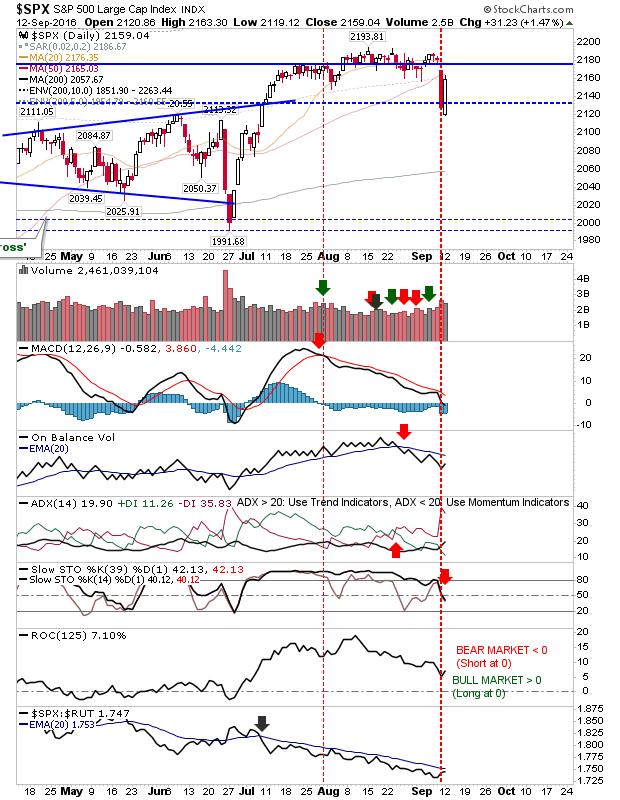

After weeks (and weeks) of inactivity, markets have delivered two big days of activity: Friday’s sell-off and today’s recovery. Which of these days delivers the basis for market action over the next few months remains to be seen. One could argue today’s lighter volume and inability to recover all of Friday’s losses gives bears the edge, but the longer term trend is all bullish. I am biased by holding a Dow Jones short, but intermediate term technicals have turned bearish for both S&P and Dow.

The rally in the S&P stalled out at the 50-day MA. The index has underperformed since July and Friday’s gain only made modest in roads into returning to a leadership role.

On the flip side, Friday’s sell-off in the Nasdaq tagged the 50-day MA before mounting a recovery. Such action looks more like a recovery ‘buy-the-dip’ which plays with the continued relative outperformance of Tech indices relative to Large Caps.

Small Caps had enjoyed a period of outperformance, but looking back over the last 6 months it has been in a state of flux. It too found support at the 50-day MA as did the Nasdaq, but it lost relative ground to the Nasdaq. Small Caps are a critical leadership index for secular bulls and it’s struggling.

For tomorrow, look for some bullish upside as bulls test the resolve of Friday’s bears. Whether new highs can be delivered is another matter, but I suspect markets will deliver a day of tight action. If bears do win out, look for a walk down of 3-4 days back to Friday’s lows.

Leave A Comment