Last week, Fed President Rosengren offered his analysis of the US economy:

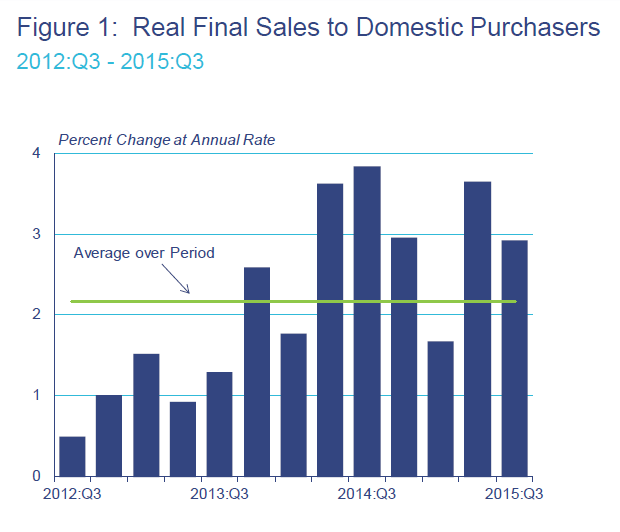

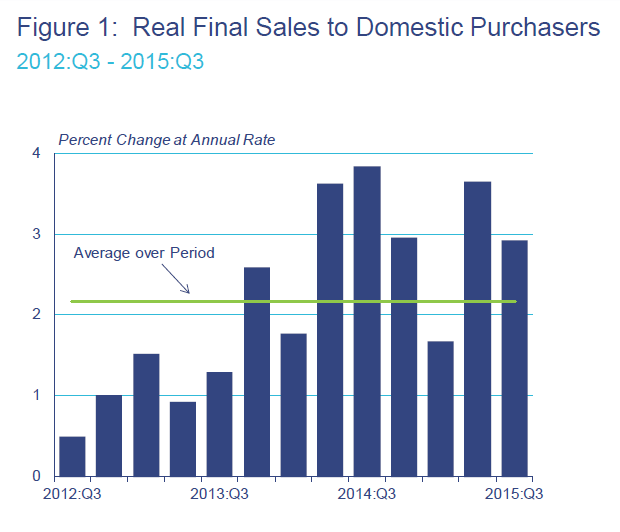

Many headlines have focused on real GDP growing at only 1.5 percent in the third quarter. However, I would like to share with you a measure that focuses on domestic demand – real final sales to domestic purchasers, which is shown in Figure 1. This statistic is similar to GDP, but excludes fluctuations in inventories and net exports. This leaves consumption, investment, and government spending – in sum, a measure that tries to capture the underlying strength in domestic demand. In the third quarter of this year, real final sales to domestic purchasers grew by 2.9 percent, following its second-quarter growth of 3.7 percent.

He offered the following chart:

As he notes, the five year average for this number is a little over 2%. Historically, this number is a bit weak, but still positive:

He then turned his focus to US consumer spending:

