The Fed is meeting in Jackson Hole this week and is expected to toe the line regarding a rate cut sometime soon. In geopolitics Hamas continues to dig deeper into their non-transient position, while Kiev continues to dig into Russian territory.  depositphotos Monday the S&P 500 closed at 5,608, up 54 points, the Dow closed at 40,987, up 237 points and the Nasdaq Composite closed at 17,877, up 245 points.

depositphotos Monday the S&P 500 closed at 5,608, up 54 points, the Dow closed at 40,987, up 237 points and the Nasdaq Composite closed at 17,877, up 245 points.  Chart: The New York Times Most actives were led by Nividia (NVDA), up 4.4%, followed by Tesla (TSLA), up 3.1% and Intel (INTC), also up 3.1%.

Chart: The New York Times Most actives were led by Nividia (NVDA), up 4.4%, followed by Tesla (TSLA), up 3.1% and Intel (INTC), also up 3.1%.  Chart: The New York Times In morning futures trading S&P 500 market futures are up 3 points, Dow market futures are down 28 points and Nasdaq 100 market futures are up 67 points.TalkMarkets contributor Lance Roberts says the Market Decline Over As Investors Buy The Dip. “…August has historically been volatile for markets; this year was no exception. A combination of factors drove the S&P 500’s 8.5% drop:

Chart: The New York Times In morning futures trading S&P 500 market futures are up 3 points, Dow market futures are down 28 points and Nasdaq 100 market futures are up 67 points.TalkMarkets contributor Lance Roberts says the Market Decline Over As Investors Buy The Dip. “…August has historically been volatile for markets; this year was no exception. A combination of factors drove the S&P 500’s 8.5% drop:

The correction, however, was unsurprising and something we repeatedly discussed in June and July.

“Reversals of overbought conditions tend to be shallow in a momentum-driven bullish market. These corrections often find support at the 20 and 50-day moving averages (DMA), but the 100 and 200-DMAs are not outside regular corrective periods.

If you remember, in March, we discussed the potential for a 5 to 10% correction due to many of the same concerns noted above. That correction of 5.5% came in April. We are again at a juncture where a 5-10% is likely. The only issue is it could come anytime between now and October.“ – June 22nd

With that 5-10% correction complete, many investors wonder what caused the rapid reversal last week, given that many factors leading up to the market decline remain…

…With the market rebounding, it’s crucial to identify the key technical levels that will determine the following potential entry points to increase equity exposures.

…With the market rebounding, it’s crucial to identify the key technical levels that will determine the following potential entry points to increase equity exposures.

While the market’s recent recovery is encouraging, several risks could derail the rally over the next few months.

depositphotosContributor Christopher Lewis says the Dow Jones 30 Forecast: Continues To Look For Higher Levels.

depositphotosContributor Christopher Lewis says the Dow Jones 30 Forecast: Continues To Look For Higher Levels.

…At this point, I think we are starting to see some exhaustion come into the market, and therefore think you need to be cautious about the idea of putting too much money into the market in any one move. After all, this is a market that has bounced straight up in the air since melting down about 2 weeks ago. I think this volatility will continue to be a major issue, and therefore you need to be cognizant of the fact that this is a market that could be very difficult to get your hands around…The volatility that we have seen jump around has been quite extraordinary, but quite frankly that does make sense when you look at the geopolitical issues, the fact that the Federal Reserve might be cutting rates due to the fact that employment might be an issue in America, and of course anybody who does not live in New York City is aware of the fact that there is a true recession going on.”TM contributors Warren Patterson and Ewa Manthey look at Ceasefire Hopes and what they mean for commodities.”Oil prices came under renewed pressure yesterday. ICE Brent settled a little more than 2.5% lower on the day, which saw the front-month contract close well below US$78/bbl. Sentiment in the market remains bearish. Demand concerns centered around China continue to linger. Recent data releases, reinforce the view of weaker Chinese oil demand. Trade and industrial output numbers last week suggested that apparent oil demand continued to trend lower in July. These worries mean that speculators continue to be hesitant about jumping into the market, despite expectations for a deficit environment for the remainder of the year…

