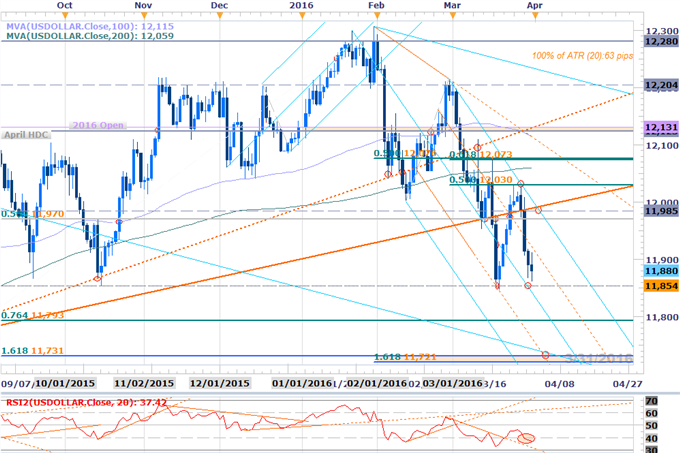

US Dollar Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook: The Dow Jones FXCM U.S. Dollar Index (Ticker: USDOLLAR) is working on its fifth day of consecutive declines after reversing off confluence resistance at 12030 noted on Monday. Heading into Non-Farm Payrolls tomorrow, the immediate short-bias is at risk while above the median line extending off the yearly high with interim resistance eyed at the 50-line (red) backed by 11970. Our broader bearish invalidation level is now lowered to Monday’s outside-day reversal close at 11985– note that the upper median-line parallel converges on this level over the next few days. A break lower targets the 76.4% retracement at 11793 backed by a key support confluence at 11721/31.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the “Traits of SuccessfulTraders” series.

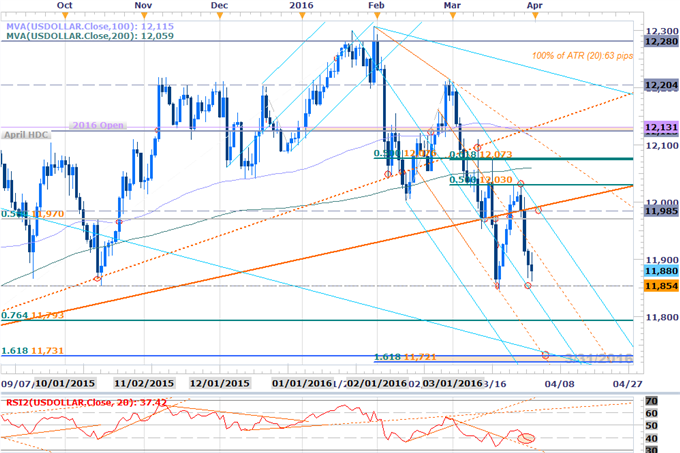

USDOLLAR 30min

Notes: Interim support is eyed at 11846/54 where the October low converges on the March low & the median-line extending off the weekly high. A break below this threshold targets subsequent support objectives at the broader median-line extending off the January 21st high (~11820) and the 76.4% retracement of the advance off the May low at 11793.

A breach above the 50-line risks a rally back towards the upper median-line parallel before resuming lower. Keep in mind tomorrow’s NFP release comes on the start of the month / quarter and we’ll want to remain nimble & lower leverage heading into the weekend. Consensus estimates are calling for a print of 205K jobs for the month of March with the headline unemployment rate widely expected to hold steady at 4.9%. Traders will also be closely eyeing the broader labor force participation rate as well as the wage inflation figures.

Check out SSI to see how retail crowds are positioned as well as open interest heading into April trade.

Leave A Comment