The U.S core inflation rose unexpectedly in December to reinforce the possibility of the Federal Reserve raising interest rates many times in 2018.

The core consumer price index climbed 1.8 percent from a year earlier in December, according to the Labor Department report published on Friday. On a monthly basis, the core CPI rose 0.3 percent, up from 0.1 percent. The highest in almost a year.

Including all items, the broader CPI gained 0.1 percent in December, lower than the 0.4 percent from the previous month but on a yearly basis, all items CPI rose 2.1 percent to exceed the 1.6 percent annual average in the past 10 years. While this was higher than the Fed’s 2 percent target, it is the least preferred price indicator as volatile energy prices and food items sometimes distort reality.

Still, experts believed the surged in underlying prices as shown by the core CPI will increase the odds of the Fed raising interest rates at least three times this year, especially with the economy expanding at a solid pace and unemployment rate at a record-low of 4.1 percent.

“The data is consistent with the view of the Fed on inflation, which is that weakness in growth before was due to transitory factors,” said Lewis Alexander, chief economist at Nomura Securities International Inc. in New York, who had projected a 0.3 percent monthly gain in core prices. “It’s in line with an economy operating at full employment.”

He further stated that the biggest positive news was the revision of November retail data, which suggests the final quarter of 2017 growth may have been stronger than previously reported.

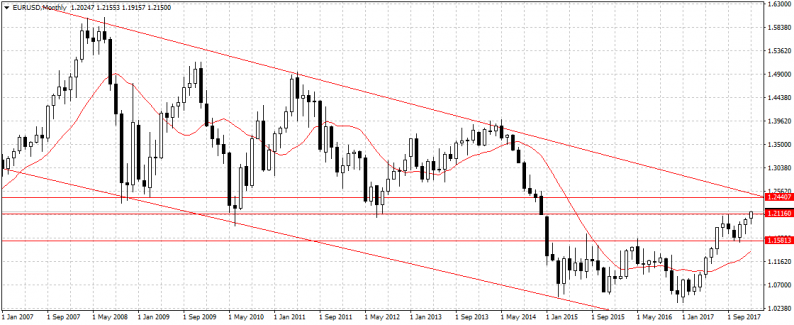

The U.S. dollar slid against the Euro on Friday following the news of Angela Merkel led political party reaching an agreement with another party to form a coalition government.

Leave A Comment