This week, positive data on the U.S. economy was released, but the markets have seemed to focus on today’s ECB meeting. What does it mean for the gold market?

Durable goods orders rose 2.2 percent in September, much more than expected (the Bloomberg consensus was 1 percent). Importantly, core capital goods orders (nondefense ex-aircraft) increased 1.3 percent, also above expectations.

Moreover, the IHS Markit Flash U.S. Composite PMI Output Index rose from 54.8 in September to 55.7 in October. It implies that U.S. economic activity accelerated. Actually, it was the fastest upturn in private sector output since January. Importantly, the expansion was widespread: manufacturing reached a 9-month high, but services also grew significantly, reaching a 2-month high. Hence, it seems that the U.S. economy started the final quarter of 2017 quite strongly. This is not good news for the gold market, as the robust economy should support the greenback and interest rates, exerting downward pressure on the yellow metal.

However, the price of gold increased yesterday, as one can see in the chart below.

Chart 1: Gold prices over last three days.

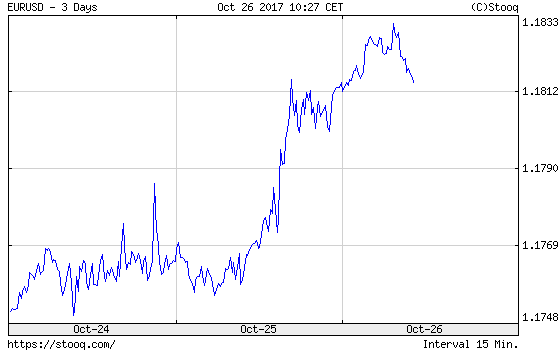

Why did the price of gold increase in face of upbeat U.S. economic data? Well, investors focused on today’s ECB monetary policy meeting. As the next chart shows, the euro appreciated as investors awaited details of the ECB’s decisions.

Chart 2: EUR/USD exchange rate over the last three days.

As a reminder, given the rebound in the economy of the Eurozone, the bank is likely to reduce its quantitative easing program. However, due to low inflation, the ECB is expected to extend the program, making a “less-but-for-longer move”. The consensus is that the bank will cut its asset purchases from 60 to 40 billion euros per month starting from January, while extending the program by six to nine months. Any dovish deviations from that would be bearish for the euro and gold prices, while hawkish surprises should be positive for the yellow metal. Investors will also focus on whether the ECB signals its intent to exit quantitative easing (bullish for the euro and gold) or keeps it open-ended (dovish for the euro and gold). We believe that Draghi will be neutral or more dovish than expected, due to stubbornly low inflation and elevated market expectations but, on the other hand, he believes that soft inflation pressures are only temporary. We will analyze the ECB’s meeting and its likely impact on the gold market in the upcoming days

Leave A Comment