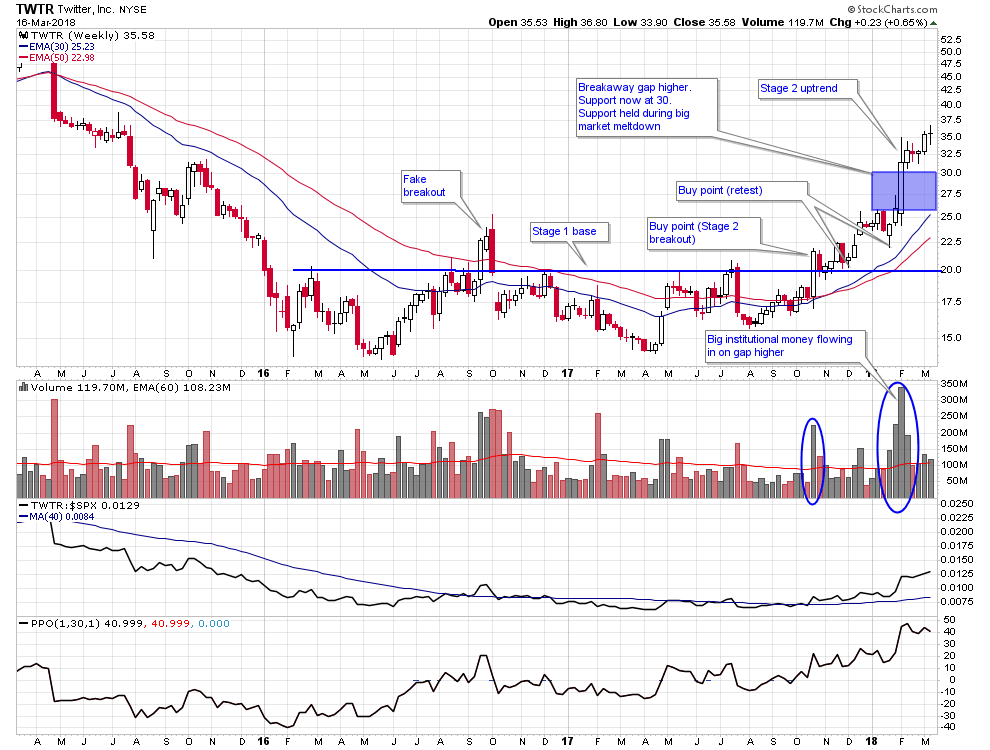

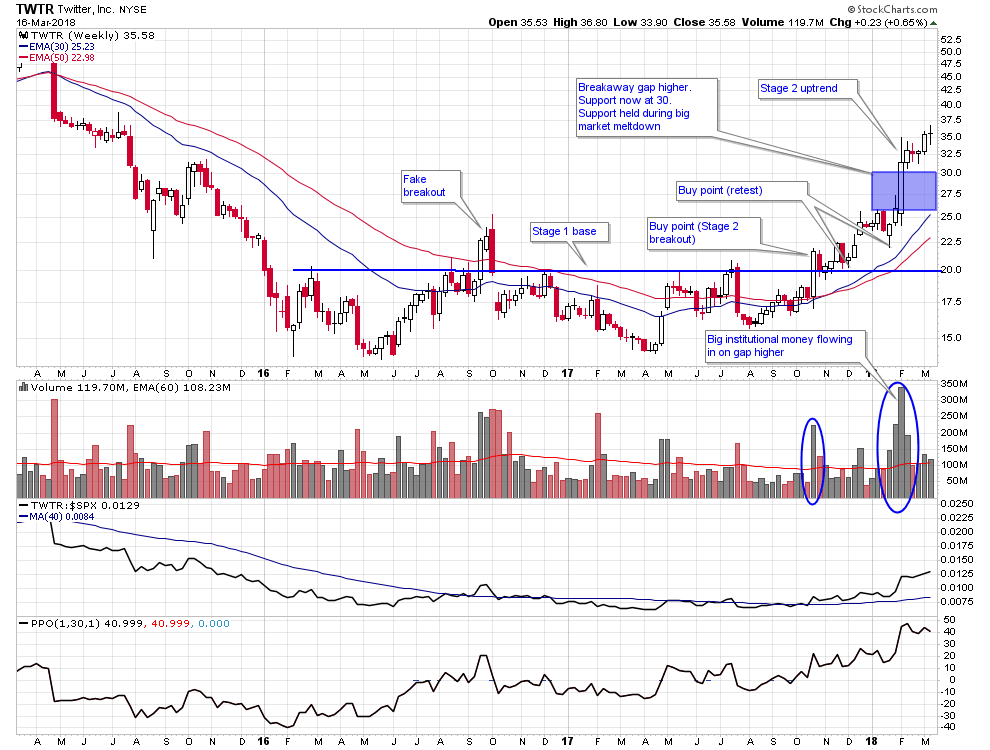

Readers of nextbigtrade.com got alerted to a monster breakout in Twitter back on October 29, 2017 when it broke out of a Stage 1 base on a massive increase in volume. Let’s take a look at the technical action in the stock before and after that key event and highlight some important turning points.

