Following yesterday’s dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all global risk assets.

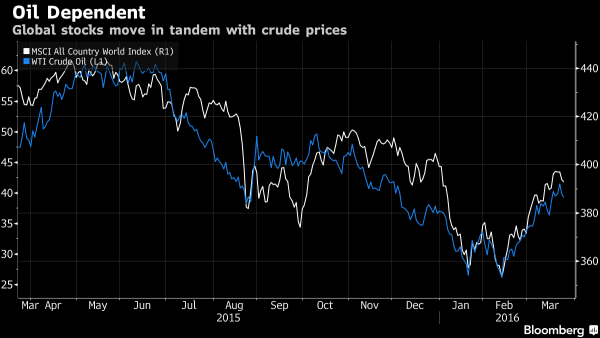

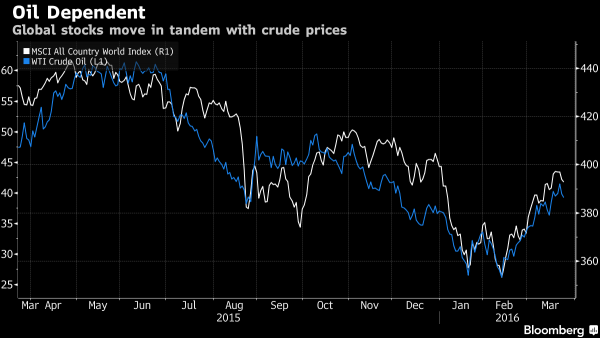

And since a stronger dollar means a weaker Yuan, more potential devaluation, greater capital outflows but most importantly lower commodity prices and key among them cheaper oil, now flirting with sliding below $39 to the downside, which would lead to its first weekly decline, as lower oil means lower risk prices in general as per the very well-known correlation shown below…

… traders walking in today are greeted by something they have barely seen in the past month’s bear market rally: a sea of red: not only are S&P500 futures down nearly 0.5% in today’s illiquid session, but European shares have retreated for a fourth day, while raw-materials producers led declines among Asian equities as the Bloomberg Commodity Index slumped for a second day. Industrial commodities like iron ore fell for a third day, while gold has continued to drift lower. Government bonds advanced in Australia and the euro area.

The reason for this resurgent dollar strength is none other than the very confused Fed: after last week halving its projection for interest-rate rises this year to two – a shift that spurred global stock gains and depressed the dollar – various Fed officials have in the past few days talked up the possibility of an increase something that CNBC’s Steve Liesman classified as a potential mutiny against a very confused Janet Yellen. As Bloomberg writes, Fed Bank of St. Louis President James Bullard on Wednesday joined a chorus of policy makers floating the possibility of a rate hike as soon as April, helping fuel a rebound in the greenback that’s unsettling the mostly dollar-denominated commodity market.

“Fed officials this week reminded the market that they still want to move forward with the rate hikes,” Mark Lister, head of private wealth research at Craigs Investment Partners told Bloomberg.

“Investors have been looking for a reason to pull back and this is one” he added and sure enough, the MSCI All Country World Index fell 0.5% in early trading after sliding 0.8 percent on Wednesday. The Stoxx Europe 600 Index slid 0.8%, the MSCI Asia Pacific Index lost 1.1% and futures on the Standard & Poor’s 500 Index declined 0.5%.

Additionally, now that the broader market levitation appears to be over, we have seen numerous single-name slams overnight, such as the following:

Standard Chartered -4.3%; on track for worst weekly performance since early Jan.

Absent a dramatic turnaround in the USD momentum we expect this negtive list to extend once the US market is open for trading for its last weekly session.

Top news stories include Starboard’s possible attempt to shake up board at Yahoo; Konecranes, Zoomlion bids for Terex, Nomura’s possible NorthAm job cuts.

Markets Snapshot

Top Global News

Leave A Comment