Confidence in the US economy has wobbled over the last several months, in part due to mixed updates for several key indicators. But drawing conclusions about the broad trend by cherry picking data points is a dangerous game if you’re looking for reliable estimates of recession risk. Recent history reaffirms this message quite clearly. Despite the rush in some corners this autumn to declare that a new downturn is fate, a diversified set of economic and financial indicators has yet to confirm such claims with the statistical coup de grace.

But pessimism springs eternal, and eventually the dark forecasts will be right. Blackstone Group President Tony James, for instance, said that a US recession is a possibility for 2017. Not next year, but the year after, he warned. “It wouldn’t surprise me if we had one in 2017,” he advised at a conference yesterday. “I’m turning more pessimistic now. There are a lot of headwinds facing us right now.”

Perhaps, but for the moment the odds are low that a new recession has already started, based on the published numbers to date. Near-term projections through the end of the year also point to a positive macro trend.

The relatively upbeat analysis at present is based on a methodology outlined in

. Using this framework, an aggregate of economic and financial trend behavior shows that business-cycle risk remained low through last month, based on the Economic Trend and Momentum indices (ETI and EMI, respectively). The current profile of published indicators through last month(12 of 14 data sets) for ETI and EMI continue to signal a positive trend overall. The lone exception in October: the corporate bond spread. Otherwise, positive trending behavior dominates.

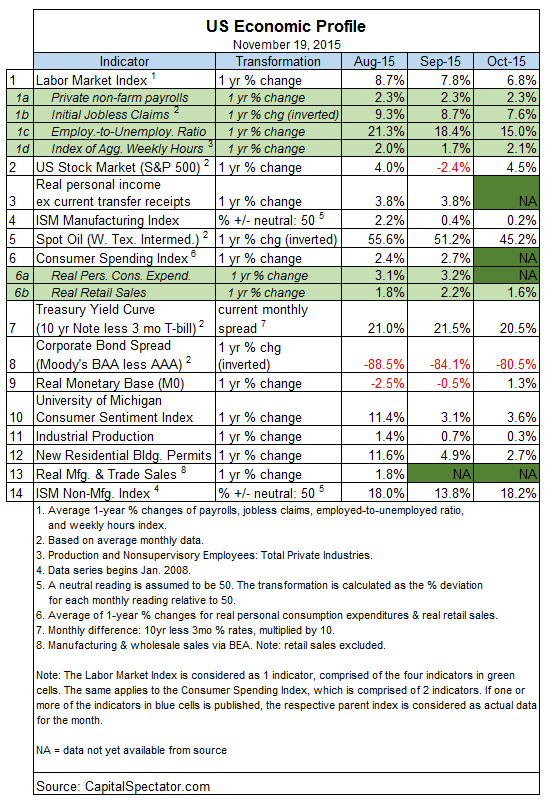

Here’s a summary of recent activity for the components in ETI and EMI and the various calculations that are used to calculate the trend benchmarks:

Aggregating the data into business cycle indexes reflects positive trends overall. The latest numbers for ETI and EMI indicate that both benchmarks are well above their respective danger zones: 50% for ETI and 0% for EMI. When the indexes fall below those tipping points, we’ll have clear warning signs that recession risk is elevated. Based on the latest updates for October — ETI is 85.7% and EMI is 3.3% — there’s still a wide margin of safety between current values and the danger zones, as shown in the chart below. (See note at the end of this post for ETI/EMI design rules.)

Leave A Comment