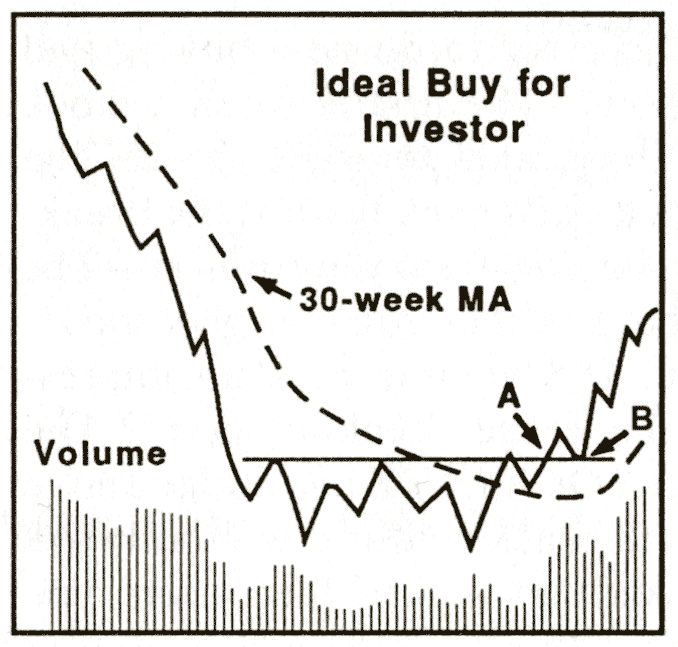

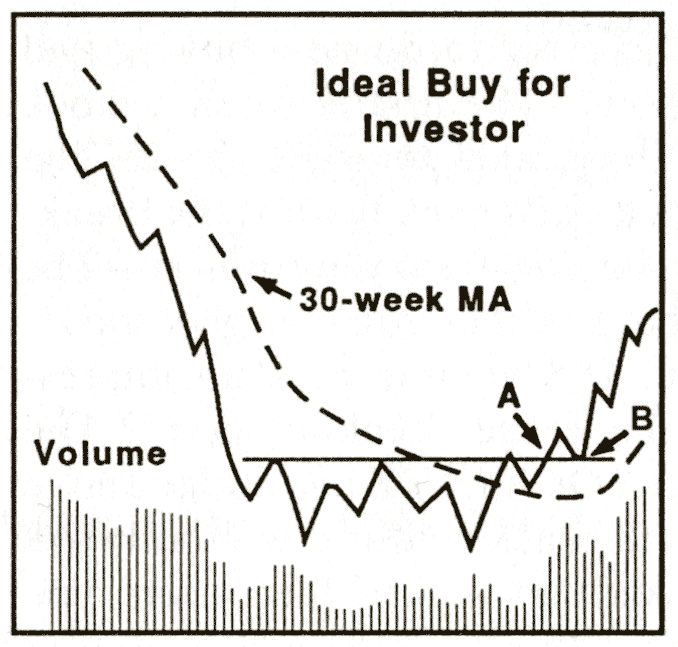

Source: Secrets For Profiting In Bull And Bear Markets

Back in October 2016 we had a fake breakout in TWTR that failed and plunged the stock back into a Stage 1 base. It took another year for TWTR to build a bigger Stage 1 base from which it started to break out in October 2017. It’s very common for stocks to experience multiple fake breakouts while they are in Stage 1 bases as sellers still remain after the previous Stage 4 downtrend.

When TWTR broke out in October 2017 the one thing I didn’t like was the fact that it didn’t follow up over the next few weeks with further big volume moves higher. This could be why it took multiple months for the stock to finally start moving higher. This certainly tested my patience since the market was very strong in the last few months of 2017, so it was hard to see TWTR not continue to act strong after the breakout. The price action continued to stay above the 30-week moving average though and the MA turned higher, which is how a Stage 2 uptrend starts to take place.

Then after TWTR reported earnings on February 8, 2018 the stock experienced a breakaway gap higher on 5-6x average daily volume. What is notable about this event is a few things:

TWTR finally experienced a cluster of multiple weeks above 2x average weekly volume around this earnings report. That is what you want to see in a stock in a new explosive uptrend.

TWTR held support at 30 (the top of the gap higher) while the market was melting down in early February. New leading stocks tend to hold up better during market pullbacks and TWTR has been one of the best acting stocks since early February.

TWTR remains one of my favorite stocks currently and as you can see from the charts above it is still early in a new Stage 2 breakout. I am long shares of TWTR.

Leave A Comment