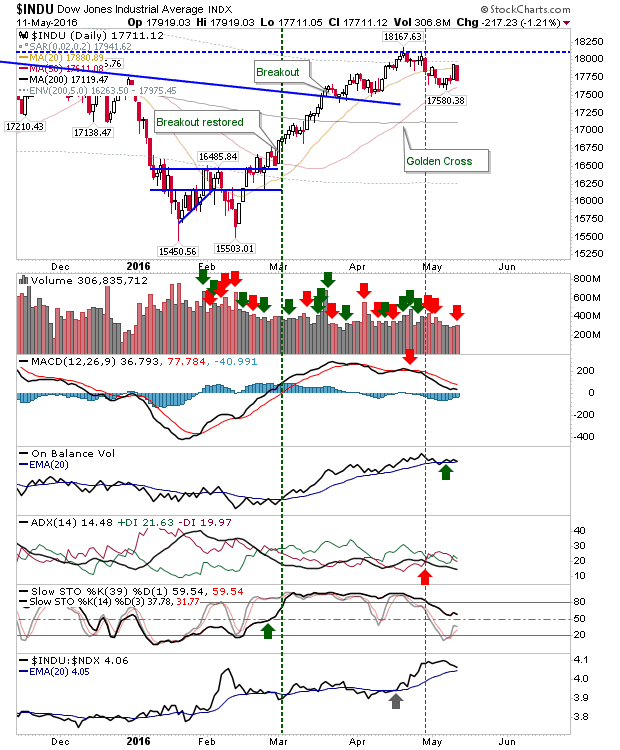

After yesterday’s gain it was disappointing to see such quick reversals. The Dow finished with the classic paired reversal. While this is bearish there are bullish factors to consider such as positive On-Balance-Volume, the 50-day MA, and stochastics above the bullish mid-line.

Today’s loss in the S&P is keeping to a bearish reversal head-and-shoulder pattern, its neckline marked by the hashed blue line; a close below it, and the 50-day MA will confirm. This will open up for a test of 1,940. Technicals are improving, with even the MACD close to a ‘buy’ trigger.

The Nasdaq reversed just below converged resistance of 20-day, 50-day and 200-day MAs. Volume climbed to register confirmed distribution, while all key technicals remained bearish.

The Russell 2000 had managed to recover from its channel breakdown, but today’s action puts this positive response in jeopardy as it drifts out of the channel and back below its 200-day MA.

Tomorrow will have bulls sweating. A positive pre-market will be required to reinstate the rally kicked off last week. The risk is an undercut of the May swing low which would like lead to accelerated losses. Next support is the double-bottom neckline from January and February. Bulls hold the long term advantage after February’s extremes, but bears are probably sniffing for blood now.

Leave A Comment