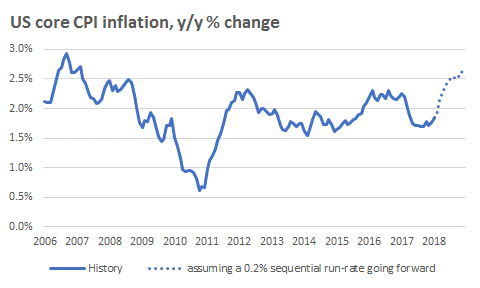

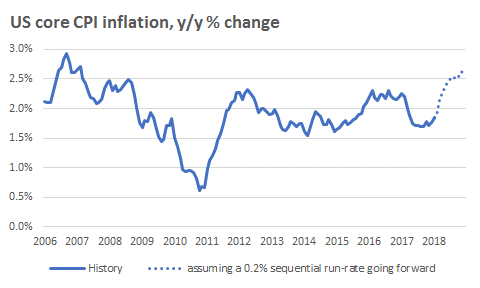

Today’s U.S. inflation data significantly exceeded consensus expectations, including ours—with the Consumer Price Index (CPI) jumping 0.5% in January. U.S. core inflation increased 0.349%, which was the highest reading since March 20051—and the gains were broad-based across multiple categories. The stronger inflation news will likely help to cement a March rate hike by the U.S. Federal Reserve (the Fed) —which is something we and the markets already had conviction in.

Source: Bureau of Labor Statistics and Russell Investments calculations

In addition, some analysts have suggested today’s inflation news may cause the Fed to upgrade its guidance in the March dot plot from a 3 to 4 hike pace. While we believe that outcome is in the realm of possibility, there are a few factors we see as weighing against this:

Market reaction to CPI report

Perhaps the biggest surprise today was that markets did NOT react more negatively to the inflation news. With a core inflation number of this magnitude, we wouldn’t have been shocked to see equities re-test their recent lows—yet U.S. Treasury yields hardly budged on the news. Why? The answer can likely be boiled down to two factors:

All things considered, we see the resilience in markets thus far today as encouraging—and consistent with our belief that last week’s market volatility is likely not the start of a bear market.

Leave A Comment