Substantial attention has been devoted to the disasterous effects of implementing a Donald Trump agenda of imposing 45% tariffs on imports of goods from China. To gain some perspective, consider the implications for prices of goods imported from China if such a tariff were imposed (and a large country assumption used, so that only half of the tariff increase manifested in increased prices).

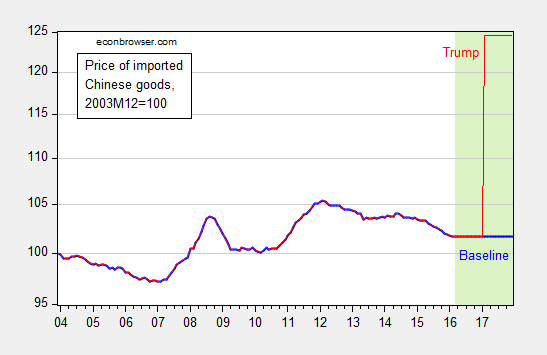

Figure 1: Price of Chinese commodity imports, 2003M12=100, with 2016M03 values at 2016M02 values (bold blue), and a 22.5% higher price level as of 2017M02 assuming the half of incidence falls on the US (red). Light green shaded area denotes projection period. Vertical axis is logarithmic. Source: BLS, and author’s calculations.

Obviously, drop the large country assumption, and the resulting price increase can be up to 45%.

From WaPo yesterday:

An economic model of Trump’s proposals, prepared by Moody’s Analytics at the request of The Washington Post, suggests Trump is half-right about his plans. They would, in fact, sock it to China and Mexico. Both would fall into recession, the model suggests, if Trump levied his proposed tariffs and those countries retaliated with tariffs of their own.

Unfortunately, the United States would fall into recession, too. Up to 4 million American workers would lose their jobs. Another 3 million jobs would not be created that otherwise would have been, had the country not fallen into a trade-induced downturn.

The job losses would be halved if China and Mexico chose not to retaliate to the tariffs of 45 percent and 35 percent, respectively. In which case U.S. growth would flatline, but the country would not fall into recession.

Here is the key graph from the article, depicting the baseline, and the alternative under Trump:

Source: WaPo yesterday.

I don’t know all the assumptions built into the simulation, and in particular I don’t know if the assumptions regarding imported goods price increases match those I’ve shown in Figure 1. But the trade flow impacts in the Moody’s simulation apparently match those in Peter Petri’s calculations, as recounted in this WSJ article.

Leave A Comment