Stocks Crash – Heightened Volatility On Tuesday

Tuesday was extremely volatile as it had the feeling of a bear market rally. The stock market was oversold coming into the day. But the S&P 500 still fell 2.34% at its worst point in the day.

It rallied in the afternoon to only close down 0.55%. This makes investors feel great because the market is off the lows. However, stocks ended the day even more severely oversold than they started it.

Nasdaq fell 0.42% and the Russell 2000 fell 0.84%. VIX increased 5.45%. This caused the CNN fear and greed index to fall from 16 to 12 as it still indicates extreme fear.

The lower it falls, the higher the chance stocks will rally in the next month. At one point in the day, the index fell to 8. It’s interesting to see that exactly one year ago, the index was at 85. That’s extreme greed.

Stocks Crash – Previous Corrections

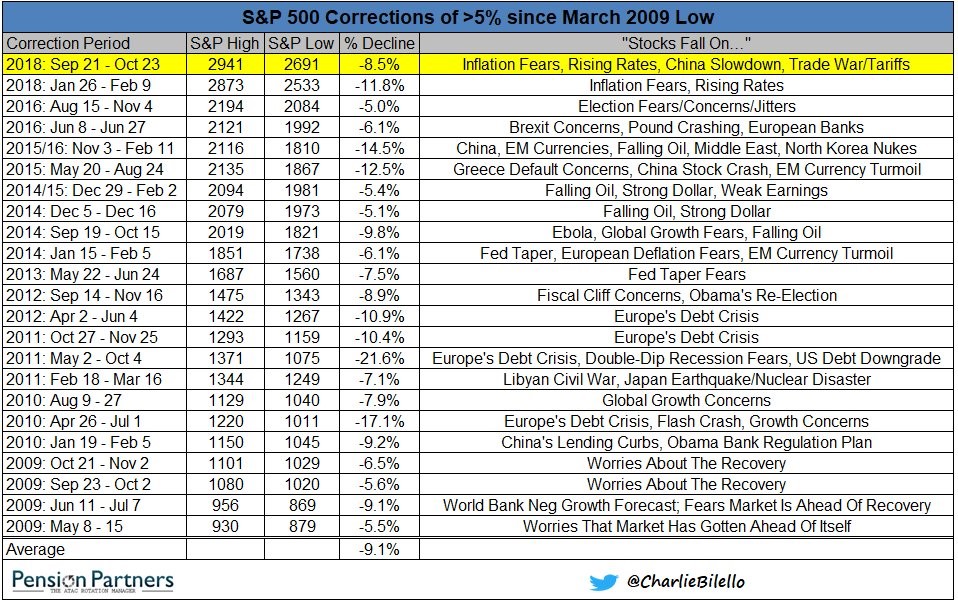

The table below is an amazing depiction of all the corrections since the start of the bull market in March 2009.

To be fair, I don’t agree with each description. The point is to show how there are always worries the market needs to overcome. I disagree that the current correction is caused by inflation. The most recent CPI report showed inflation is falling.

Rising rates are now a problem because the housing market is weak. The principal reason the market is weakening is affordability. But rising rates don’t help.

The Chinese economy is slowing, but it might improve in 2019 because of the tax cut.

Finally, the trade wars are a big factor. It doesn’t look like there is any progress being made on getting a deal done with China before the tax rate increases to 25%.

Stocks Crash – Details Of Tuesday’s Action

One interesting part about the day’s trading action is the home builder ETF rallied 1.62%. It turned positive at 11:10 AM while the S&P 500 was down huge.

This was a good sign the market was about to turn because the selling in the worst group was abating. The KBW small bank ETF also outperformed. But it still closed down 0.047%. The auto industry has been underperforming this year as well. Auto ETF CARZ was up 0.33%.

Leave A Comment