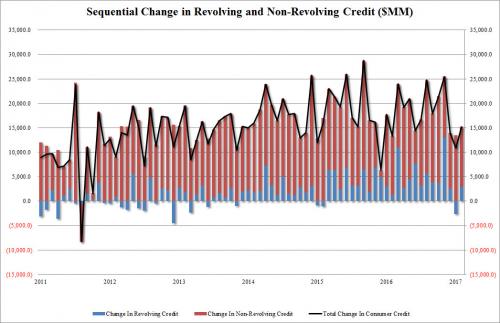

Unlike last month’s unexpectedly week consumer credit report, which saw a plunge in revolving, or credit card, debt moments ago the Fed, in its latest G.19 release, announced that there were few surprises in the February report: Total revolving credit rose by $2.9 billion, undoing last month’s $2.6 billion drop – the biggest since 2012 – while non-revolving credit increased by $12.3 billion, for a total increase in February consumer credit of $15.2 billion, roughly in line with the $15 billion expected.

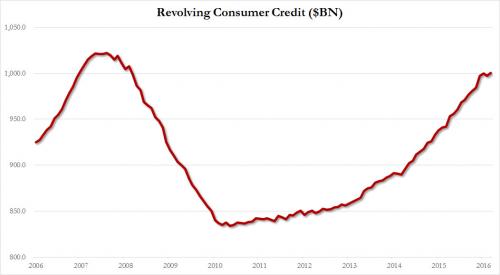

However, while in general the data was uneventful, there was one notable milestone: in February, following modest prior revisions, total revolving/credit card debt, has once again risen above the “nice round number” of $1 trillion for the first time since January 2007…

…. where it now joins both auto ($1.1 trillion) and student ($1.4 trillion) loans, both of which are well above $1 trillion as of this moment.

Leave A Comment