…At this point, I think we are starting to see some exhaustion come into the market, and therefore think you need to be cautious about the idea of putting too much money into the market in any one move. After all, this is a market that has bounced straight up in the air since melting down about 2 weeks ago. I think this volatility will continue to be a major issue, and therefore you need to be cognizant of the fact that this is a market that could be very difficult to get your hands around…The volatility that we have seen jump around has been quite extraordinary, but quite frankly that does make sense when you look at the geopolitical issues, the fact that the Federal Reserve might be cutting rates due to the fact that employment might be an issue in America, and of course anybody who does not live in New York City is aware of the fact that there is a true recession going on.”TM contributors Warren Patterson and Ewa Manthey look at Ceasefire Hopes and what they mean for commodities.”Oil prices came under renewed pressure yesterday. ICE Brent settled a little more than 2.5% lower on the day, which saw the front-month contract close well below US$78/bbl. Sentiment in the market remains bearish. Demand concerns centered around China continue to linger. Recent data releases, reinforce the view of weaker Chinese oil demand. Trade and industrial output numbers last week suggested that apparent oil demand continued to trend lower in July. These worries mean that speculators continue to be hesitant about jumping into the market, despite expectations for a deficit environment for the remainder of the year…  depositphpotos …The other key development weighing on prices is the prospect of a ceasefire between Israel and Hamas. Antony Blinken, the US Secretary of State has said that Israel has accepted a ceasefire, or at least a “bridging” proposal for a ceasefire. This has helped ease some fears over supply risks hanging over the oil market. However, we still need to see if Hamas will accept the deal, and if we get a deal, whether the ceasefire holds. Oil prices are likely to remain sensitive to how this evolves…”Contributor Prachi Khanna notes Asia-Pacific Markets Edge Up As China Maintains Loan Prime Rates.”Asia-Pacific stock markets showed mostly positive performance on Tuesday, buoyed by a rally in Wall Street and new economic data from China.The region’s diverse markets exhibited varied responses, reflecting both regional economic conditions and global influences.China maintained its loan prime rates (LPR) at 3.35% for the one-year rate and 3.85% for the five-year rate. This decision aligns with the expectations of economists surveyed by Reuters.The one-year LPR is a critical benchmark for most corporate loans, while the five-year LPR serves as a reference rate for mortgages. By keeping these rates unchanged, China’s central bank aims to provide stability amid fluctuating economic conditions…

depositphpotos …The other key development weighing on prices is the prospect of a ceasefire between Israel and Hamas. Antony Blinken, the US Secretary of State has said that Israel has accepted a ceasefire, or at least a “bridging” proposal for a ceasefire. This has helped ease some fears over supply risks hanging over the oil market. However, we still need to see if Hamas will accept the deal, and if we get a deal, whether the ceasefire holds. Oil prices are likely to remain sensitive to how this evolves…”Contributor Prachi Khanna notes Asia-Pacific Markets Edge Up As China Maintains Loan Prime Rates.”Asia-Pacific stock markets showed mostly positive performance on Tuesday, buoyed by a rally in Wall Street and new economic data from China.The region’s diverse markets exhibited varied responses, reflecting both regional economic conditions and global influences.China maintained its loan prime rates (LPR) at 3.35% for the one-year rate and 3.85% for the five-year rate. This decision aligns with the expectations of economists surveyed by Reuters.The one-year LPR is a critical benchmark for most corporate loans, while the five-year LPR serves as a reference rate for mortgages. By keeping these rates unchanged, China’s central bank aims to provide stability amid fluctuating economic conditions…  depositphotos …Japan’s Nikkei 225 index climbed 1.8% on Tuesday, extending its gains from the previous sessions. The broader Topix index also saw an increase of 1.2%. Conversely, South Korea’s Kospi index rose by 0.87%, and the Kosdaq index, which tracks smaller companies, increased by 1%. In contrast, Hong Kong’s Hang Seng index decreased by 0.42%, while mainland China’s CSI300 index was down by the same percentage…In corporate news, Chinese real estate firm Kaisa saw its shares jump by up to 14% following the announcement of a significant debt restructuring agreement.The company plans to issue $5 billion in senior notes and 4.8 billion yuan in mandatory convertible bonds. This move is part of Kaisa’s efforts to stabilize its financial position amidst challenging market conditions…”In the “Where to Invest Department”, TM contributor Andrew Rocco writes the Bear Of The Day is Delta Air Lines.

