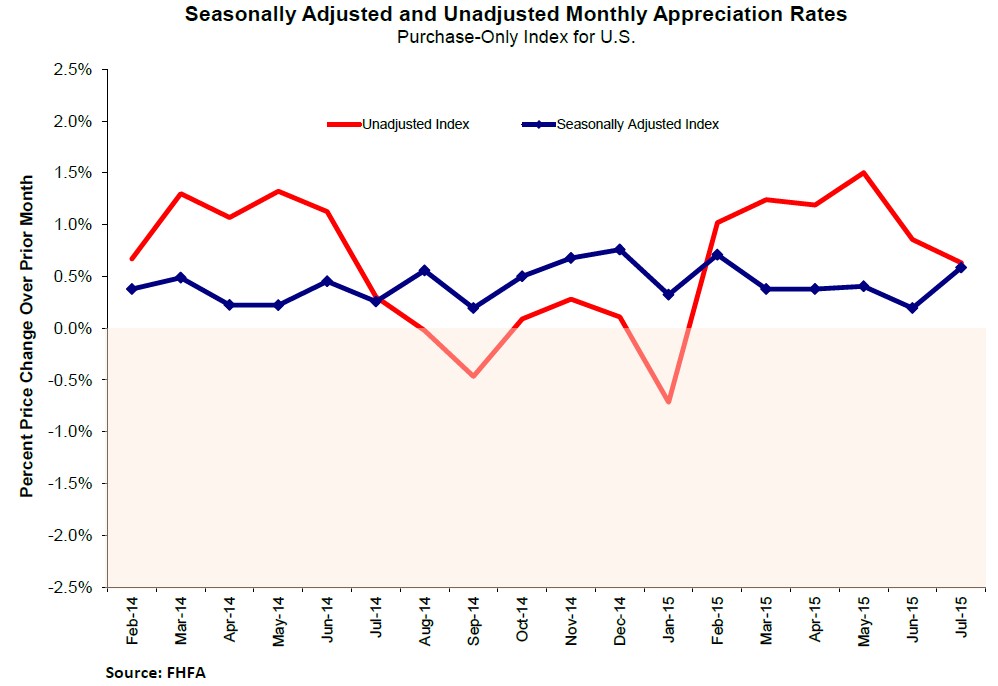

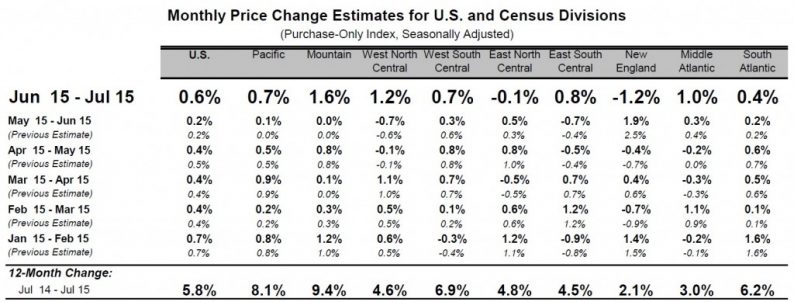

The Federal Housing Finance Agency (FHFA) reported that the House Price Index (HPI) increased on a seasonally adjusted basis of 0.6% in July. According to the agency, the house prices in the United States climbed 5.8% over the past 12 months.

The U.S. HPI is still 1.1% lower than its March 2007 peak, and it is almost the same as the November 2006 index level. The FHFA is calculating the HPI using the home sales price information from mortgages sold to or guaranteed by the Fannie Mae / Federal National Mortgage Assctn Fnni Me (OTCBB:FNMA) and Freddie Mac / Federal Home Loan Mortgage Corp (OTCBB:FMCC).

House prices changes were positive

According to the agency, the seasonally adjusted monthly changes in house prices for the nine census divisions (from June to July 2015) ranged from -1.2% in the New England division to +1.6% in the Mountain division.

The FHFA noted that the 12-month changes in house prices were all positive, ranging from +2.1 percent in the New England division to +9.4 percent in the Mountain division.

Sales of previously-owned homes declined in August

A separate report from the National Association of Realtors (NAR) showed that the sales of previously-owned homes in the United Sates declined in August despite the slowing increase in house prices and a positive turnaround in the share of sales to first-time buyers.

NAR Chief Economist LawrenceYun said, “Sales activity was down in many parts of the country last month — especially in the South and West — as the persistent summer theme of tight inventory levels likely deterred some buyers. The good news for the housing market is that price appreciation the last two months has started to moderate from the unhealthier rate of growth seen earlier this year.”

According to NAR, the total sales of previously-owned homes dropped 4.8% to a seasonally adjusted annual rate of 5.31 million last month. In July, the total existing home sales was 5.58 million.

Leave A Comment