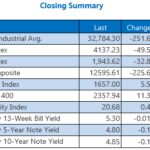

Markets moved sharply as the U.S. Fed announced the 25 basis points interest rate increase. Markets were volatile, but which market was the real winner? The answer will be surprising to most.

First and foremost, when markets react in a volatile way on financial news, it is wise to wait a couple of days before coming to conclusions. Although most moves were clearly in certain directions today, there was also an inconsistency. For instance, we observed a strong increase in bond prices while stocks rallied simultaneously. That is not really making sense, as stocks are ‘risk on‘ assets but bonds ‘risk off’.

In other words, we recommend not to take a one-day move too serious. One day does not make a market, it only gives some indications.

Stock markets in the U.S. but also global stocks went higher today. Basically, this has no significant meaning, as a stock bull market was the ongoing trend.

Bond prices went higher as well, but, as said, that is not consistent with rising stock prices. As long as bonds remain below the purple horizontal line visible on below chart, they are in a consolidation area, or, worst case, a tactical bear market. Time will tell, but, so far, there is no trend change in the bond market.

The dollar is by far the most interesting market. While the previous interest rate hike resulted in a breakout, which we documented in US Dollar Breaks Out To A New Bull Market, it seems that today’s reaction was different. Again, one day does not make a market, but weakness in the dollar is important right now as the dollar trades right at 100 points, a very significant price level.

Watch closely what the dollar does in the coming weeks around the 98 to 100 points level.

So far, we did not notice any real trend changes apart from a potentially pending trend change in the U.S. dollar.

However, if there is a real winner after today’s interest rate hike, it clearly is one that went unnoticed: emerging stock markets. We explained today that it is official now: Emerging stock markets break out. The long term chart, also included below, shows the first sign of a breakout. The article which is linked has a very long term chart which highlights the importance of the 42 to 46 level in the emerging stock market ETF EEM. Watch closely what happens in emerging markets in the coming weeks.

Leave A Comment