressional Budget Office (CBO) has examined the President’s 2018 budget.

It concludes:

“Excluding economic feedback effects, CBO…estimates federal budget deficits under the President’s proposals would shrink relative to the size of the economy over the coming decade, ranging between 2.6 percent and 3.3 percent of gross domestic product (GDP) during that period.”

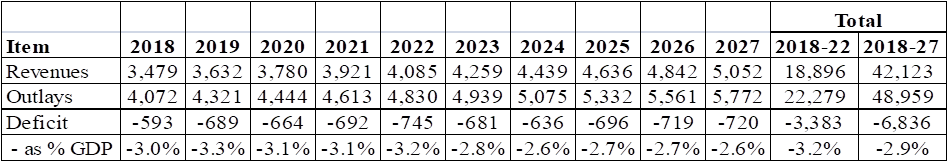

Table 1 provides the CBO data. The trajectory here is positive as measured by the deficit as a percent of GDP because the projected deficit is growing at a slower rate than GDP.

Table 1. – The President’s 2018 Budget Proposal (bil. US$)

Source: Congressional Budget Office (CBO)

Revenue Adjustments

But the devil is in the details. Consider first what has happened to revenues projections since the budget was presented last May. Since then, efforts to repeal the Affordable Care Act have failed. That failure means the projected savings of $1 trillion over the next decade have been lost. Needless to say, that $1 trillion was a critical component in planning the Trump tax cut.

Table 2. – Revenue Adjustments (bil. US$)

Source: Congressional Budget Office (CBO)

Expenditure Adjustments

The President’s budget proposal included a number of dramatic cuts in discretionary items (Table 3). It is highly unlikely that Congress will approve many of those highlighted.

Table 3. – Proposed Expenditure Changes (bil. US$)

Source: Congressional Budget Office (CBO)

Leave A Comment