The United Kingdom manufacturing sector strengthened in October amid rising prices. Manufacturing gauge stood at 56.3 in October, according to IHS Markit report released on Wednesday. This is higher than the 56 recorded in September. Continuous surge in input costs due to weak Pound Sterling bolstered selling prices as businesses passed the difference on to consumers.

“Manufacturing made an impressive start to the final quarter of 2017,” said Rob Dobson, director at IHS Markit. “The continued robust health of manufacturing and rising price pressures will help cement expectations of the Bank of England hiking interest rates for the first time in a decade.”

The Bank of England is expected to raise interest rates on Thursday when the monetary policy committee will be meeting to announce inflation report and policy stance going forward. It would be the first time in a decade the apex bank would be raising rates.

Meanwhile, the Pound is expected to respond positively as investors in the fixed income market are likely to tap into the new monetary rate. However, the weak business investment and stagnant wage growth maybe worsen with a surge in borrowing cost.

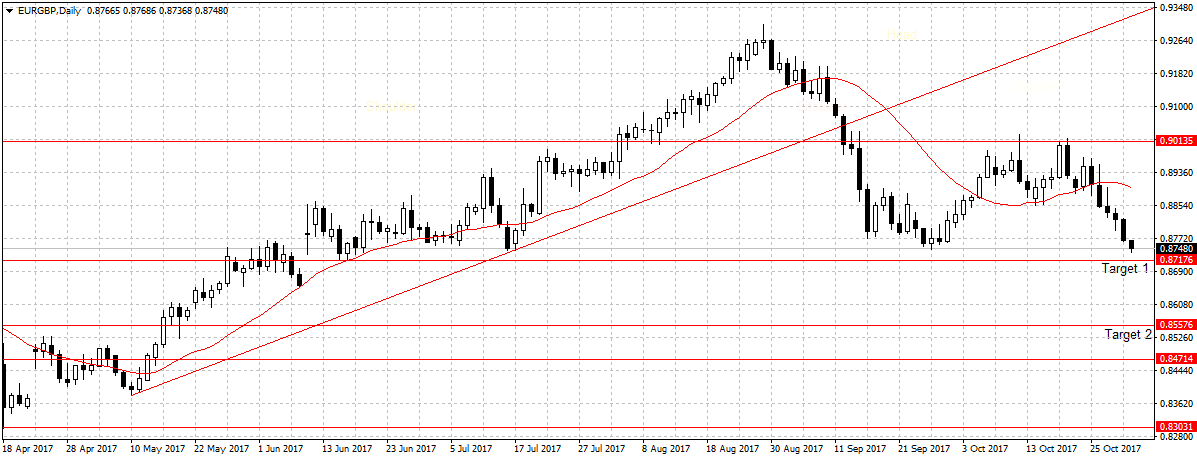

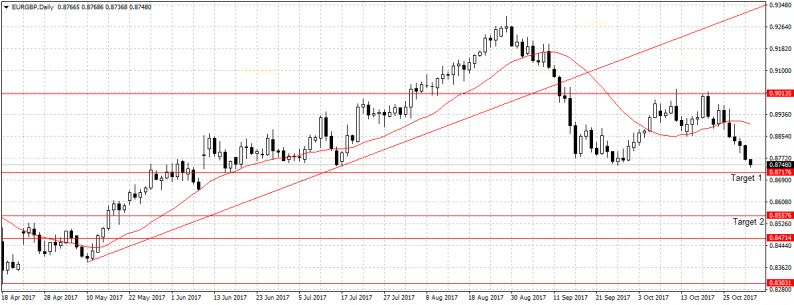

The EUR/GBP should close below our first target as explained on Monday, and a sustained break is expected to open up 0.8557 targets.

Leave A Comment