US residential construction, driven by a surge in new multi-family projects, increased by a solid 6.5% in September, the Census Bureau reports. The rise beat forecasts and signals that the housing market remained on a recovery track. At the same time, newly issued building permits dipped 5% last month, suggesting that the housing market’s growth will remain moderate.

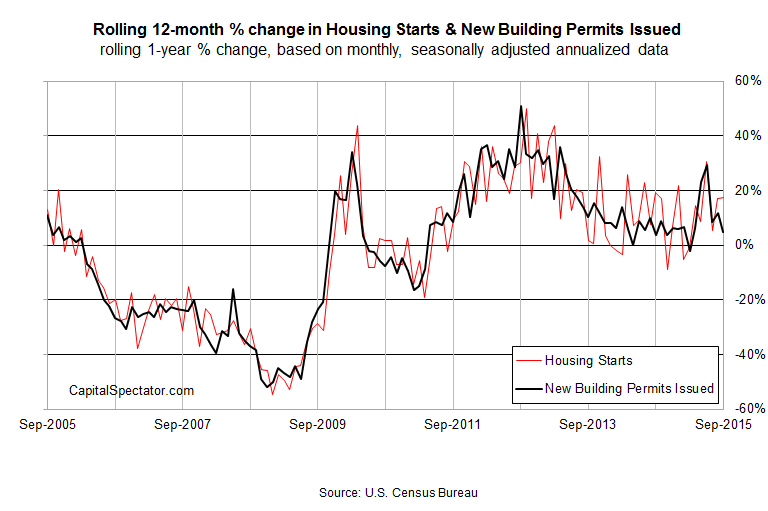

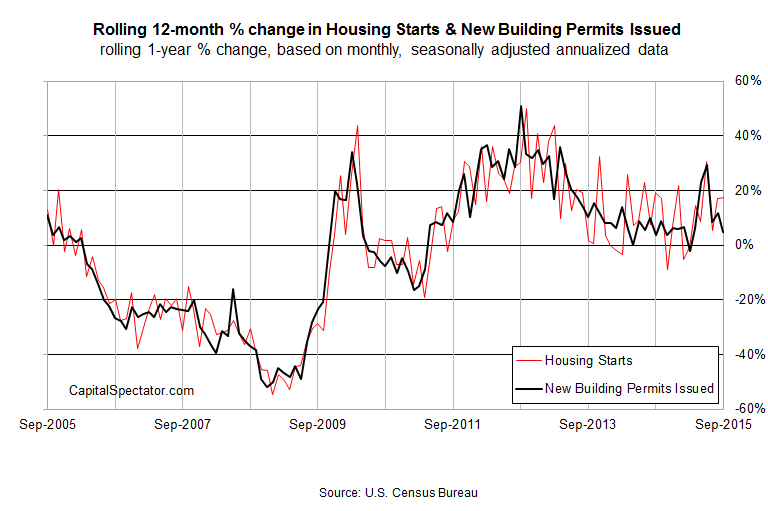

Steady if moderate growth is the general message in the year-over-year changes for housing starts and new building permits. On both fronts the trend looks encouraging, with starts rising 17.5% last month vs. the year-earlier level. That’s the second straight month of annual increases close to 20% and the sixth straight month of gains in year-over-year terms. Permits are rising at a lesser rate, slipping to a mild 4.8% annual increase in September. But for the moment, the overall picture for housing activity points to ongoing growth.

A rosy outlook was certainly the forecast via yesterday’s update of the NAHB Housing Market Index, which monitors builder confidence. The benchmark rose to 64 for October—a ten-year high. A reading above 50 indicates that a majority of builders are optimistic and so the latest figure suggests that housing activity will continue to bubble.

“With October’s three-point uptick, builder confidence has been holding steady or increasing for five straight months,” said NAHB Chief Economist David Crowe in a statement. “This upward momentum shows that our industry is strengthening at a gradual but consistent pace.”

Today’s hard data on housing starts doesn’t offer any reason to argue otherwise. In fact, the upbeat housing data suggests that the wobbly US economy of late will muddle forward and continue to post modest growth for the near-term future. As Reuters reminds in today’s review of the housing release, “although residential construction accounts for less than 3 percent of gross domestic product, housing has a broader impact on the economy, with rising home prices boosting household wealth and therefore supporting consumer spending.”

Leave A Comment