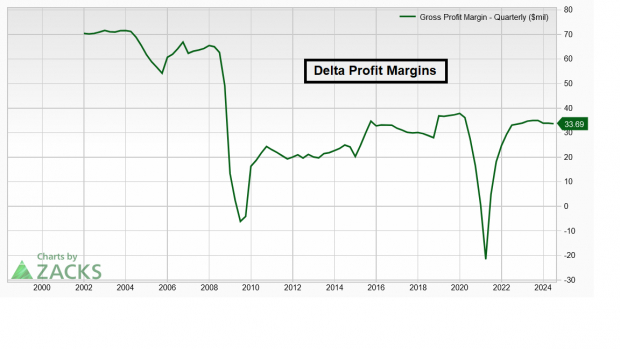

depositphotos …Japan’s Nikkei 225 index climbed 1.8% on Tuesday, extending its gains from the previous sessions. The broader Topix index also saw an increase of 1.2%. Conversely, South Korea’s Kospi index rose by 0.87%, and the Kosdaq index, which tracks smaller companies, increased by 1%. In contrast, Hong Kong’s Hang Seng index decreased by 0.42%, while mainland China’s CSI300 index was down by the same percentage…In corporate news, Chinese real estate firm Kaisa saw its shares jump by up to 14% following the announcement of a significant debt restructuring agreement.The company plans to issue $5 billion in senior notes and 4.8 billion yuan in mandatory convertible bonds. This move is part of Kaisa’s efforts to stabilize its financial position amidst challenging market conditions…”In the “Where to Invest Department”, TM contributor Andrew Rocco writes the Bear Of The Day is Delta Air Lines.  depositphotos “Delta Air Lines (DAL) is known for its travel services for both passengers and cargo. Delta, the second-largest U.S. airline, links customers to locations in the United States and worldwide. The company follows a “hub and spoke system” with hubs located in cities such as Atalanta and New York…

depositphotos “Delta Air Lines (DAL) is known for its travel services for both passengers and cargo. Delta, the second-largest U.S. airline, links customers to locations in the United States and worldwide. The company follows a “hub and spoke system” with hubs located in cities such as Atalanta and New York…  Rising geopolitical tensions in Europe and the Middle East present a major “Black Swan” threat to the travel industry should global war escalate further…Weak pricing power is hurting Delta’s EPS. Discount carriers like Spirit Airlines (SAVE) currently have excess seats available, causing them to lower fares and steal business from larger airlines like Delta…Delta is exhibiting troubling relative weakness. The stock is flat for the year, while the S&P 500 is up nearly 18%. Worse, DAL’s chart shows a bear flag pattern emerging on the daily chart.

Rising geopolitical tensions in Europe and the Middle East present a major “Black Swan” threat to the travel industry should global war escalate further…Weak pricing power is hurting Delta’s EPS. Discount carriers like Spirit Airlines (SAVE) currently have excess seats available, causing them to lower fares and steal business from larger airlines like Delta…Delta is exhibiting troubling relative weakness. The stock is flat for the year, while the S&P 500 is up nearly 18%. Worse, DAL’s chart shows a bear flag pattern emerging on the daily chart.  …Zacks in-house studies prove that when a stock has a negative Earnings Surprise Prediction (ESP) score combined with a Zacks Rank #3 or worse, like Delta does, the stock tends to underperform over the next year….The airline industry is notoriously unpredictable. Rising fuel costs and cutthroat competition make Delta stock one to avoid.”That’s a wrap for today.We’re hoping against hope that Secretary Blinken can succeed in bringing Hamas to negotiate in earnest.Peace.

…Zacks in-house studies prove that when a stock has a negative Earnings Surprise Prediction (ESP) score combined with a Zacks Rank #3 or worse, like Delta does, the stock tends to underperform over the next year….The airline industry is notoriously unpredictable. Rising fuel costs and cutthroat competition make Delta stock one to avoid.”That’s a wrap for today.We’re hoping against hope that Secretary Blinken can succeed in bringing Hamas to negotiate in earnest.Peace.  PixabayMore By This Author:Thoughts For Thursday: Won’t You Please Come To Chicago

PixabayMore By This Author:Thoughts For Thursday: Won’t You Please Come To Chicago

Tuesday Talk: Stabilized But Still Spooky

Thoughts For Thursday: Markets And Mayhem

Leave A Comment