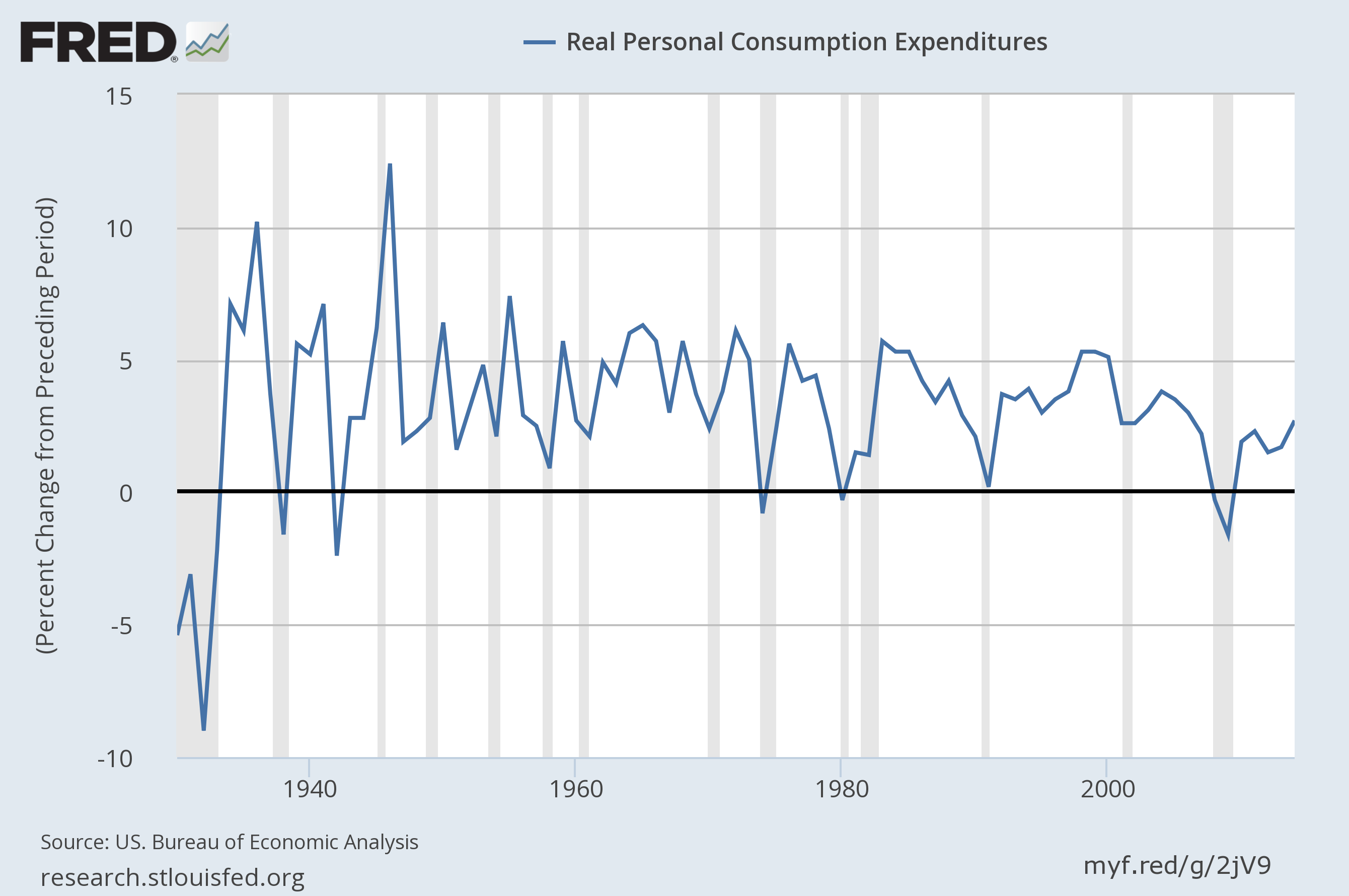

In part, this indicator of more robust growth reflects the strength of consumer spending, shown in Figure 2. Consumer spending has been boosted by the continued gradual improvement in labor markets, lower gasoline prices, and the relative strength in housing prices and stock prices, which have improved household net worth.

While last week’s retail sales number was weak (up .1% M/M and 1.7% Y/Y), the broader measure of consumer spending (total real PCE expenditures) is up 2.7% Y/Y.

Although this is historically weak, it is positive.

Rosengren’s basic analysis is sound: so long as there is sufficient domestic demand and consumer spending, the economy will be fine. Current GDP projections support this analysis.The Atlanta Fed’s GDP now model shows a 2.3% 4Q GDP rate – GDP now model. The Cleveland Fed’s number is a bit lower at 1.9%.Conversely, the Atlanta Fed’s recession probability indicator is at 13%.

Leave A Comment